A form 6-K filed by América Móvil to the U.S. SEC revealed several details of the structure of their new carve out towerco Telesites. We combine insights gleaned from that submission, together with press coverage and TowerXchange’s own research with other stakeholders in the Mexican tower industry to provide this summary.

Why is América Móvil spinning off a towerco?

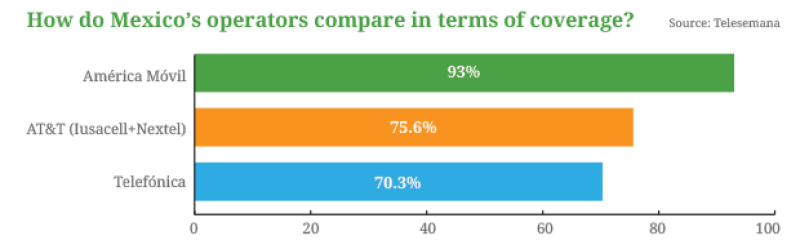

América Móvil cites the usual motivations to spin off their towers; coverage is no longer a competitive differentiator; the capex required to meet data demand drives the impetus to share; and, given the relatively low penetration of fixed line infrastructure in CALA, the criticality of mobile networks in facilitating broadband access and services has already prompted several MNOs in the region to sell a total of over 30,000 towers in recent years.

However, when the Federal Institute of Telecommunications (IFT), Mexico’s newly empowered telecoms regulator, declared América Móvil and its subsidiaries Telcel, Telmex, Grupo Carso and Grupo Financiero Inbursa “preponderant” (market dominant) a year ago, the clock started ticking on the inevitable and fundamental restructuring of the Group.

Would América Móvil have spun off a towerco without their hands being forced by the IFT? Probably not. Does that mean it’s not going to be a highly lucrative venture? Probably not.

Will the spin-off of Telesites be sufficient for the IFT to not be considered preponderant?

No. The spin-off of Telesites is not expected to be sufficient for Telcel, and fixed line equivalent Telmex, to not be considered preponderant. But it will be seen as a step in the right direction.

Who will control Telesites?

Holders of América Móvil’s shares will receive one Telesites share for every América Móvil share held, with substantially the same rights.

Just how much control does Carlos Slim and the Slim family have over América Móvil and thus, with shares being issued one for one with the same voting rights, how much control will the Slim family have over Telesites?

Under América Móvil’s current capital structure, which will be mirrored by Telesites, 97.33% of shares with voting rights are “Series AA Shares”. Of the Series AA shares, just 8% are led by Carlos Slim himself. However, 46.5% of the Series AA shares are held by The Control Trust, which holds various América Móvil shares for the benefit of the members of the Slim Family. A further 18.2% of Series AA shares are held by Immobiliaria Carso, and a further 12.2% are held by Control Empresarial de Capitales, both of which “may be controlled indirectly by the Slim Family” according to the footnotes in the Form 6-K. In summary, 97.33% of both América Móvil and Telesites shares with voting rights are or will be held by entities directly or indirectly controlled by the Slim family.

The form 6-K also states “Telesites will be organized as an independent company, with sufficient capacity to hold its own assets and dispose of them.”

How many towers are there in Mexico, who owns them and what proportion will Telesites represent?

There are a little over 23,000 towers in Mexico, of which Telesites will be managing and marketing 10,800 initially, or 46.8%. American Tower has acquired the majority of the other MNO’s sites, and they currently have 8,716 towers in Mexico, or 37.3% of the total. Six other towercos own and market a further 1,906 towers, or 8% of the stock: MTP, Centennial, IIMT, Torrecom, Conex (QMC) and NMS Towers.

América Móvil suggest that the spin-off of Telesites will mean that 90% of Mexico’s towers are accessible to any operator, which implies that MNOs retain about 10% of Mexico’s towers. Since TowerXchange understand that Telefónica and Nextel (recently acquired by AT&T) retained only around 350 towers, this would suggest that Telcel and/or Telmex has retained around 1,650 towers.

And how many towers does Mexico need?

América Móvil’s submission to the SEC notes “in 2013, the Mexican Federal Telecommunications Commission estimated that Mexico required a four-fold increase of radio bases, which would result in an increase from 20,000 radio bases to a total of 80,000, creating an important growth opportunity for Telesites.”

It should be noted that this reference appears to be to a need for base stations as opposed to towers. Thus the required 80,000 BTSs could be accommodated on a healthy Mexican tower market of 40,000 towers with an average tenancy ratio of 2.0.

One thing is for certain: Mexico needs a lot more cell sites! One of Telesites’ first priorities will be building sites for Telcel.

