The market for communication tower sharing appears to have cooled in Chile, following the enactment of Law No. 20.599 published on June 11 2012, which established regulations for the installation of antennas and transmission stations telecommunications services. Furthermore, economic headwinds from a slowdown in Chinese demand for industrial metals exports have also led to slower GDP growth and weaker investment. Despite these trends, the Chilean telecoms market maintains the strongest fundamentals in the region, backed by a favourable business environment and our outlook for the towers market is more positive over the longer term, as growth in 3G/4G services increases along with consumer spending power.

By comparison to some of its Latin American neighbours, the Chilean market for third-party tower companies has been relatively muted, particularly since the end of 2012, when the last major transaction took place. The three major Chilean mobile network operators have seen declining contributions in voice revenues and shrinking profit margins, as capital expenditures are increased to cater to a growing transition to non-voice and mobile data services. With these financial pressures, combined with coverage requirements and other network maintenance and upgrades, it is common for operators to sell non-core towers assets to third-party independent tower companies but this was not the case during 2013 or Q1 2014.

Towers Act Has Slowed Down Asset Sales

We attribute this largely to the passage of Law No. 20.599, which set regulations for the construction of antennas and telecoms infrastructure to encourage co-location and decrease the environmental impact of tower saturation. Voluntary co-location had previously existed in the market, however, the Towers Law now requires that wireless infrastructure is built with the capacity to share with other mobile providers. It also sets more stringent conditions for the installation of towers in saturated areas (areas with two or more), as well as restricting the construction in sensitive areas (such as near schools, hospitals, nurseries), requires approval for towers over 12 metres high and establishes compensation for local communities. With such rigorous conditions regarding tower sharing between mobile operators and tower construction, we believe this has acted as a disincentive for operators to sell to third-party tower providers. Tower companies may also be hesitant to enter the Chilean market, cautious of how the laws may affect their operations and potentially in anticipation of further regulations.

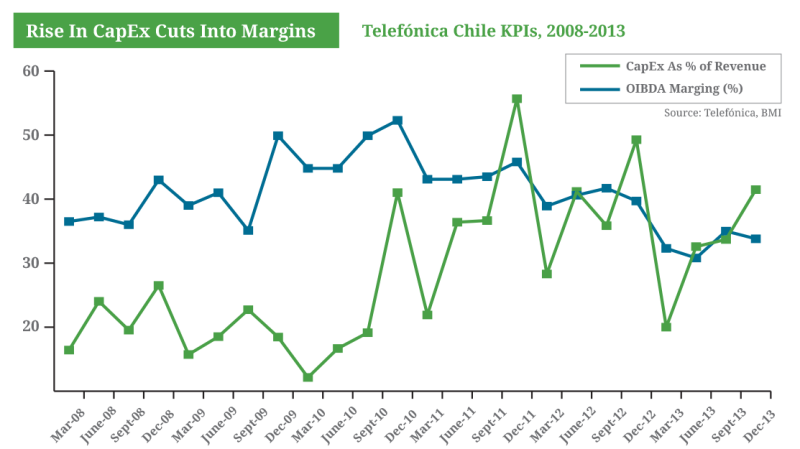

Rise In CapEx Cuts Into Margins

Telefónica Chile KPIs, 2008-2013

In the wake of the reforms, mobile operators noted how these additional complications would result in increased costs, as they compensate local communities and make retroactive adjustments to their existing tower portfolios. Although charging rival operators in order to share infrastructure should help recoup some of this expenditure, it is possible that they will not be able to recover the full investment.

Additional 4G Spectrum Will Require Investment

Despite these problems in the short term, we view the longer term picture in Chile as more positive and conducive to the tower sharing trend. The February 2014 auction of 700MHz 4G spectrum, will provide for the deployment of 4G networks to support the existing holdings of 2.6Ghz spectrum awarded in July 2012. Both licences came with rollout and coverage requirements, focusing on underserved areas of the country and encouraging high quality of service. In order to meet these commitments, the three main operators will need to invest heavily in infrastructure, expanding their current portfolios by three to four times their current size. With higher costs of construction due to the Towers Act, operators could look to divest non-core tower assets to third parties in order to fund this heavy capital expenditure burden.

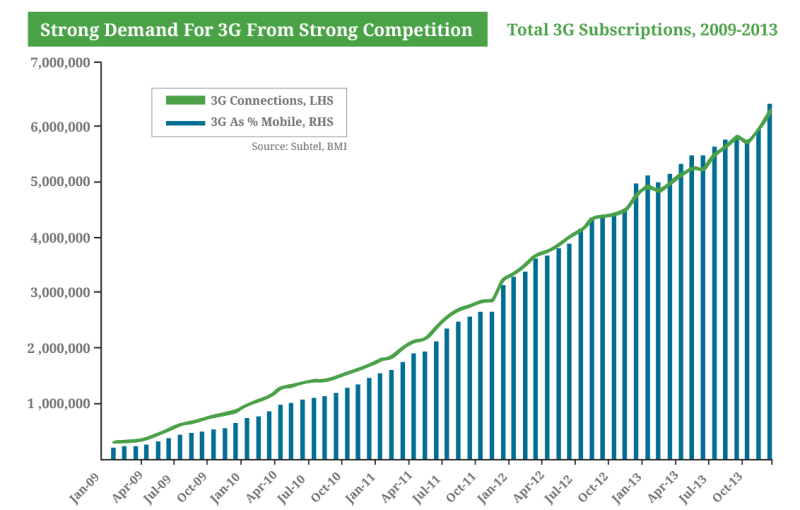

Chile is one of the more developed mobile markets in Latin America, with 3G connections accounting for 26.8% of total subscriptions at the end of 2013, following growth of 29% year-on-year. This shows a strong demand for higher value services in the country and 4G is therefore likely to be met with some demand. We believe the country has a subdued consumer story over 2014 as a result of exchange rate weakness and higher inflation that will weigh on purchasing power. However, our view over the next decade is a lot stronger, as the country tries to diversify away from its dependence on mining to a more consumer-driven economy, which should lead to greater spending power for mobile subscriptions and smartphones, for example.

Strong Demand For 3G From Strong Competition

Total 3G Subscriptions, 2009-2013

Furthermore, networks are obliged to account for MVNOs and will also need to include measures for handling capacity from machine-to-machine (M2M) connections. The rise in mobile data looks set to continue in Chile and will be one of the outperformers in the region in terms of 3G/4G subscriptions and non-voice revenues. Mobile operators will therefore need to explore tower sharing options as a way to handle the extra capacity.

The Most Stable Business Environment In Latin America

Also working in Chile’s favour is the more stable and favourable business environment that the country offers in comparison to the rest of the region. Chile offers foreign investors some of the world’s most competitive business costs. Privatisation and deregulation have created sophisticated public utility and telecoms industries, while corporate taxes and labour costs are moderately low. Market-friendly policies and strong institutions have been the hallmark of the Chilean government in recent years, and we believe that the country will continue to set the benchmark for political stability in the region going forward. While the market for towers has cooled since 2012 as a result of the Towers Law and economic headwinds leading to lower foreign investment in the economy, the longer term picture for Chile is still the strongest in the region and we expect to see the market for tower companies pick up as the rise in 3G and 4G services continues to pick up.