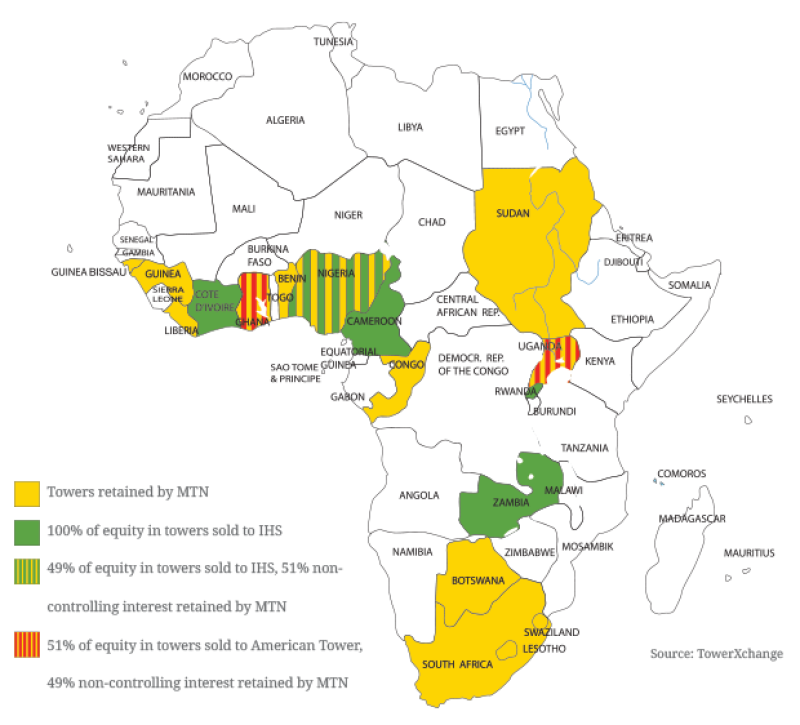

MTN has monetised their towers in seven sub-Saharan African countries – representing the majority of the most attractive portfolios to towercos. While Airtel concluded a portfolio asset sale, albeit to multiple counterparts, MTN has proceeded one country at a time – raising a similar amount to Airtel, albeit with MTN’s prized tower assets in South Africa as yet retained. In this article, TowerXchange summarises MTN’s tower transactions to date, and once again asks “what’s left?” MTN has disposed of the majority of their most attractive tower assets, raising an estimated US$2.5bn+ whilst retaining equity stakes in joint venture towercos in selected markets. MTN’s passive infrastructure monetisation strategy made headlines in the global telecom press with the recent sale of equity in their Nigerian towers to IHS, although most reports didn’t pick up on the fact that MTN retained a “non-controlling interest of 51% with protective rights in the new entity” (quoting MTN H1 2014 interim results). The Nigeria transaction followed previous sale and leasebacks of 100% of the equity in MTN’s towers in Cameroon, Côte d’Ivoire, Rwanda and Zambia, again with IHS as the counterparty. MTN commenced their passive infrastructure monetisation strategy in 2010-11 with the formation of joint venture towercos with American Tower in Ghana and Uganda, in which MTN retained 49% equity. So, with MTN’s towers in five of their top eight countries, plus probably the most attractive assets in the “small opco cluster”, already transferred to towercos, is there still a pipeline of potential tower deals to come from MTN? What’s left?

MTN South Africa

MTN’s ~6,000 South African towers seemed to be on the brink of sale to American Tower in 2013 before MTN stepped back from the deal. The towers remain operator captive. Although intensifying competition in South Africa resulted in MTN’s market share declining by 2.7% over H1 2014, with revenue down 7% and EBITDA down 1.5%, negative subscriber growth has been reversed and MTN remains in a robust position with 31.9% market share. So robust is MTN’s competitive position that they lack motivation to divest their South African towers. The Group still sees their network as a source of competitive differentiation in South Africa, where Cell C and Telkom have labored to capture market share from leaders Vodacom and MTN. The extent of bi-lateral infrastructure sharing, in particular with Vodacom, means that any MTN tower transaction would face a complicated path to convert so many swaps into commercial leases – on the plus side, it also means tenancy ratios would likely start nearer two than one, which significantly increases the valuation that could potentially be realised. With the South African tower market considered by most as one of the two most appealing in SSA (alongside Nigeria, which is finalising its own process of migrating to a towerco-driven business model), it will be interesting to see if Telkom’s recently initiated process to seek buyers of their passive infrastructure might precipitate a re-evaluation of MTN’s preference to retain their South African towers. Telkom is believed to have issued an RFP in December 2014 seeking bids for a portfolio of assets which could include as many as 6,000 shareable structures (including perhaps 3-4,000 macro towers). Airtel’s African tower sale triggered MTN to bring their Nigerian towers to market – it remains to be seen whether the Group will re-evaluate their approach to get to market first in the event of a process being commenced by a competitor in South Africa.

