Passive infrastructure outsourcing has been a global trend for more than a decade. Tower transactions which first occurred in the US and Europe have spread to other regions such as South America, Africa and Asia while fuelling the growth of tower companies such as American Towers, Crown Castle, Bharti Infratel, Tower Bersama, Helios Towers, Eaton Towers, IHS and others. In this context, the Middle East is one of the few remaining ‘virgin’ markets. Even though site sharing among operators in the region is relatively common, there have been virtually no transactions to date.

In 2011 STC and Mobily were in talks to spin off their towers in Saudi Arabia into a joint venture with the operators retaining ownership in the joint venture and becoming anchor tenants. The deal was expected to reduce passive infrastructure related capital and operating spend. However, no agreement has been reached as yet. Separately, in 2012 Batelco kicked off a sale process for its towers in Bahrain and Jordan, but in the end decided not to proceed with the deal because according to the Group’s CEO Sheikh Mohamed Al-Khalifa the various proposals received “did not create sufficient, long-term economic value”. Batelco would instead look for tower sharing opportunities in its countries of operation.

No significant transactions around tower sharing and outsourcing in the Middle East

So, why have there been no transactions in the Middle East?

There are a number of reasons behind the relatively underdeveloped tower market in the Middle East. To begin with, the mobile telecom market has been historically characterised by high ARPUs, healthy EBITDA margins and reasonable debt levels, which has reduced the operators’ need for funds or need for cost reductions. Secondly, passive infrastructure outsourcing has not received the necessary regulatory support. There is no mention of tower sharing in the telecom regulations of Kuwait and Yemen, while only recently Qatar, Lebanon and Iraq have started to look closely into the matter. The remaining regulatory frameworks encourage infrastructure sharing but there is little clarity on the requirements for the set-up and licensing of a towerco and the transfer of passive infrastructure. Lastly, some operators continue to perceive their towers as a strategic asset and are reluctant to outsource them in light of the threat of increased competition and market share loss.

Green shoots in the desert

Despite the lack of tower deal making in the Middle East, we expect the tower market in the region to become active in the next 12 to 18 months given the willingness of some of the leading operators to put passive infrastructure in the centre of their strategy and the interest expressed by leading towercos in the market. Potential transactions could be executed on a country by country basis or could be targeted at the full tower portfolio of the regional players (e.g. Zain Group, Ooredoo, and STC). In either case, the optimal transaction structure for each market needs to be tailored according to its maturity, growth prospects, the operators’ own ambitions and the regulatory and tax environment in the market in which they operate.

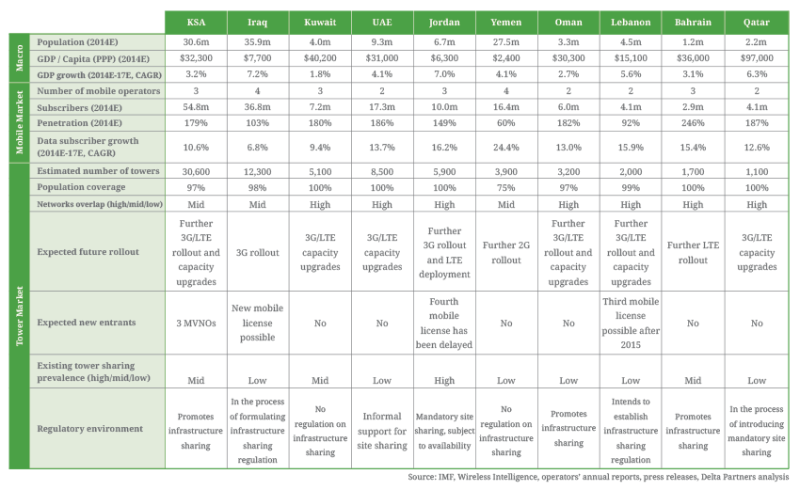

There are over 70,000 mobile telecom towers in the Middle East, according to our estimates. The markets with most towers are Saudi Arabia (~30,600), Iraq (~12,300), UAE (~8,500), Jordan (~5,900) and Kuwait (~5,100).

Estimated number of towers in the Middle East

We perceive as most attractive from a passive infrastructure perspective the following markets: Saudi Arabia, Iraq and Kuwait. Even though UAE and Jordan have a sizeable tower base, they are considered as less attractive for a variety of reasons. In the case of the UAE, there are only two mobile players (Etisalat and du) operating in a closed environment which limits the tenancy ratio upside. The value creation potential of the tower market in Jordan, on the other hand, is hindered by its high electricity costs and the tax environment.

Saudi Arabia

Saudi Arabia is the most sizeable mobile telecom market in the Middle East with 54.8 million subscribers. It comprises of three mobile operators (STC, Mobily and Zain) and is expecting the launch of three MVNOs. Saudi Arabia’s mobile penetration has grown steadily and is forecast to reach approximately 180% by the end of 2014, making it one of the top SIM-penetrated markets in the world. The growth in voice services is slowing down and future growth is expected to be driven by a focus on high-value services and stronger uptake of 3G and 4G services.

