Yet another change of direction within the Myanmar rollout – for a couple of weeks it looked like the heralded co-ordinated rollout might finally take place, with Telenor issuing an RFP for 1,105 sites on which Ooredoo were to co-locate, but now our sources tell us phase three of the rollout will again be undertaken separately, albeit with a new alignment of towercos to operators that is set to reshape the fledgling tower industry in Myanmar.

Phase one and two of the rollout finally complete

After delays caused by a lack of bureaucratic capacity, delays caused by a lack of capital, delays securing build permits and land registration, and delays caused by monsoon rains, the 4,650 towers in phase one and two of Ooredoo and Telenor’s Myanmar rollout are nearing completion – all the towers will probably be lit by the time you read this article. Phases one and two took around three months longer to rollout than anticipated.

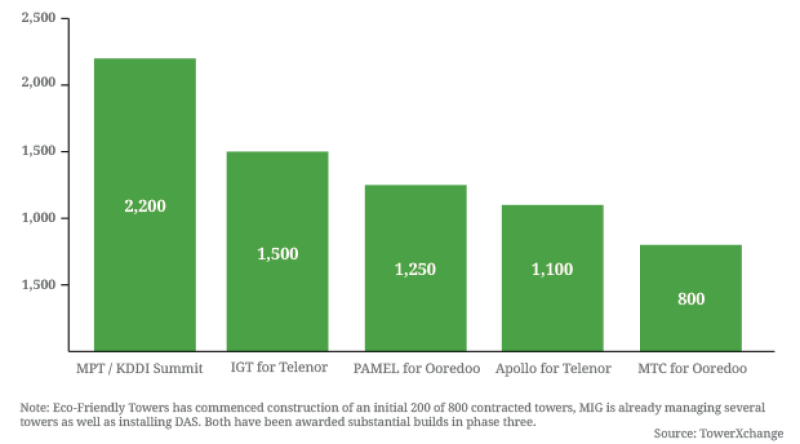

Incumbent operator MPT, boosted by KDDI and Sumitomo Corporation capital and management expertise, supplemented their existing tower network with several hundred towers built by a variety of Chinese contractors. This brings the total count of lit towers in Myanmar at the start of Q2 2015 to around 6,850.

Estimated tower counts in Myanmar, Q2 2015

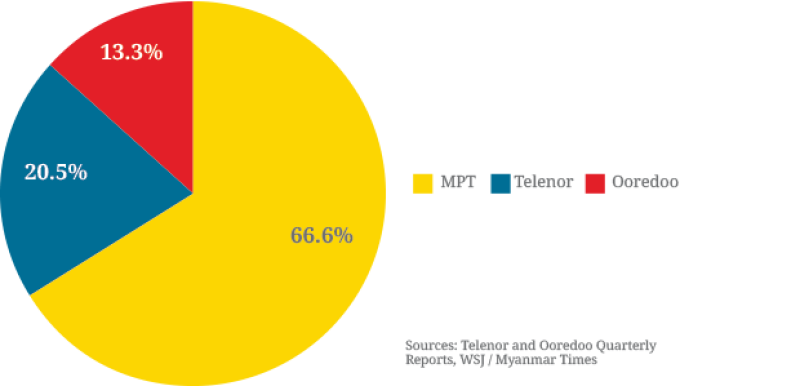

Estimated Myanmar mobile market share at end Q4

MPT remain market leaders in the race for subscribers

At the end of Q4 2014, Ooredoo Myanmar had 2.2mn customers, and their population coverage was approaching 50% (25/51.4mn). At the same end of Q4 timeline, Telenor Myanmar had 3.4mn customers and ARPU around US$5, having deployed around US$200mn in capex and opex to date. However, perhaps the biggest news on the MNO front is that MPT claim to have surged to 11mn subscribers, which would represent over 66% market share.

According to GSMA Intelligence, 40% of Myanmar’s subscribers at the end of 2014 were mobile broadband users.

Award of next phase of rollout leads to restructuring of the Myanmar towerco market

With Myanmar’s towerco contractors geared up to build as many as 200 towers per month, they have ramped up staff numbers and cannot afford to sit around waiting for phase three of the rollout to begin. Experienced tower builders and climbers are a rare breed of nomadic mercenaries, and they go where the work is. So when the joint RFP for 1,105 sites, issued by Telenor with Ooredoo as co-locating tenant on the majority of sites, fell through, it was a relief to learn that another tranche of separate awards have reportedly now been made.