Figure 2: Mapping MTN’s passive infrastructure monetisation strategy to date

MTN Syria and Sudan

The only other countries from MTN’s “large opco cluster” where MTN retains 100% ownership of passive infrastructure are Syria and Sudan. Security is obviously of paramount concern in Syria at the moment, creating challenging conditions for the operation of any infrastructure in the country, towers included. Any tower deal in Syria would have been held up by the “Build Operate and Transfer” (BOT) agreement which, until the end of 2014, existed between MTN Syria and the Syrian Telecommunications Establishment (STE). Under a BOT framework, MTN Syria would have been required to handover their network to STE at the end of their licence period. However, the BOT agreement was converted into a 20-year operating license, taking effect on 1 January, 2015. International sanctions against Syria and Sudan are indicative of elevated country risk in both countries, which in turn makes investment in infrastructure and the repatriation of funds difficult. This would seem to preclude the participation of any US publicly listed towerco in any auction of towers from those regions, while similarly limiting the pool of prospective private equity with an appetite for investing in opportunities in these countries, thus leaving several PE-backed towercos similarly hamstrung. Nonetheless, the potential for towerco activity in these markets is greater than zero as TowerXchange are tracking several entrepreneurial, risk-tolerant tower companies with an appetite for opportunities in Syria and, in particular, Sudan. However, MTN has a preference to work with proven towercos of scale, so the operator is likely to remain reluctant to enter into transactional relationships with what they would consider “unproven” counterparts until they have reached scale. Thus, TowerXchange forecast that tower opportunities in Syria and Sudan will remain restricted to build to suit and managed services deals. Whilst the resolution of the BOT agreement in Syria is a positive step, until country risk recedes and sanctions are eased, MTN’s passive infrastructure assets in Syria and Sudan will probably remain on their balance sheet for the foreseeable future.

Figure 3: MTN Group EBITDA by country (in Rm, as per MTN H1 2014 interim results)

MTN Iran

Iran is MTN’s third most commercially attractive market, outside of Nigeria and South Africa. MTN’s joint venture Irancell, which serves 42.7mn subscribers in Iran, acquired spectrum to upgrade their license to include 3G / 4G in August 2014 with intent to commence rollout imminently. Reports suggest MTN has rolled out 2,146 towers in Iran in anticipation of the launch of mobile broadband services. However, International sanctions mean it remains unlikely that an independent tower company could acquire infrastructure in the country. Quoting Analysys Mason: “Iran’s telecoms market is known for its unpredictability. Would-be foreign investors, including Etisalat, Türk Telekom and Zain, have all come close to launching mobile operations in the country since its telecoms market was liberalised in 2004, but have been prevented from doing so following reported failures to adhere to their licence commitments. MTN has succeeded in establishing Irancell as the second national mobile operator in Iran, but has faced costly legal battles because of alleged improprieties when it acquired its licence, in addition to Western pressures to pull out of Iran.” TowerXchange thus forecast that MTN’s Iranian towers will also remain on their balance sheet for the foreseeable future.

MTN’s Small OpCo Cluster

With the towers in Rwanda and Zambia, perhaps the most investible towers from MTN’s Small OpCo Cluster, already sold, MTN retains their towers in Afghanistan, Yemen, Benin, Guinea Conakry, Congo Brazzaville, Botswana, Liberia, Swaziland, South Sudan, Guinea Bissau and Cyprus. Of MTN’s Small OpCo cluster, three stand out as being ripe for tower transactions. The recent Airtel African tower sale, with assets believed to be in the process of being transferred to Helios Towers Africa, will kick start an independent tower market in Congo Brazzaville. Until Airtel’s acquisition of #3 operator Warid, MTN had been the market leader in Congo Brazzaville. With the market supporting only one additional operator, Bintel’s Azur, there are a finite amount of tenancies up for grabs, which means towers residing on balance sheets are effectively declining in value. It would thus seem logical for MTN to at least explore the possibility of selling their towers in Congo Brazzaville, with Helios Towers Africa being the most likely counterpart.

The Group continues to improve operational and cost effectiveness with initiatives including the monetisation of passive infrastructure through tower deals across a number of key markets (MTN H1 2014 interim results)

In Guinea Bissau and Guinea Conakry Orange will soon commence a process to seek a towerco partner for a ‘manage with licence to lease’ deal. While no partnership has yet been consummated, a window may be opening for MTN to bring their Guinean towers to market first, albeit the small scale of these markets does not appear to make them a priority for towercos in the absence of a bundled transaction. This may explain why Orange are believed to be bundling the Guineas with their more attractive Senegal and Mali towers. MTN and Etisalat explored the possibility of selling their towers in Afghanistan to IHS, but it was rumoured that IHS’s backers had finite appetite for opportunities in a market so removed from their West African core territories, and with such obvious country risk. It’s notable that Afghan Wireless spun off their towers to Frontier Tower Solutions several years ago, so there is a precedent for independent towerco operations in Afghanistan. Depending on the success of the handover of peacekeeping to local authorities, we may not have heard the last of potential tower transactions in Afghanistan.

Conclusion

MTN has completed the lion’s share of their prospective tower transactions in Africa. One highly attractive portfolio remains on MTN’s balance sheet, South Africa, where the traction achieved by the Telkom process may prompt a re-evaluation of MTN’s appetite to sell. MTN’s tower assets in North Africa and the Middle East remain affected by varying levels of country risk, making transactions unlikely in the short to medium term. Perhaps the most likely next MTN tower sales are in Guinea Bissau and Conakry, if triggered by an Orange ‘manage with license to lease’ deal, in Congo Brazzaville where Airtel’s towers will be sold to Helios Towers Africa, and potentially Afghanistan.