Helios Towers Africa (HTA) has acquired 3,100 of Airtel’s 15,000+ African towers currently for sale. TowerXchange present an educated guess as to the four countries involved, and note that reported valuations of US$400-550mn correspond with HTA’s parallel announcement of the injection of $630mn in new capital. This feature also includes an exclusive interview with Chuck Green, CEO of HTA and member of TowerXchange’s Inner Circle Informal Advisory Board.

After 11 months of negotiations, the first tranche of Airtel’s African tower sale has been announced, with Helios Towers Africa (HTA) acquiring 3,100 towers in four countries. Like most emerging market tower deals, this looks like a win-win: Helios Towers Africa strengthens it’s leadership position in existing markets while diversifying to mitigate country and counterparty risk; Airtel pays down debt, stabilises opex, and frees up management bandwidth to concentrate on the retail side of the business.

HTA have been unable to reveal in which four countries they have acquired 3,100 of Airtel’s African towers as the sale of Airtel’s other African towers is an ongoing process, and the exchanges are subject to regulatory approval and fiscal oversight. However, the Economic Times of India quotes a “person familiar with the matter” suggesting that the countries are Tanzania, Democratic Republic of the Congo, Republic of the Congo and Chad. TowerXchange are reasonably confident that Airtel’s portfolios in Tanzania and DRC are included in the deal, but have not had the opportunity to confirm the other countries at time of press.

Similarly the acquisition price has not been confirmed, but it is possible to work out a window given HTA’s concurrent announcement of US$630mn of private equity capital raised (plus US$350mn in bank debt), sufficient to allow HTA to close the Airtel deal and to retain some capital for what HTA CEO Chuck Green described to TowerXchange as “other opportunities in the pipeline over the next 6-8 months”.

Press and analyst coverage puts the deal value at US$400-550mn, which values the towers at US$130,000-175,000 each, a statistic of finite value without knowing the lease term and lease rate.

HTA CEO Chuck Green described the Airtel deal as having “significantly increased the scale of the business, while also resulting in further geographical diversification for Helios Towers Africa.”

TowerXchange’s latest exclusive interview with HTA CEO Chuck Green

TowerXchange: Congratulations on HTA’s latest capital raise, attracting a further US$630mn in new equity resources from existing and new shareholders. As towercos like HTA mature, to what extent is diversification of country and counterparty risk a pre-requisite to attracting capital from a new pool of telecoms and infrastructure specialist investors who perhaps 2-3 years ago might have considered African towers an interesting but immature sector?

Chuck Green, CEO, Helios Towers Africa:

The long term value of this business has always been expected to be optimised with scale and diversification.

Diversification means the specific risk associated with investing in any one country is mitigated, which can provide comfort to certain investors because the perception of emerging markets can be one of instability and a lack of political transparency. From day one Helios Towers Africa set out to have multi-market exposure in order to mitigate risk and achieve a scale that would optimise exit opportunities for private equity shareholders at some point in the future.

One of our priorities over the next three to four years is preparing for a substantial liquidity event, such as listing the company. Scale, geographical and customer diversification are all extremely important to attract the public markets, as investors become comfortable with counterparty and country exposure. With our latest acquisition from Airtel, HTA now owns over 7,800 towers in Africa.

While HTA are delighted to have attracted new capital from Providence Equity, it is also important that we have retained our original investors. When our existing equity follows us in our next round of financing, it’s an indication of support and confidence in our business model, in our management team, and in the African tower business in general.

The tower industry in Africa has been developing positively since the HTA undertook the first sale and leaseback in Ghana with Millicom back in 2010 – from that point on, the profile and relevance of investment opportunities in African towers, and investment opportunities in Africa in general, has increased. The number of people willing to consider investing in such opportunities increases as they become more familiar with the compelling prospects offered by these markets.

TowerXchange: What can you tell us about the tower sale process inaugurated by Airtel?

Chuck Green, CEO, Helios Towers Africa:

Airtel have run an incredibly disciplined process –the seller’s team were very strong. Data control has been on a par with the best of the other transactions – virtual data rooms have been quite complete. Airtel have done a great job considering they didn’t appoint a banker, and ran 16 or 17 markets simultaneously with several potential buyers – it was tough enough for us and we were only dealing with 4 markets!

We envisage taking on many of Airtel’s tower-operations personnel. We’re getting skills, experience and a familiarity with the assets which has been invaluable in past transactions.

