There are a number different combinations of market dynamics that make a country a ‘perfect fit’ for independent towercos. Malaysia is one such ‘perfect fit’: three strong, competitive operators each with substantial market share; a wave of new LTE license holders seeking to co-locate rather than deploy their own sites; a data hungry subscriber base fuelled by growing disposable incomes; and an established culture of tower sharing. Malaysia is home to edotco’s headquarters and first live opco, and home to a multitude of smaller, regionally-focused State-backed and independent towercos. Let’s take a closer look at the structure of Malaysia’s tower market.

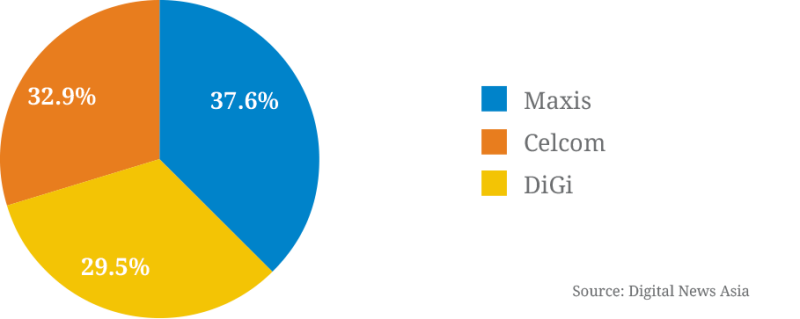

Figure 1: Mobile market share 1H 2014

The size of the independent tower industry in Malaysia

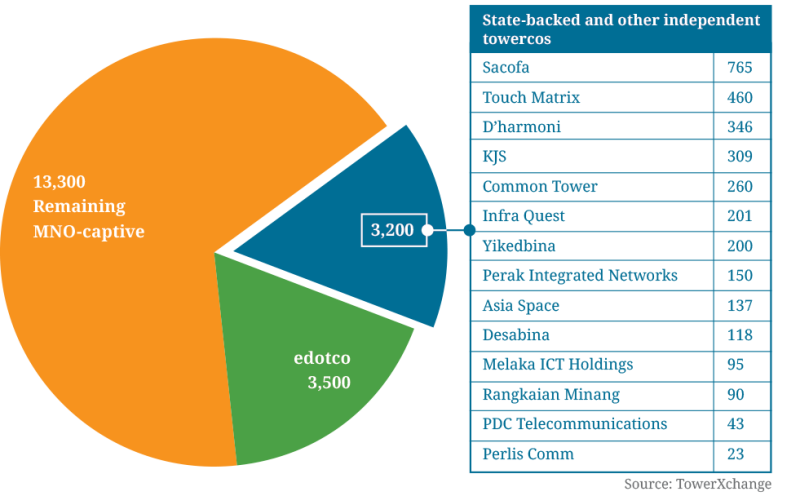

Malaysia has around 20,000 telecom towers, of which 3,500 have so far been carved out and transferred from Axiata to edotco. edotco has been trading for one year and is the newest and largest of several independent towercos operating in Malaysia. Many of Malaysia’s towercos are State-backed, regional players, some of which have been operating since the millennium.

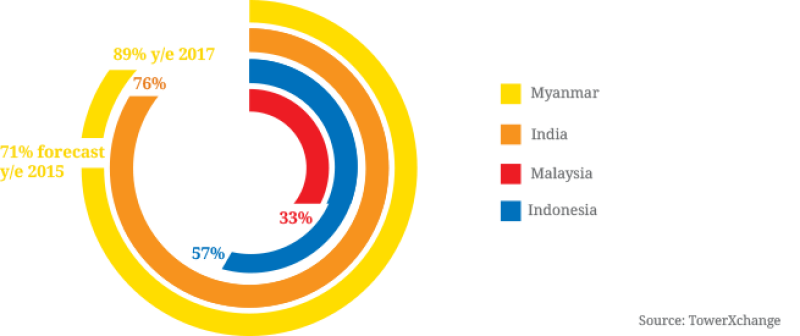

Towercos own around a third of Malaysia’s towers, a similar proportion to Indonesia, but lagging the mature Indian market where towercos own two thirds of the towers, and trailing Myanmar, which stands as a unique case with 15,500 new towers all being rolled out by towercos by 2017 (according to GSMA GPM forecasts).

Figure 2: Comparing the penetration of the independent tower industry in each Southern and Southeast Asia’s top four tower markets

While DiGi and Maxis both currently retain their towers, both have been rumored to be considering launching their own carve-out towercos.

An established culture and regulatory framework supporting infrastructure sharing

Malaysia’s independent tower industry was effectively inaugurated by the Communications and Multimedia Act (CMA) of 1998, which recognised an infrastructure class license for “Network Facilities Providers”.

Some State-backed infrastructure companies have near-monopoly status within their State, other regional markets are more open. Many of the important granular decisions in the regulation of the Malaysian telecom tower industry, such as matters concerning land title and infrastructure access permits, are typically in are taken at State rather than Federal level.