TowerXchange’s sources suggest that Ooredoo has commissioned around 2,500 towers in phase three, including Myanmar Infrastructure Group’s first 500 tower builds in the country, and a further 800-1,000 towers awarded to IGT. The identity of the company to whom the remainder of the phase three Ooredoo towers have been awarded has not been revealed, although we would be surprised if PAMEL hadn’t been awarded some Ooredoo towers. Telenor has reportedly awarded 800 towers to Eco-Friendly Towers, a quantity which undoubtedly draws Eco-Friendly Towers beyond Shan State, where they appeared to be the only tower company prepared to build.

There will inevitably be consolidation among Myanmar’s six towercos. For example, TowerXchange understands from multiple sources that the assets of Digicel Myanmar Tower Company, MTC, are for sale. Having successfully executed the build of ~800 sites per the original rollout plan developed in support of Digicel’s MNO license bid, and with all the MTC towers having Ooredoo as anchor tenant, thus currently provided under a simple ‘steel and grass’, power excluded arrangement, it seems Denis O’Brien is seeking to “cash in the chips” on his first tower venture. A speedy, profitable exit may be a consolation prize compared to the full operator license Digicel coveted in Myanmar, but O’Brien’s insatiable appetite for entrepreneurial telecom ventures may have been whetted, so we don’t expect Digicel MTC to be his last towerco venture!

Towercos take on power…

Phase three of the rollout finally sees both Telenor and Ooredoo’s towercos take on responsibility for acquiring and operating power systems. The dimensioning of a typical Telenor and a typical Ooredoo site remain fundamentally different however, primarily due to the large, power-hungry (but ultimately efficient) equipment Ooredoo is deploying.

The future of the power systems on Ooredoo’s ~2,050 phase one and two towers remains uncertain – an RFP reportedly led to the award of an energy services contract to Leap Power Solutions, but there has been no confirming announcement from either MNO or vendor.

… but the towercos don’t seem to have the balance of power

Why is the Myanmar rollout not fulfilling the promise of being a genuinely co-ordinated, shared rollout? One explanation could be that the MNOs seem more motivated by lean procurement and cost control than by marketing, coverage and the QoS.

An opportunity to create genuine, shared value is in danger of being missed if Telenor and Ooredoo continue to co-locate only for infill capacity, not building shared towers as they extend coverage. Towercos are a proven platform for creating and sharing efficiencies. But the key word is sharing, and whilst tenancy ratios remain much nearer one than two, Myanmar’s towercos won’t be able to generate the value their MNO counterparts, and their investors, are seeking.

High capex and opex combines with moderate leaseback rates to make capital raising challenging for Myanmar towercos

Lease rates in Myanmar have been driven to challengingly low levels. While a reported US$1,000-1,500 per month might seem rich by Southern Asian standards (lease rates are typically US$500 in India), economies of scale mean Indian tower companies can rollout a new site for less than US$25,000. In Myanmar, the capital outlay for a greenfield site is nearer US$100,000, with premium energy solutions such as Flexenclosure’s eSite being widely deployed. Not that we’re questioning the selection of eSite – it’s a highly efficient solution designed for multi-tenant sites, and Flexenclosure were able to contribute significant vendor finance.

Lease pricing is critical to tower companies’ ability to raise capital. The key determinant in evaluating the investibility of a towerco is the pricing in the Master Lease Agreement or MLA (sometimes known as the Master Service Agreement or MSA). When moderate leaseback rates and high capex and opex are combined with the perception of high country risk in Myanmar, raising capital becomes a major challenge.

A significant proportion of the capex burden is being transferred from MNOs, with strong credit ratings, to towercos with less established credit ratings. Private equity houses have invested more cautiously into Myanmar towers than many expected. TPG put capital into Apollo Towers, PAMEL secured a US$85mn cross-border, non-recourse corporate loan, but we haven’t seen many other sizable cheques cut for Myanmar towercos. Raising debt finance has been even trickier, complicated by further delays securing authorisation to draw down the debt from the Central Bank of Myanmar. With so little credit available, with the MMK not convertible, and with minimal US$ reserves in Myanmar, the mechanics of servicing a debt deal have proved extremely challenging in Myanmar.

