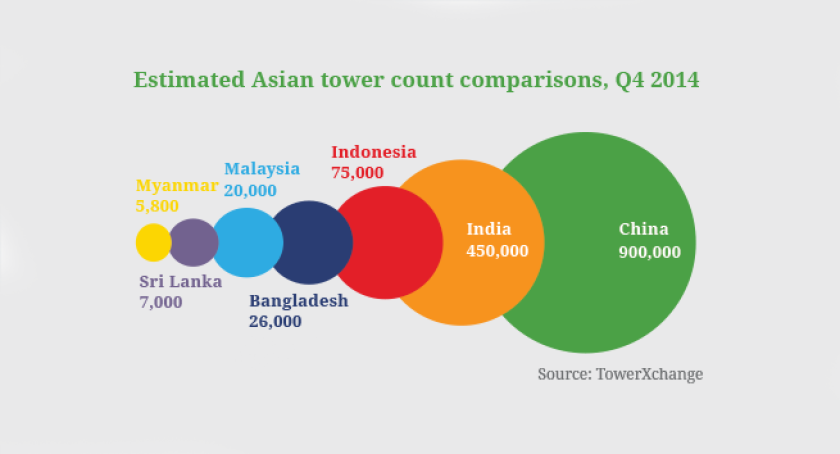

The Chinese telecom tower industry dwarfs that of every other country on the planet. With an estimated 900,000 towers in the country today, and another 900,000 towers needed as China migrates from the current blend of 2G and 3G to 4G, you can see why the Chinese market is attractive to tower entrepreneurs and passive infrastructure vendors. With the launch of joint venture China Tower Company, are there opportunities in China?

There are almost 1.3bn mobile subscribers in China. However, while the US wireless market generates US$200bn per annum China generates a little over US$1.5bn on a customer base four times the size, which illustrates the gulf in ARPU.