The State-backed towercos have an association known as BPIT which creates a framework within which the towercos abide by standard lease pricing and contractual terms. One of the noteworthy consequences of this market structure is that State-backed tower companies’ lease prices are believed to be discounted by 25% after 7-10 years. Therefore lease pricing on macro towers is well established and widely confirmed with in Malaysia, although there is more flexibility for the increasing number of Malaysia’s towercos that have ventured into provision of ‘Special Structures’ (such as lamp posts which have modular, upgradable designs).

There are a handful of completely independent tower developers in Malaysia, some of which offer disruptive pricing options significantly lower than the norms established by BPIT. While such companies seem to be targeting specific, attractive locations, the profitability of such an approach remains questionable.

Figure 3: Estimated tower count for Malaysia

Organic and inorganic growth opportunities in Malaysia

The maturity of network rollouts, combined with aforementioned State-led regulation of new site permitting, and the dominance of local State-backed towercos in some parts of the country, mean opportunities to build new towers are limited in the Malaysian market. It seems that independent towercos can secure permits to build new towers in around half of Malaysia’s States, with the State-backed towerco having exclusive rights in the other half. However, Malaysia boasts more or less umbrella 3G coverage (with 2G EDGE); the MNO’s coverage varies between the high 80’s and low 90’s percent.

There are still opportunities for organic growth for towercos in Malaysia. Malaysia’s three incumbent MNOs announced 2014 capex budgets totaling RM 3bn (just under US$1bn). Cell site densification, driven by growing data demand and the technical specifications of LTE, mean infill sites are needed in Malaysia’s dense urban areas, but the demands of regulators and aesthetics mean smaller lamppost-style structures (often still sharable) will generally be preferred to macro towers.

The fragmentation of Malaysia’s tower market may offer edotco, or prospective new market entrants, an opportunity to grow inorganically through the acquisition of one of the better performing, larger State-backed towercos operating in the more demographically attractive states, obviously subject to the consent of regulators.

At time of writing, it did not seem likely that either of the remaining MNO’s towers were likely to become available under sale and leaseback in the near term (although DiGi and Maxis have both been rumored to be considering launching their own carve-out towercos). However, as TowerXchange has seen in several other tower markets, it’s amazing how quickly MNO’s stance on tower divestitures can change when a towerco of scale enters their market!

Cell site energy in Malaysia

Less than 5% of Malaysia’s cell sites are off-grid, for example only 140 of edotco’s 3,500 Malaysian sites are off-grid. Malaysia’s grid power is generally reliable. More challenging transport infrastructure conditions in the East of Malaysia mean cell site autonomy is a greater priority here than in the West of the country.

However, this doesn’t mean energy efficiency is not important in Malaysia – burgeoning data demand is driving the energy load on some sites to and beyond capacity, and Malaysia’s high availability expectations means many high traffic connector sites have backup power sources and battery banks.

Fibre to the tower

A surprising proportion of Malaysia’s cell sites still rely on microwave backhaul but, with LTE coming, fibre to the tower is becoming a priority. As more urban sites are connected with fibre, the removal of heavy microwave dishes frees up valuable space for co-location sales.

With data traffic rising and the price per MB of data falling amid price competition, the cost of fiberization may prompt collaboration and fibre sharing.

Malaysia already has some active fibrecos offering bandwidth to operators, but their reach is limited and more are needed. There is less of a shortage in the trunk as at the costly metro access and last mile / fibre to the tower.

Potential for IBS, small cells and Wi-Fi offload

The majority of cell sites in Malaysia are still conventional macro sites. IBS remains a premium solution, with multi-tenant DAS representing around 10% of edotco’s portfolio for example, but with a pipeline for perhaps 3-4 times as many IBS.

Malaysia needs improved indoor coverage, especially in dense urban areas, prompting the usual debate about the relative merits of small cells and Wi-Fi.

LTE rides a wave of collaboration and RANsharing

Malaysia recently issued eight LTE licenses, subject to a condition that 10% of the population be covered within the first year. With such time to market pressures, the majority of new LTE entrants are co-locating on towers and a lot of RANsharing is taking place.

There seem to be minimal restrictions upon RANsharing within Malaysian towerco’s contracts, with the view prevailing that with the MVNOs piggy backing on the radio area networks of Malaysia’s three incumbent MNOs, there will come a time when growing capacity demands will prompt ‘tenants’ sharing RAN to seek their own fully fledged networks. The three established MNOs simply can’t give capacity to everyone indefinitely.

Incumbent operators Celcom and Maxxis are felt to offer the best 4G coverage, with the initial focus being on Malaysia’s biggest cities, beyond which 4G coverage is spotty rather than continuous.

Conclusion

The unique structure of the Malaysian telecom market means there are no benchmarks for international comparison. While 3G coverage is mature and there are plenty of macro towers, FTTT, special structures and IBS are needed to provide capacity as LTE takes root. With the permission of regulators, there seems an obvious opportunity to create economies of scale through the consolidation of some of the country’s more profitable state backed and independent tower companies. With eight new LTE licenses creating a race to market, there remains the possibility that DiGi and/or Maxis’s tower assets may follow Celcom’s in being made commercially available for co-location.

Several of the key stakeholders in Malaysian towers will be represented at the TowerXchange Meetup Asia, taking place on December 9 and 10 in Singapore. For more details, click here