TowerXchange: Appreciating that you can’t confirm in which four countries HTA is acquiring the towers, I understand HTA already has operations in at least one of those countries. When you combine a new portfolio of mostly single tenant towers with a more mature vintage which has been upgraded and several years worth of co-locations added, what are the implications for the cash flow position of your local opco and their propensity to make capitally intensive investments?

Chuck Green, CEO, Helios Towers Africa:

Adding new towers has no effect on the propensity of our local opco to make capitally intensive investments.

We always factor improvement capex into the financial structure of a transaction. Our improvement capex budget is based on sample surveys in due diligence, and a complete survey post-completion. Whether it’s through internal cash flow or capital allocation, we ring-fence funds for improvement capex.

Our first order of priority is to improve sites that are already heavily loaded or that might be less secure, for example any sites where we need improve structural integrity for health and safety reasons. Our next priority is the improvements necessary for meeting our Service Level Agreements (SLAs) – typically these are around power systems. Improvement capex then cascades into towers where we know we have demand for, or a high probability of attracting, a second tenant – we quickly strengthen such towers and upgrade power solutions for the co-location of new tenants. This improvement capex can be anticipatory or in response to demand. Upgrading towers is a systematic process can take many months to complete, but from day one we achieve a steady reduction in energy opex costs that improves incrementally for several months.

Improvement capex investment doesn’t detract from the local team’s ability to continue to run the existing portfolio; we can easily fold new tower upgrades into the project group’s activity, and it doesn’t impact on annual maintenance capex and improvements. It also doesn’t affect our appetite for more capitally intensive investments; if there’s a compelling argument to use one approach to improving power over another we’ll do it from day one, even if it’s a new portfolio.

TowerXchange’s analysis of four possible markets

While TowerXchange have been unable to confirm which four countries were involved in Airtel’s sale of 3,100 African towers to HTA, we’re reasonably confident that Tanzania and DRC are included, and there are unconfirmed rumors that the Republic of the Congo and Chad are the other two markets. Since all the Airtel African towers are likely to be sold in the end, whether to HTA or other towercos, let’s take a closer look at these four markets.

Tanzania: Regionalised market perfectly suited to co-location

TowerXchange have spoken to local stakeholders in Tanzania who have all but confirmed that the deal includes Airtel Tanzania’s towers transferring to Helios Towers Tanzania.

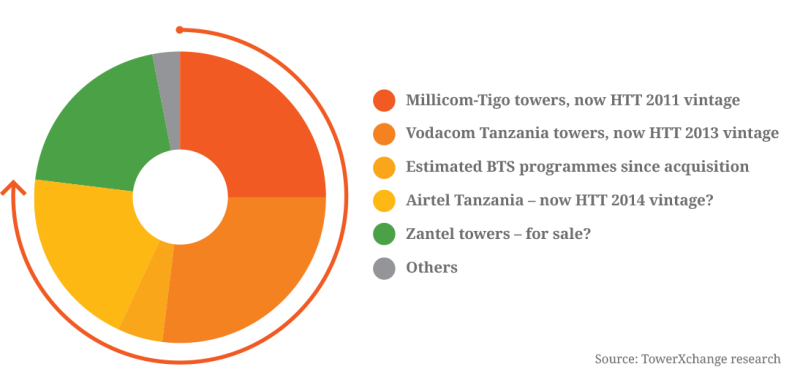

HTA has an established presence in Tanzania, and already owned more than half the towers in the country. In 2011, HTA acquired 1,020 towers from Millicom-Tigo for US$80mn and a 60% stake in the resultant joint venture towerco, Helios Towers Tanzania (HTT). HTA added 1,149 towers from Vodacom Tanzania in 2013, paying an estimated US$75mn for a majority stake in the same combined joint venture towerco, reducing Millicom’s stake to 24.5% in the process. If HTA have added the Airtel towers to HTT, they would have a tower count of 3,200-3,500 in Tanzania, and 75%+ market share. HTA would almost certainly retain 51% of the joint venture towerco. Of Tanzania’s tier one MNO’s, only Etisalat’s Zantel’s towers remain operator-captive, and those assets (or indeed the opco itself) have reportedly been on the block for several months.

