Laurent Viviez has over 15 years consulting experience in telecoms. For the last 5 years he’s focused on Africa, working with most of the major telcos, equipment and handset manufacturers on projects as diverse as pricing, distribution, m-payments, cost-efficiency, and network outsourcing.

In the tower space, Laurent has worked for several large operators on network transformation and cost-efficiency programmes – structuring many initiatives around network and tower outsourcing. Laurent has also worked with investors looking to invest in towercos in markets such as South Africa, Ghana and Tanzania.

TowerXchange: What’s your view of the African tower outsourcing market?

Laurent Viviez, VP & Partner, AT Kearney:

We’re still in the early stages of tower outsourcing in Africa. MTN is doing tower sharing or tower outsourcing in South Africa, Uganda, Ghana, Cameroon and Cote d’Ivoire, but it’s still early days. Etisalat have tower outsourcing on their agenda, but have not followed it up strongly to date. Orange Group has pressure to reduce its debt level, so there’s pressure to accelerate tower outsourcing. As we know, Airtel has registered tower companies in 16 African countries. Meanwhile Vodafone seem a bit late in the game, having only done a deal in Ghana. But there are lots of deals in the pipeline.

TowerXchange: In your recent report “African Telecoms at a Crossroad”, you highlighted potential consolidation of operators as Africa’s major players, MTN, Vodacom, Airtel, Orange (plus in certain markets Globacom, Etisalat and Millicom) have very strong positions in their markets while operators ranked fourth and lower struggle to achieve profitability. Does this illustrate a lack of credit-worthy potential tenants available to independent tower operators?

Laurent Viviez, VP & Partner, AT Kearney:

Many of the towerco business plans I have seen have targeted tenancy ratios greater than two – in some cases as high as 2.3 to 2.6. I believe tenancy ratios above two are going to be tough to achieve in markets where multiple operators do tower deals.

If you’re a market leader and you want to share towers, your most likely clients are smaller players. While African markets might have an average of 3.5 competing operators, the markets with 8-9 competing operators markets like Nigeria and Tanzania are not sustainable. In the context of a consolidating operator market, it will be tough to achieve high tenancy ratios if smaller operators are forced to exit, merge or undertake structural moves like full network mergers, active network sharing or national roaming agreements.

In a number of markets it was a smaller, challenger operator who sold their towers first, for example third-ranked operator Cell C in South Africa, and Millicom in Ghana. These moves have triggered market-leading operators to follow and bring their towers to market. Prospective tenants often find market leaders often have most attractive locations, so it will be tough for towercos linked to smaller players to achieve aggressive tenancy ratio targets. For example, Cell C had targeted tenancies from Telkom in South Africa, but when MTN secured many of those tenancies, it forced Cell C and American Tower to revise the business plan and the valuation.

Tower contracts that pass through power costs are a huge missed opportunity for both operators and tower companies

TowerXchange: How should tower companies respond to the lowering of the glass ceiling on their potential tenancy ratios?

Laurent Viviez, VP & Partner, AT Kearney:

I feel many towercos will need to revisit the assumptions in their business plans around the achievable tenancy ratios, and make them more conservative – tenancy ratios above two are quite ambitious.

However there are opportunities to increase tenancy ratios through the consolidation of towers. Competing operators all have towers close to each other in dense urban areas, which limits the potential for sharing in these high traffic areas – the potential for sharing may be greater in less fashionable areas. In urban areas, there is an opportunity to consolidate and discontinue existing towers, and share remaining towers, achieving higher tenancy ratios. However, this requires considerable co-operation. The costs of decommissioning towers and transferring hardware can be high, but there’s an opportunity to consolidate towers when upgrading to 3G and 4G as operators are installing new equipment anyway.

