BMI View: Peru will become one of Latin America’s top markets for towers growth in 2015-2016, as market trends and government support are leading to large investment outlays from the major mobile operators. The improving telecoms regulatory environment will help to spur major investment in towers infrastructure during 2015-2016. This bodes well for the new entrants into the market Entel and Viettel, as well as for the projected demand for mobile data services.

Competition and capacity benefit from antenna regulation

The Peruvian government is preparing to implement a new regulatory framework to better facilitate the deployment of telecoms infrastructure across the country. The law will create a single administrative process to rollout aerials, poles, masts and cables, with fewer obstacles for acquiring permits to deploy infrastructure. The Transport and Communications Ministry (MTC) estimates that the country needs the total number of mobile aerials to increase from 8,000 to 22,000 within the next three years, in order to meet increasing demand for mobile and data services. This need for towers capacity has resulted in the government playing an important role in facilitating towers growth through relaxed regulation, introduction of a fourth player and the auction of 700MHz spectrum. Market forces are also playing a role in increased tower deployments and this will result in Peru being one of the top towers markets in the region during 2015-2016.

Competition dynamics curbing infrastructure investment

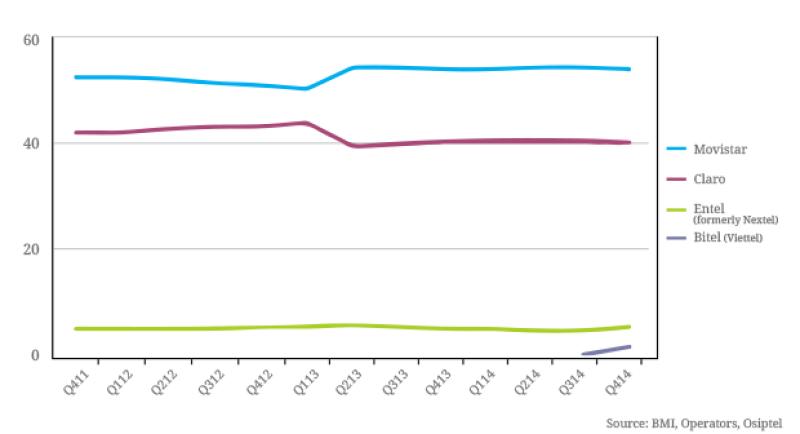

Market Share (%), 2011-2014

Prior to the announcement from the government, leading operators in Peru had already announced significant investment budgets over the coming years, as they look to expand and upgrade their networks. Claro Perú announced in January 2015 that it plans to invest PEN3bn (US$987.1mn) to extend coverage, increase network capacity and develop new value added services over the next three years. Claro’s chief rival Telefónica announced its own layout in February 2014, undertaking investment of US$1.8bn during the 2014-2016 period, of which at least PEN1bn (US$324.94mn) will be used for the development of its 4G network. Furthermore, Entel Chile has pledged spending of US$1.2bn over the period from 2014-2019, as it looks to turn its Nextel assets into a national operator. Finally, new market entrant Viettel is spending US$400mn for the installation of 2,000 towers and laying 15,000km of fibre to ensure national coverage of 80% for its 3G services. With competition heating up between the four operators, Viettel will likely look to expand this budget in order to make a mark in the race for subscribers.

3G Growth will define market to 2019

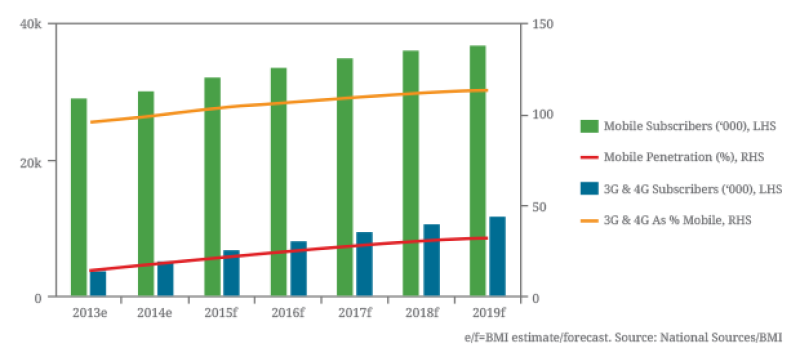

In addition to helping with competition dynamics through improved coverage, we also cite the need to improve capacity, as the country sees strong uptake in mobile data services. Since the launch of 4G, Movistar had gained 500,000 LTE customers and Claro 600,000 by the end of 2014, already accounting for nearly 4% of the total market. Although 4G has been launched by Movistar, Claro and Entel, with encouraging early returns, we believe that 3G will continue to be the driving force of investment strategies and customer growth over our five-year forecast period.