The regional nature of Tanzania’s mobile networks, with each operator dominant in a different part of the country, creates a perfect environment for infrastructure sharing as each operator seeks a broader footprint across the country. The same regional phenomenon may mean there is still a market for Zantel’s towers, even coming to market fourth. Zantel is strong in Zanzibar, Tigo is dominant in coastal areas, Vodacom in the Arusha area, and Airtel strong in the Lake zone. A further boost to HTA’s opportunity is provided by Vodacom Tanzania’s ongoing network expansion programme, together with the build-to-suit programmes of Tanzania’s other MNOs. Tanzania is also host to several other licensed MNOs, ISPs and WiMAX operators, including TTCL, BOL, Smile, Sasatel, and Benson. The enthusiasm of such parties to co-locate rather than build their own sites further raises the glass ceiling on tenancy ratios achievable in Tanzania.

Democratic Republic of the Congo: Proven market for HTA

TowerXchange are also reasonably confident that HTA’s Airtel transaction includes Airtel’s towers in DRC, where other stakeholders have confirmed that Helios Towers Africa appears to be the only towerco with an appetite to acquire towers, and where HTA’s local opco HTDRC has achieved impressive tenancy ratios amid challenging logistics.

HTA entered the DRC market via the acquisition of 729 towers from Millicom-Tigo in 2010, for which they paid US$45mn for 60% equity in the joint venture towerco. Millicom-Tigo’s towers were concentrated in urban areas, whereas the Airtel network is reputed to be the most widespread in the DRC, so would represent an excellent addition to HT DRC’s portfolio.

Africa’s third most populous nation, with a population of 75.5mn spread over 2.3mn sq km, DRC is served by only ~4,000 telecom towers and mobile penetration is at 17.5%, which means the runway for growth in the country is tremendous. Four major MNOs were established in DRC (Airtel, Orange, Tigo and Vodacom), before Africell recently caused considerable turbulence by leveraging co-locations on 180 HT DRC sites to accelerate their launch and minimise costs, enabling Africell to aggressively price tariffs and grab almost 20% market share. Supercell also has 2% market share in DRC, and may be an acquisition target.

While HTA has thrived in the DRC, their experiences also demonstrate that such challenging markets are best left to proven emerging market towercos. Beyond the three main cities of Kinshasa, Goma and Lubumbashi, almost all cell sites are off-grid, with the DRC’s under-developed transport infrastructure meaning $1 worth of diesel can cost $1.80 delivered. Security is another challenge, both in terms of fuel theft and in terms of intermittent unrest in the East of the country. Ultimately, declining ARPUs and rising opex costs create a potent motivation for the outsourcing or divestiture of towers in DRC, so Millicom-Tigo and Airtel’s tower deals may not be the last in the country.

While TowerXchange have been unable to confirm or deny the Economic Times of India’s suggestion that the third and fourth countries included in Airtel’s deal with HTA are the Republic of the Congo and Chad, let’s analyse these two virgin towerco markets.

Republic of the Congo: Operator consolidation but strong fundamentals

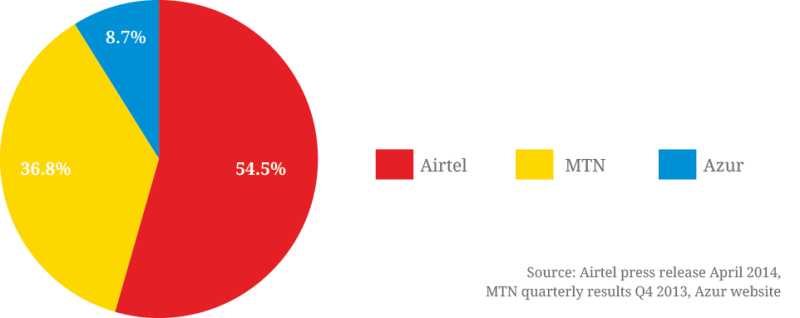

In Spring 2014 Airtel announced the acquisition of Warid’s assets in Congo for US$70-80mn, combining the second and third ranked operators and adding 1mn Warid subscriber’s to Airtel’s existant 1.6mn, who leapfrogged MTN to become market leaders. MTN reported 1.76mn subscribers and ARPU of US$11.77 in Q4 2013. The other MNO in Congo is Bintel subsidiary Azur, which claims to have 415,000 subscribers and which recently signed a partnership deal with Monaco Telecom. Azur’s tariffs are priced aggressively, and ARPUs are correspondingly comparatively low.

Airtel announced the launch of 3G in Congo in October 2011.