So if Telesites’ first priority will be to build more sites for Telcel, will the towers actually be proactively marketed to third party tenants?

Quoting the Form 6-K concerning the spin-off of Telesites: “This new business unit will grant access to, and allow use of, the Site Infrastructure by América Móvil’s subsidiaries, as well as to third party providers of wireless telecommunications services.” Later in the document it is revealed that Telcel had published a “Tower Reference Offer” with an initial term expiring on December 31, 2015. “Under the terms of the Tower Reference Offer, the operators who wish to have access and shared used of the Site Infrastructure must execute a master services agreement, as well as specific agreements for each site.”

However, to manage expectations, it should be noted that it can take several months to carve out a towerco, so we don’t expect much to change in 2015.

Who is going to define Telesites’ lease rates?

It seems that the market will set the lease rate – and that’s how we think it should be at TowerXchange! A light touch from regulators is required when it comes to tower companies. However, IFT would doubtless get involved if they felt Telesites’ lease rates were set inappropriately high in order to maintain the status quo. This is acknowledged in the Form 6-K from which we again quote: “the IFT may, when necessary to provide access services, and if there are no alternatives, establish terms governing the usage and sharing of physical space as well as the corresponding fees… Moreover, as established by the IFT’s resolution, the predominant economic agent must allow operators access to and shared use of passive infrastructure on a nondiscriminatory and nonexclusive basis. Fees for access to and shared use of passive infrastructure shall be negotiated by the predominant economic agent and the operator requesting such services. If agreement cannot be reached, the IFT shall determine access rates using a long-run average incremental cost methodology, which must be offered on nondiscriminatory terms and may vary by geographical area.”

When will the creation of Telesites actually take place?

The restructuring of América Móvil to spin-off Telesites is set to be approved at an EGM on 17 April 2015. The spinoff itself will occur in May or June 2015.

Will the strategy to spin-off towercos be replicated in América Móvil’s other markets? Indeed, could those towers be transferred to Telesites?

The international expansion of Telesites remains a possibility in the medium to long-term. According to the 6-K “There will be no limitation on Telesites’ ability to carry out any type of business in Mexico or abroad.”

What are the potential benefits to América Móvil of the spin-off of Telesites?

Increasing their focus on global customer acquisition, customer service and differentiation through innovation.

Refocusing on investments and costs. “Capital expenditures and operating expenses are the biggest costs in the telecommunications industry, especially in emerging markets like Mexico. Making the Site Infrastructure business independent will allow América Móvil to reduce costs quickly and significantly and simultaneously refocus its capital investments on the expansion of its Active Infrastructure.” The 6-K also makes reference to the opportunity to share land rent between multiple tower tenants.

Finally, the 6-K also references the potential to capitalize on the spin-off by selling Telesites to a third party in future, but what seems the more likely outcome is “an increase in aggregated market value of both companies” as a function of the relatively high multiples at which towercos trade; according to the 6-K “the major telecommunications companies traded at four times EBITDA while telecommunications infrastructure service providers traded at 14 to 16 times EBITDA.”

What are the lessons learned here for market dominant operators worldwide?

Any operator with >50% market share runs the risk that an empowered, independent telecoms regulator might seek to stimulate competition in their market by introducing asymmetrical regulations and mandating infrastructure sharing.

If you have a better network than your competition, why not monetise it? Towercos currently trade at multiples around four times greater than MNOs... Spinning off a towerco is more than a hedge against competition risk, it represents a genuine opportunity to create huge new capital value

Why not jump before you are pushed? If you have a better network than your competition, why not monetise it? Towercos currently trade at multiples around four times greater than MNOs – investors appreciate the separation of retail risk from a pure infrastructure play with long term recurring contracted revenues. Unless you are operating in one of the last remaining Nationalised telecom markets, competition is inevitable. Spinning off a towerco is more than a hedge against competition risk, it represents a genuine opportunity to create huge new capital value.

Akhil Gupta, Vice Chairman of Bharti Enterprises, one of the forefathers of two of the most successful operator-led carve out towercos in the world, Indus Towers and Bharti Infratel, of which he is also Chairman, summed it up best in his recent TowerXchange interview: “Our vision for the next three to five years is to get all the passive infrastructure out of the hands of the MNOs; it will be a wonderful day when that happens! The towerco industry is such an efficient one, and MNOs will become more efficient as a result. Infrastructure needs to be shared – gone are the days when owning towers conferred a competitive advantage. Nobody has ever been able to stop a competitor putting up a tower next door, but the efficiencies that can be achieved by sharing towers are undeniable.”