MCIT finally issues towerco licences

On the 3rd of February 2015, one year and three days after Ooredoo and Telenor were granted their coveted Nationwide Telecommunications Licences, the towercos who rolled out the phase one and two towers finally received their licenses. Among the companies to receive a “Network Facilities Service (Class)” or NFS(C) license were:

Pan Asia Majestic Eagle Co. Ltd (also known as Pan Asia Tower or PAMEL)

Digicel Myanmar Tower Company (MTC)

Irrawaddy Green Towers Ltd (IGT)

Apollo Towers Myanmar Ltd

KDDI Summit Global Myanmar Company Limited, the joint venture between MPT, KDDI and Sumitomo Corporation, also received an NFS(C) license as did Eager Communications Group Co.,Ltd; Global Technology Co.,Ltd; and Myanmar Fiber Optic Communication Network Co.,Ltd.

The licenses were each valid for 15 years.

The fees payable for an NFS(C) license in Myanmar are currently MMK 12.5mn per year (~US$12,000), plus 0.5% of relevant revenues and a MMK 2.5mn application / registration fee (~US$2,400).

The “Network Facilities Service (Class) Licence” or NFS(C) is effectively an infrastructure service provider license designed to allow a tower company or fibreco to construct, deploy and maintain passive infrastructure and to lease it to holders of full telecommunications licences, known as a “Network Facilities Service (Individual) Licence” or NFS(I). Quoting directly from the Myanmar Ministry of Communications and Information Technology application form, the “Network Facilities Service (Class) Licence” or NFS(C) authorises the licensee to

construct, deploy and maintain passive Telecommunications Network infrastructure and to lease such infrastructure to an NFS(I) Licensee . An NFS(C) Licensee is not restricted from leasing its infrastructure to multiple entities on a shared basis, to a single entity or to third party non-Licensees provided that such leasing is permitted under the laws and rules of Myanmar.

construct, deploy and maintain telecommunications networks solely for the self-provision of telecommunications services and not available for sale or hire.

The activities authorized by the NFS(C) License relating to the deployment and maintenance of:

any type of passive network infrastructure for civil engineering elements and other telecommunications equipment to enable end-to-end telecommunications infrastructure solutions for NFS(I) Licensees include, but are not limited to: towers, masts, ducts, trenches, poles, dark fiber and radio equipment installed to send, receive and route communications, provided that the NFS(C) Licensee does not offer telecommunications services other than self- provided telecommunications services.

telecommunications networks and the self-provision of telecommunications services used solely for internal communications are limited to network facilities and telecommunications services that only permits internal/intra-organizational communications and does not provide interconnection with any other network.

The latest round of licensing also included the issuance of NFS(I) licences to Shwe Than Lwin Media Co.,Ltd, Elite Telecom Public Company Limited and Yatanarpon Teleport Public Company Limited. The latter, widely known as YTP, remains Myanmar’s principal (only?) ISP, and is expected to become Myanmar’s fourth MNO when a foreign investment partner can be secured.

Those responsible for towerco regulation or with a vested interest in the Myanmar rollout might care to read Myanmar’s full set of licensing rules here.

Myanmar’s towercos have been able to trade for the last year thanks to letters granting permission to proceed from the MCIT, and because each secured an MIC Permit from the Myanmar Investment Concession allowing them to apply for import and export permits, lease land for a period of over one year, while also granting access to certain tax incentives.

Conclusion

The delays to the issuance of towercos’ licenses didn’t hinder the rollout and reportedly didn’t significantly hinder their capital raising efforts, although the license delays were just one example of the bureaucratic issues, beyond the control of Myanmar’s towercos or MNOs, which slowed the rollout timeline.

Building towers in Myanmar requires the application of the old Nike slogan “just do it!” In order to “just do it” in a more timely manner, Myanmar’s MCIT and MNOs alike must better understand and support their tower companies’ efforts to raise capital, capital to be invested in the government’s, Telenor’s and Ooredoo’s vision of ICT connectivity.

A successful partnership between MNOs and towercos should not be defined solely by achieving the lowest possible lease rate. Myanmar was supposed to be the great the last greenfield network AND the first network designed to be shared from the outset. The more Myanmar’s MNOs and towercos can work together to create and share value, the more capital will flow into the country and the more satisfied all the stakeholders will be; towercos, tenants, Ministry and citizens.