With a young population of 4.4mn (61% aged under 14) concentrated in Brazzaville and Pointe-Noire and mobile penetration at 89%, the fundamentals in Congo are conducive to healthy data growth.

Operator market share: Congo

Maintaining QoS has been a challenge for both Airtel and MTN Congo, as both were recently fined 1% of annual revenues by local regulator ARPCE. Energy logistics are a principle cause for downtime, with electrification at around 35% in Congo. Better news for whoever acquires the Congo towers is that work on Congolese section of the Central African Backbone is expected to start imminently, connecting Congo’s second city Pointe-Noire with Mbinda on the Gabon border by 2016. Business Monitor International describes the economy of the Republic of the Congo as “the fastest-growing economy in the CEMAC bloc due to high government infrastructure spending and a booming iron ore sector. The growth of a new export industry will mitigate the effect of stagnating oil revenues.”

Chad: Airtel-Tigo duopoly

For readers interested in reading up on Chad, check out BMI’s excellent analysis in issue 8 of TowerXchange, highlighting another market dominated by two MNOs, this time Airtel and HTA’s old friends Millicom-Tigo, joined by a small 3rd player. Mobile penetration is below African averages at 36.8%, there is less than 15% electrification, low population density at less than 10 per sq km, and potential security concerns, this time originating from Boko Haram over the border from Nigeria.

Hear from Chuck Green, CEO of Helios Towers Africa, and several members of his local and central management teams, at the TowerXchange Meetup Africa, taking place on October 20 and 21 in Johannesburg.

Highlights from the official press releases

Airtel divests telecoms tower assets to Helios Towers Africa

July 9, 2014: Airtel and HTA announce an agreement for the divestment of approximately 3,100 telecoms towers from Airtel to HTA

Deal includes four countries across Airtel’s African operations, which will expand HTA’s tower coverage in Africa to over 7,800 owned towers

Deal allows Airtel to focus on its core business and customers, and helps Airtel deleverage through debt reduction and reduced ongoing capital expenditure

HTA’s focus on providing telecoms infrastructure solutions helps its customers to achieve their goals of reducing operating cost, improving uptime, preserving capital, focusing on their core business, and mitigating the proliferation of towers through infrastructure sharing

Airtel will have full access to the towers from HTA under a long term lease contract

The agreement also envisages that tower operations-related personnel will be transferred from Airtel to HTA

Helios Towers Africa raises $630 million in a new equity fundraising

10 July, 2014: HTA announces that it has raised $630 million in new equity resources from existing and new shareholders

Existing shareholders including: Quantum Strategic Partners, Helios Investment Partners, Albright Capital Management, RIT Capital Partners and the International Finance Corporation (IFC), all added to their current stakes and are now joined by new shareholders Providence Equity Partners and IFC African, Latin American, and Caribbean Fund

HTA also expects to complete negotiations shortly on new and extended debt facilities of over $350 million with a strong syndicate of international and local lending institutions

Following this latest injection of capital into the business, HTA will have raised over $1.8 billion in external financing since inception in late 2009.

The agreement is another milestone in Airtel’s growth journey in Africa. Airtel pioneered the concept of a separate tower entity to promote infrastructure sharing in India and this agreement is a continuation of that philosophy. It is an important step towards the consolidation of tower assets across Africa that will drive industry-wide cost efficiencies through infrastructure sharing. The agreement will further help in accelerating the growth of telecom services in the Continent and at the same time benefit the environment by avoiding duplication of infrastructure - Manoj Kohli, Chairman, Bharti Airtel International Netherlands BV (BAIN) We are delighted to have received this vote of confidence in our strategy and the growth opportunity available, from both our existing investors and new supporters. The market opportunity is as compelling as ever and this new capital injection will help us to consolidate our pan-African vision and market leading position, even further. We now have over 7,800 owned towers in Africa and the financial firepower to enter more new markets - Chuck Green, CEO, HTA

As long-term investors in the global wireless industry, we are excited about the tremendous growth potential across Africa and HTA’s unique position as the leading, independent telecoms tower company on the continent – Dany Rammal, Managing Director, Providence Equity Partners

We are very pleased to enter into a partnership with HTA and its investors. HTA is well-positioned for growth in several under-penetrated markets in Africa and the Bharti Airtel transaction is another demonstration of the company’s credibility with large operators in the mobile telephone industry – Sujoy Bose, Head of the IFC African, Latin American, and Caribbean Fund