BMI believes that 3G/4G subscriptions accounted for 17.7% of the mobile market at the end of 2014, around 5.4mn connections. We forecast this to rise to 11.8mn in 2019, representing 31.7% of mobile subscribers, more than doubling in size. Aside from the operator network investments, the entrance of Entel and Viettel into the market will spur price competition, driving down the cost of 3G tariffs, as well as smartphones. The auction of 700MHz spectrum, which is expected later in 2015, as well as the prospective launch of three MVNOs, provide upside risk to our forecast. The move to streamline the deployment of telecoms infrastructure will be welcomed by operators as they look to meet increased 3G/4G demand.

3G The main mobile market driver

2013-2019

Rural expansion offers organic returns

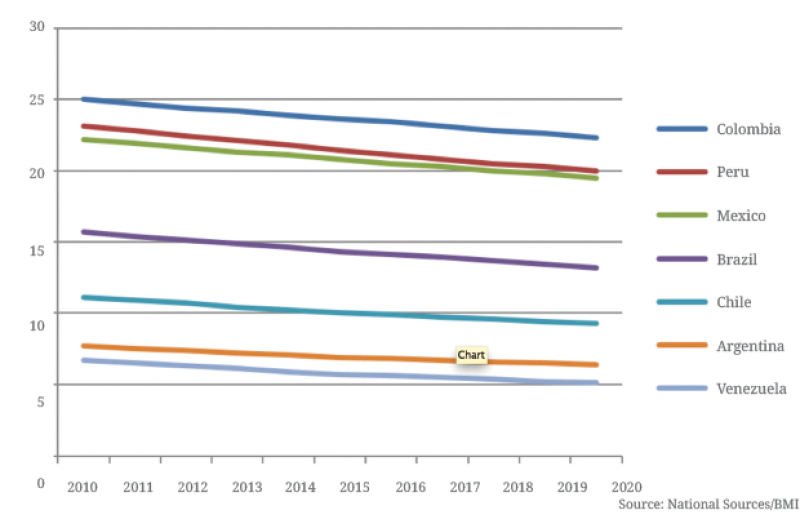

Additionally, investment will be used for expansion into rural areas of Peru, which remain underserved as a result of the strong positions of Movistar and Claro in the mobile market. The government is encouraging investment in these areas, with subsidies to operators, and as conditions of licence renewals. However, it is also worth noting that Peru’s rural population accounted for 21.8% of its total population in 2014, higher than all other major markets in Latin America, except Colombia. This amounted to 6.694mn people and therefore represents an attractive growth opportunity for a still developing mobile sector. We see the urbanisation rate rising over the next five years, but this will not be a rapid transition, with rural citizens still representing 20% of the population by 2020.

As part of its licence agreements, Viettel is required to provide mobile services to 48 unserved or underserved rural districts within its first five years of operation. In order to facilitate these infrastructure deployment requirements and the expansion projects of Entel, the moves by the government to reduce the obstacles for permits should help provide the necessary enhanced coverage. Claro claimed that barriers at the municipal level prevented it from investing US$100mn in infrastructure in 2014. The company claimed that as a result of these difficulties, Peru has one of the lowest antenna per capita ratios in the world.

High rural population in Peru

Rural population (%), 2010-2020

Macroeconomic investment climate improving

Trends in the telecoms towers market reflect those in the broader construction sector, which we see as having a major impact on Peruvian economic growth in 2015. In large part thanks to the stronger construction activity, private consumption growth in Peru will be among the highest in the region. We forecast real private consumption growth of 4.3% in 2015, up from 4.1% in 2014. The construction sector is the key employment generator in the country and unemployment will drop to a record low of 5.8% this year from 6.0% in 2014. In tandem with lower oil prices as a result of muted inflation, this will support consumer confidence increasing spending on ‘big-ticket’ items such as smartphones and tablets. Finally, loose monetary policy by the Banco Central de Reserva del Perú will support credit growth. Low interest rates and recently implemented lower reserve requirements for the commercial banks will stimulate consumer lending activity, leading to a faster economic recovery