Ownership changes in the Indonesian telecommunications tower sector will continue over the medium term – carrying over the trend of recent years – as the industry is at an inflection point with leading telecom operators looking to monetise additional tower assets over the next 12-18 months.

This trend, which is further indicative of a significant change in the telecommunications industry’s underlying dynamics, provides a strong opportunity for the independent tower operators, particularly the big three, to further increase their market share.

Moreover, their expansion will be boosted by organic growth as they build towers in response to the push by telecom operators to expand their 3G/LTE networks.

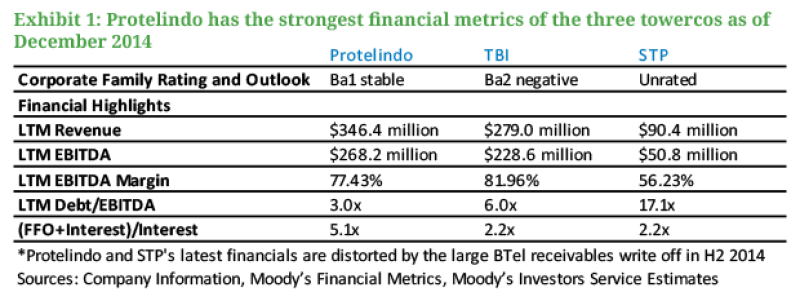

However, the three leading tower operators – Profesional Telekomunikasi Indonesia (Protelindo, Ba1 stable), Tower Bersama Infrastructure (TBI, Ba2 negative), and Solusi Tunas Pratama (STP, unrated) – currently have divergent financial profiles, leading to differences in their abilities to make large debt-funded acquisitions. Currently, the three own 45% of Indonesia’s 72,000 telecommunications towers.

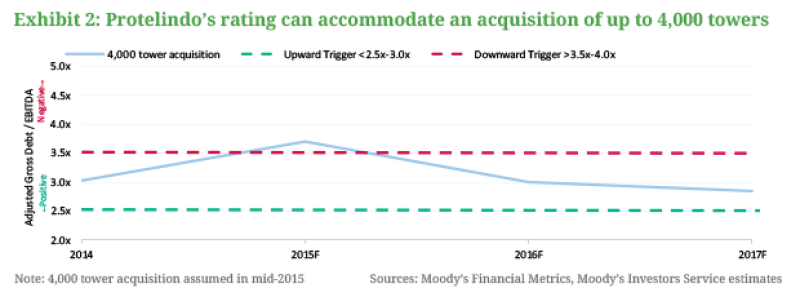

Over the next 12-18 months, Protelindo has greater financial flexibility to make significant debt-funded acquisitions and still retain its credit rating. This situation reflects its relatively low debt-to-EBITDA ratio following several years of organic – rather than acquired – growth. After its recent ratings upgrade, Protelindo can acquire up to 4,000 towers – substantially debt-funded – and still maintain its adjusted debt/EBITDA at 3.0-3.5x and its Ba1 rating.

In comparison, TBI and STP have less flexibility. TBI’s financial metrics, with adjusted leverage at 6.0x, are still recovering from the company’s debt-funded acquisition of 2,500 towers from PT Indosat Tbk (Ba1 stable) in 2012. Therefore, TBI has limited headroom within its rating for additional debt-funded acquisitions. Nonetheless, its recent largely equity-funded acquisition of Mitratel (unrated) has improved its leverage profile.

And in the case of STP, it acquired the largest proportion of its portfolio from its acquisition of 3,500 towers from PT XL Axiata (Ba1 stable) in December 2014. However, while this deal improves its business profile and scale, additional debt-funded acquisitions of a similar size would strain its financial flexibility and credit metrics.

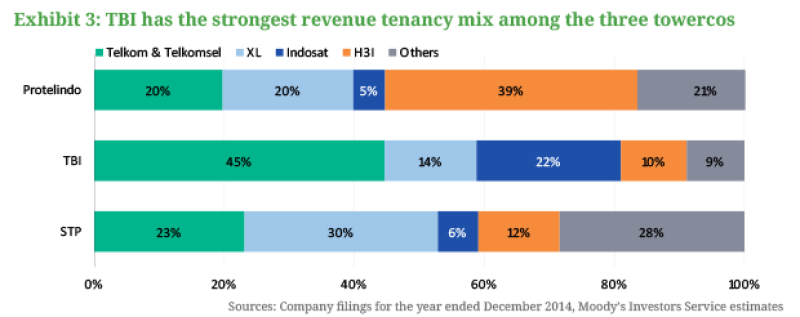

From a counter-party risk perspective, the Big Four telecom operators – Telekomunikasi Indonesia (Telkom, Baa1 stable), Telekomunikasi Selular (Telkomsel, Baa1 stable), Indosat and XL – have stronger credit quality than other telecom operators in Indonesia.

Thus, a greater proportion of revenue from these operators is credit positive. Generally, the Big Four should make up an increasing proportion of revenues for Protelindo, STP and TBI as they continue to invest in 3G and 4G network expansions.

In this context, TBI currently has the strongest tenancy mix, with over 80% of revenues attributable to the Big Four. Its acquisition of Mitratel will further improve its tenancy mix because the majority of Mitratel’s towers have Telkomsel as their anchor tenant.

By contrast, STP’s exposure to smaller and less creditworthy operators has weighed on its financial profile, with EBITDA margins declining since 2013 following write-downs in receivables.

In the case of Protelindo, a considerable portion of its tenancies is weighted towards Hutchison 3 Indonesia (H3I, unrated). Nonetheless, Protelindo’s high tower tenancy ratio supports its strong EBITDA margins because most incremental revenues from co-locations flow through to its operating profit.