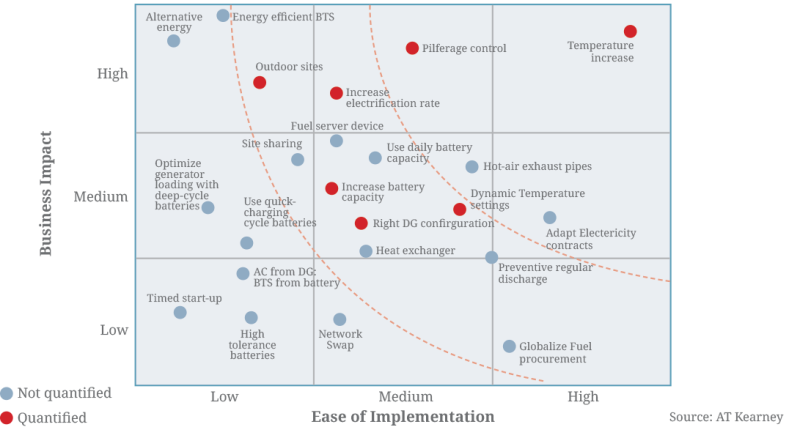

I also feel towercos haven’t maximized opportunities in energy management. Towercos can compensate for any tenancy ratio shortfall by offering to leverage reduced fuel consumption. Fuel can cost as much as 10% of revenues. Tower contracts that pass through power costs are a huge missed opportunity for both operators and tower companies. I recommend that operators task tower companies to achieve fuel consumption by as much as 50%. While the operator may retain responsibility for diesel price changes, volume of fuel consumption should be part of a towerco’s service level agreement. This incentivises the towerco make changes such as reducing pilferage, which can be up to 30% in some markets, and installing solar panels or hybrid diesel generators with the right capacity – generators have significant over-capacity in some markets.

Traditional Power Optimization Levers

TowerXchange: In the report “African Telecoms at a Crossroad”, two of your calls to action were “drive a step change in operational excellence” and “keep investing in the network”. What practical steps should CTOs, senior network planners and independent tower operators take to fulfill those calls to action?

Laurent Viviez, VP & Partner, AT Kearney:

Let’s answer this from a capex and opex point of view.

Capex budgets in Africa have become compressed over time. Network investments can represent up to 80% of capex. Where capex was as high as 30-40% of revenue two years ago, in some markets capex is now down to 10-15% of revenue. There was a time when opex was not growing as fast as revenue growth, driving free cash flow appreciation and stock valuations. But now operators have hit a wall because traffic is still growing fast, price wars are suppressing revenue growth, and capex budgets have to be squeezed. Yet operators still need to invest to extend networks, they need to invest in 3G, 4G, backbone and backhaul capacity, so there’s a surge in capital investment requirements. For example in Nigeria MTN and Etisalat have had to increase their capex budgets this year. If you’re a smaller operator, it’s a challenge to match this capital requirement spree, so you need to explore structural ways to reduce opex and capex, considering network sharing and national roaming arrangements. Even market leaders should consider network sharing and roaming agreements to cover rural areas.

With prices dropping dramatically, for example Nigeria saw a drop from $20 to $6 in the last two years, operators need to accelerate cost efficiency initiatives, given that the network consumes up to 50% of spend. Operators’ internal optimisation teams are looking at sourcing programmes to reduce equipment costs, power reduction, and the outsourcing of network management, O&M and towers. The opportunities for cost reduction are simply massive.

However, operators need to be clear about what they’re expecting from tower outsourcing. There is a trade-off between reducing opex and releasing cash when structuring these deals, and I’m not sure all operators have might the right decision, particularly in cases where capital release has been favoured over opex reduction.

CTOs have an array of options to reduce capex and opex: tower outsourcing, network outsourcing, energy management services, national roaming, and managed capacity deals like we’ve seen in India. CTOs need to take a long term perspective, and ensure decisions taken now don’t create blocking points to long term opportunities. For example, if an operator outsources towers and their towerco secures substantial tenancies from operator A, yet the anchor tenant subsequently wants to share infrastructure or even merge with operator B, that outsourcing deal becomes a blocking point. This is why many CTOs hesitate to initiate outsourcing deals.

TowerXchange: Your report also calls attention to the rising levels of data usage forecast in Africa. With the introduction of 3G and eventually LTE, what are the implications for the densification of cells – will this drive infrasharing? Or usher in a small cell era?

Laurent Viviez, VP & Partner, AT Kearney:

Small cells don’t mean operators stop building new towers. For example, Orange in France had about 10,000 sites in 2000, now they have more than 22,000, and it could rise to 35-50,000 including small sites.

Growing traffic and the use of higher frequency means further network densification is needed. 3G and 4G will drive significant densification – Africa will need new sites, so this is positive news for towercos.

I’m not sure how much attention African towercos have for small cells – it’s further down the road in Africa. There is a potential infrastructure play around small sites, for example in the UK Virgin Media is building a wholesale offering for small sites where they’ll manage sites, radio equipment and use their fibre to provide backhaul. I can see a play for towercos around small sites, but they need backhaul capacity as backhaul is such a big chunk of the cost of small sites. So a parallel growth opportunity for towercos is fibre to the site. Fibre is costly, and again operators will need to share, creating an opportunity for towercos to provide microwave and fibre to site backhaul capacity.

