With almost 117m subscribers generating US $9bn in revenue this year, subscriber numbers forecast to increase to 150m by 2016*, and a need for three times the current 24,252** towers, Nigeria is one of the most attractive growth telecoms markets not just in Africa, but in the whole world. (Sources: *Business Monitor International, **GSMA)

The independent towerco business model made its African debut in Nigeria in 2005-6, and independent towercos own a little over 13% of the towers in the country. The most mature portfolio of independent towers in Nigeria, indeed in Africa, is Helios Towers Nigeria’s (HTN) 800 green field sites, which boast a tenancy ratio of 2.6. HTN subsequently added a further 500 sites from Multi-Links. SWAP owns 680 towers in Nigeria. IHS also originates from Nigeria, where they own around 1,200 towers and manage a similar number of sites for operators.

Risk

Of course, building and operating telecoms infrastructure in Nigeria exposes companies and their investors to considerable risk. There’s commercial risk: price wars and declining ARPU have affected tier one operators, while Nigerian towercos have had their fingers burned working with tier two anchor tenants that struggled to maintain payments. “SWAP and HTN have both experienced some negative consequences from the poor performance of anchor tenants,” reported Ken Okeleke, Senior Analyst, ICT Research at Business Monitor International (BMI). “SWAP sealed an US$81.4mn sale and leaseback deal with Starcomms in December 2010 for 407 of the CDMA operator’s 557 towers. For its part, HTN signed a long-term tower lease agreement worth hundreds of millions of dollars with Multilinks and claimed it was owed around US$252mn at the time former parent company Telkom South Africa was looking to divest its stake in 2011. Starcomms and Multilinks suffered subscription losses and have recently been acquired by Capcom.”

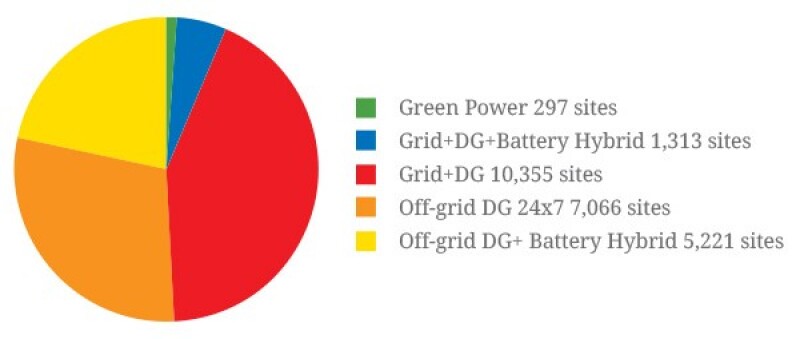

There’s operational risk: Nigeria’s ravenous diesel mafia can increase energy opex by 30% or more, compounded by challenges meeting SLAs calling for 99.5% uptime on an incomplete and unreliable power grid. The Energy Commission of Nigeria reports 78% urban electrification but only 23% rural electrification. “Cell sites often get only three to four hours of grid power, and the grid is unreliable even when you have got it,” said Fazal Hussain, CEO of SWAP International. “So most cell sites are powered by double diesel generators and a stack of batteries, making Nigeria one of the worst markets in terms of diesel usage.”

TowerPower in Nigeria

There is also a risk of corruption: according to Transparency International’s “Global Corruption Perception Index” (http://cpi.transparency.org/cpi2012/results), Nigeria is ranked 139th out of 176 countries. And there is political risk, which has directly affected the tower industry in the form of vandalism and sabotage of cell sites.

Reward

However, the potential rewards far outweigh the risks for the tower industry in Nigeria.

Tightening margins are strengthening the case for Nigeria’s operators to consider infrastructure sharing. “With revenue fairly stagnant and ARPU falling, operators’ capacity to invest capital is reduced, which leads to many operators considering adopting the ‘Lean Operator Model’ looking at different outsourcing options including infrastructure sharing,” said SWAP’s Hussain.