We estimate that there are approximately 30,600 towers in Saudi Arabia. The operators have 2G network coverage ranging from 90% to 97% of population and all of them have launched 3G and LTE services. Future rollout requirements are expected to be fuelled mostly by 3G and LTE coverage improvements and capacity upgrades needed to support the data growth in the country. The MVNO licenses per se would not contribute substantially to the demand for towers given that they will be leasing capacity from existing operators, however the MVNOs would increase the competitiveness of the mobile telecom market which would in turn lead to the operators’ enhanced consciousness of their cost base.

So far the discussions between STC and Mobily to set up a towerco have not been successful. At present, passive tower infrastructure is shared between STC, Mobily and Zain on a selective and one-on-one basis. Overall, Saudi Arabia’s market attractiveness is driven by its size and future network capacity expansion. Additionally, the potential set-up of a towerco would be facilitated by Saudi Arabia’s well developed regulatory structure that promotes a liberal and competitive telecom market and infrastructure sharing.

Iraq

Iraq is the second largest market in the Middle East in terms of number of towers (estimated at approximately 12,300). There are four mobile operators present in Iraq (Zain, Asiacell, Korek and Mobitel, the latter operating solely in the Kurdistan region). Mobile penetration currently stands at approximately 100% which, taking into account the double SIM effect, allows for further subscriber growth. 2G network coverage is generally good, with Zain and Asiacell covering 98% and 97% of the population respectively, however, Korek is lagging behind. The mobile data market is still underdeveloped because of the government’s delay in granting 3G licenses. Currently 3G services are only offered by Mobitel in Kurdistan. All in all, the demand for towers is expected to be strong, fuelled by further 2G and 3G rollout. Additionally, the network overlap is less than perfect (i.e. Zain’s network is concentrated in the South while Asiacell and Korek’s networks are concentrated in the North of Iraq), which underlies an attractive tower company business case. Furthermore, substantial savings at the operator P&L level are expected because of the efficiencies in fuel (including fuel security), security and maintenance that a specialised tower operator would bring.

From a tower market opportunity perspective, the current timing for setting up a tower company is very attractive – the Iraqi government has just granted the mobile operators the right to rollout 3G services, therefore 3G rollout will be under way soon; also, a new mobile license has been on the regulator’s agenda for some time. However, it is unlikely that any tower transaction will take place before the difficult security and political situation in Iraq is resolved.

Kuwait

Kuwait is another sizeable, yet mature market. It is characterised by high penetration rates (180%) and historical growth attributed to multiple SIM ownership, temporary visitors and immigrant workers. There are three operators present in Kuwait: Zain, Viva and Wataniya, accounting for a total of 5,100 towers. The network coverage in Kuwait is extensive: 2G services cover 100% of the population, 3G services in the range of 95% and 98% and LTE has been deployed nationwide. Therefore, there will be only limited rollout for coverage purposes going forward, however 3G and LTE capacity upgrades will be needed to cater for the data growth in the market. The limited market growth in Kuwait and significant network overlap supports the business case of simultaneous carve out of more than one tower portfolio, because this will enable healthier tenancy ratios.

Middle East towers: opportunity in the waiting

The telecom markets in the Middle East are rather diverse, ranging from highly penetrated markets boasting the latest technologies to voice-only markets with ample opportunities for growth. The common aspect of these markets is the lack of tower outsourcing activity, which is otherwise present virtually everywhere else, from the Americas to South East Asia. In other words, the Middle East presents a unique first mover opportunity for both mobile and tower operators. Being a first mover in the tower space has its inherent risks but the potential rewards typically outweigh the risks. One thing is for sure - being the last mover is almost always the worst possible outcome.

Main drivers of the tower markets in the Middle East (click on the image below to enlarge)

About the authors

Federico Membrillera heads up Delta Partners’ Corporate Finance division and he has served clients globally across different aspects including investment banking and mergers & acquisitions, corporate finance and strategic management consulting. He has over 20 years of experience in the telecoms, media and digital (TMD) industry.

Yana Kamburova has been with Delta Partners for close to five years, executing Corporate Finance mandates in the telecom, media and digital (TMD) space in the Middle East, Africa, Europe and Asia. She has worked on a number of tower transactions and passive infrastructure strategy engagements.

About Delta Partners

Delta Partners is the leading Advisory and Investment firm specialised in Telecoms, Media and Digital with offices in the Middle East, Africa, Europe, Asia, Latin America and the United States of America. We partner with global and regional telecom providers, digital players and other TMD clients to help them address their most challenging strategic issues.

Our unique combination of Management Consulting, Corporate Finance and Private Equity creates unparalleled value for our clients, investors and business partners.

For more information, please visit www.deltapartnersgroup.com

Delta Partners Corporate Finance Limited and Delta Partners Capital Limited are members of the Delta Partners Group of companies and are authorised and regulated by the DFSA.