TowerXchange: Will active infrasharing play a role in African telecoms infrastructure in the next 3 years?

Laurent Viviez, VP & Partner, AT Kearney:

I don’t see many African operators proactively pushing active infrastructure sharing today. 3G was the trigger for active infrastructure sharing in Europe, and it’s easier to implement active infrastructure sharing on a greenfield network as opposed to merging brownfield networks. I have seen an active infrastructure sharing deal in Gabon between Moov and France Telecom, in which Moov used Orange’s network in suburban and rural areas.

There are some national roaming agreements in Africa, which are a form of active network sharing, for example Telkom does national roaming on MTN’s network with Cell C on Vodacom’s network in South Africa. I wouldn’t be surprised if smaller African operators were keen on active infrastructure or national roaming deals, but it’s a question of whether will the market leaders will accommodate them.

TowerXchange: To conclude, how would you summarise your recommendations to participants and investors in the African tower industry?

Laurent Viviez, VP & Partner, AT Kearney:

there’s huge growth potential for towercos in Africa because it’s still early days for most operators. But towercos need to be careful about their assumptions around potential tenancy ratios.

Energy management services, the rollout of 3G and 4G, small sites and small cells, and fibre to the tower could also be an attractive opportunity for the tower industry, but diversifying their businesses beyond towers will make them more complex and will require new skills.

At a macro level, I’m optimistic and positive about the African tower business. On a micro level, I would make a more qualified recommendation. Investors need to be careful and look at opportunities on a deal by deal basis. Are tenancy ratio assumptions realistic? You’re dependent on the deal structure and competitive environment, and you need to be able to walk away from a bad deal.

The importance of site-level profitability as a performance measure

TowerXchange recommends readers download a copy of AT Kearney’s excellent report, “The Rise of the Tower Business”. We spoke to Nikolai Dobberstein, Partner at AT Kearney and co-author of the report.

TowerXchange: Are tenancy ratios over-emphasised as measure for the success of the tower business?

Nikolai Dobberstein, Partner, AT Kearney:

Until now, the focus has been on tenancy ratios as a measure of success for the tower industry. With many costs still passed through from the tower company to the operator, there has been less incentive to reduce fuel, O&M and security costs.

Cost-focused, smart operators, are realising that it may be better for tower companies to handle power and fuel, O&M under fixed cost arrangements, especially as they seek to penetrate rural areas with low electrification. This has the benefit of stabilizing charges, avoiding disputes and empowering the tower company to really manage operations. Under such arrangements, site-level profitability is a key performance indicator.

TowerXchange: How can the tower business improve site-level profitability?

Nikolai Dobberstein, Partner, AT Kearney:

Power and fuel cost savings remain the most important, yet the most difficult opportunity to create value and improve site-level profitability. The tower business knows there are several opportunities to optimise diesel spend (monitoring and supervising consumption, managing pilferage, ensuring you have the right spec site configuration and DG et cetera), but we feel there is an over-emphasis on technical solutions and that implementation is the key.

Vendor management and managing costs on the ground is critical. Significant improvements can be made by getting the simple stuff right: getting the air conditioning settings right, controlling and ring-fencing pilferage, using the TOC to understand what’s going on at sites and scheduling preventative maintenance. You also can improve security – dedicated security guards can be very costly and might even be correlated with pilferage. Patrolling models should be considered. And of course you can act to bring down real estate costs.

These solutions are all known to tower companies and operators, but it is critical to apply the right management concepts and tools to drive those improvements.

TowerXchange: Is site-level profitability as important in less mature African markets where there isn’t the oversupply of sites we see in countries such as India?

Nikolai Dobberstein, Partner, AT Kearney:

The importance of site-level profitability holds regardless of the environment, particularly in urban areas, where even in less mature markets there will be a high number of existing towers. As my colleague Laurent suggested, tenancy ratios over two are going to prove difficult to reach in Africa, despite the fact that there may be four or more operators in some markets. While extending networks into new rural areas often yields immediate demand for additional tenancies, there is a limited opportunity to drive co-locations and tenancy ratios in urban areas, where several operators have already built out their own tower networks.

So site-level profitability is also important for less mature markets.

TowerXchange: Are there other sources of revenue and value add for the tower industry beyond operator tenancies?

Nikolai Dobberstein, Partner, AT Kearney:

We’ve seen towers co-located with internet kiosks, retail outlets and ATMs, or used to provide electrification for rural irrigation.

The income stream is limited compared to the tenancy rental income, but they can provide good opportunities for corporate social responsibility.