There are no shortage of prospective tenants for Nigeria’s towers, indeed Nigeria offers proof that tenancy ratios well in excess of two can be achieved in Africa. HTN report that 95% of their revenue comes from Nigeria’s four tier one MNOs (MTN, Airtel, Globacom, Etisalat and Airtel). Meanwhile, consolidation among tier two operators, with several CDMA operators coming together under Capcom (and adopting LTE), may mean less tier two potential tenants, but improves the credit worthiness of those tenants. Capcom is supplemented by a healthy crop of WiMAX operators migrating to LTE, while Smile Communications rolled out an LTE broadband access network in Ibadan in Q1 2013. “Each of these companies is going to need 200-300 sites in their first 2-3 years, and none of these companies is likely to set up their own infrastructure, they’ll rely on shared towers,” said HTN’s Bajaj.

New entrants and migrating WiMAX providers won’t remain the only players in the LTE space. Airtel completed 4G trials in Lagos, and Globacom announced availability of LTE as long ago as January 2011. “We also expect the NCC to come up with an LTE license auction within 12-18 months, including Mobile Broadband. This will represent another opportunity for the towercos,” said Bajaj.

Rental rates in Nigeria were as high as US $7,000 per month four years ago, but that has halved at many towers today, which means site level profitability is a critical consideration for Nigerian towercos.

Alongside rental revenue, towercos in Nigeria can attract substantial BTS programme revenue. “Operators are investing heavily in their voice networks and data networks (3G) and the high levels of investment are in the range of US $3 billion per annum in the industry,” said Inder Bajaj, CEO of Helios Towers Nigeria. “From a tower perspective, the largest proportion of that growth in tower numbers is coming from MTN, driven by their coverage expansion strategy, and the need to densify their network to deal with the capacity demands of their large customer base.” Forecasts suggest Nigeria will add over 6,000 towers by 2015, taking the total to over 30,000.

All Nigeria’s tier one MNOs are expanding their networks. Airtel and Globacom generally prefer to build their own new towers, while MTN and Etisalat often give the option to towercos to build greenfield sites.

“With a price tag of up to US$200,000 in some cases, to build a tower in Nigeria, including the cost of obtaining all necessary permits, acquiring land and providing private power supply, the industry is capital intensive and potentially worth tens of billions of dollars, said BMI’s Okeleke.

Cellsite densification, as smart phones become more prevalent and data consumption increases, particularly in dense urban areas, will also drive demand for new sites and co-location.

The Nigerian Communications Commission has been outspoken in its advocacy of infrastructure sharing, and has not been shy to hand out penalties for Nigeria’s infamously poor QoS, contributing positively to the case for operators to transfer tower assets to independent towercos.

Will there be a tower transaction in Nigeria in the next 12-24 months?

“All of the Nigerian operators should be looking to put their towers on the market. Whoever sells their towers first gets the best valuation,” asserts SWAP’s Hussain.

“Airtel has formed Africa Towers like they did in India, and is expected to commence this in Nigeria as well,” said HTN’s Bajaj. “MTN and Etisalat are expected to follow the sale and leaseback route like they have done in other markets.”

“Nigeria’s towers market promises to be one of the most active in the region,” adds BMI’s Okeleke, agreeing with Bajaj by adding “MTN and Etisalat appear to be the most likely tier one operators to venture into tower sale and leaseback deals.”

Overcoming local stakeholder resistance to tower transactions will be a principle challenge to any potential tower transaction in Nigeria.

Huge capital required - are towerco’s pockets deep enough?

Can towercos raise the capital necessary to acquire a substantial portfolio of towers in Nigeria? With the towerco business model in Africa not yet mature enough to attract infrastructure funds, only debt and private equity finance is available to fund transactions, at a cost of capital that means a tower transaction in Nigeria would not be for the feint hearted!

If a tier one operator’s tower assets came to market in Nigeria, one possible solution would be to break up their portfolio into more digestible chunks. With three proven towercos active in Nigeria, there would be no shortage of bidders if the price were right. “Helios Towers Nigeria would absolutely participate as a bidder if the tower assets of one of the tier one operators came to market as sale and leaseback,” said Inder Bajaj. Opinion is divided as to whether American Tower would have the appetite to enter a market with the perceived country risk of Nigeria.

SWAP’s Fazal Hussain summarises the risks and rewards of entering the tower business in Nigeria: “Any investor who wants to be a major force in African towers must have a footprint in Nigeria: it’s the biggest market for infrastructure sharing and it’s the toughest market - as they say, ‘if you can make it there you can make it anywhere!’”

For further information on Nigeria’s tower market, we recommend you read:

BMI: Assessing the factors that would shape Nigeria’s tower market

HTN keen to acquire assets in Africa’s largest mobile market