The South African towerco market

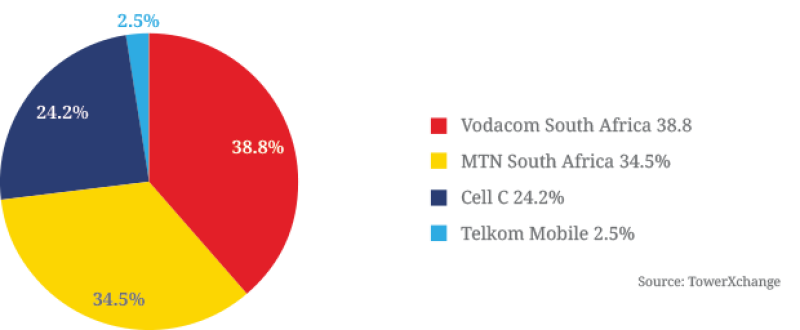

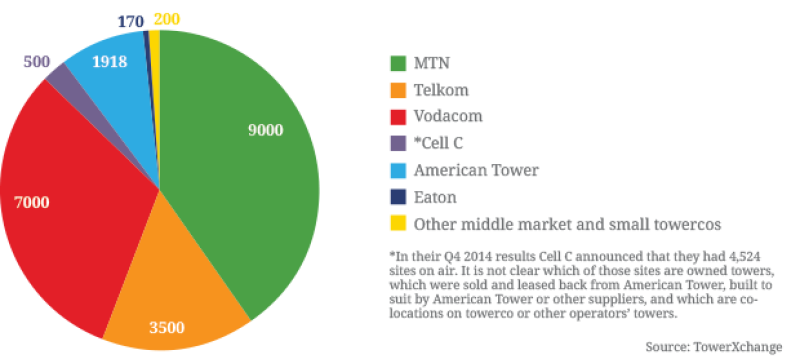

Towercos own just 10% of South Africa’s estimated 22,288 telecom towers, making the country the least penetrated of SSA’s attractive tower markets. To date two of Africa’s ‘Big Four’ towercos control assets in the country – Eaton Towers has built over 170 towers with a pipeline of several hundred more and a tenancy ratio north of two, and American Tower markets 1,918 towers, 1,400 of which were acquired from Cell C back in 2010 in a US$430mn deal which at the time was reported to include up to 1,800 towers to be constructed, the majority of which have evidently not been built. In addition several ‘middle market’ towercos operate in the South Africa including Square1 Infrastructure and Atlas Tower.

The South African market is one of the most attractive telecom markets in SSA with 148% SIM penetration, of which 35% are 3G and 4G (source: GSMA Intelligence, Q4 2014) and, given wireline penetration stands at just 9%, growth in data consumption is likely to occur mainly in the mobile market. ARPU is around US$8.

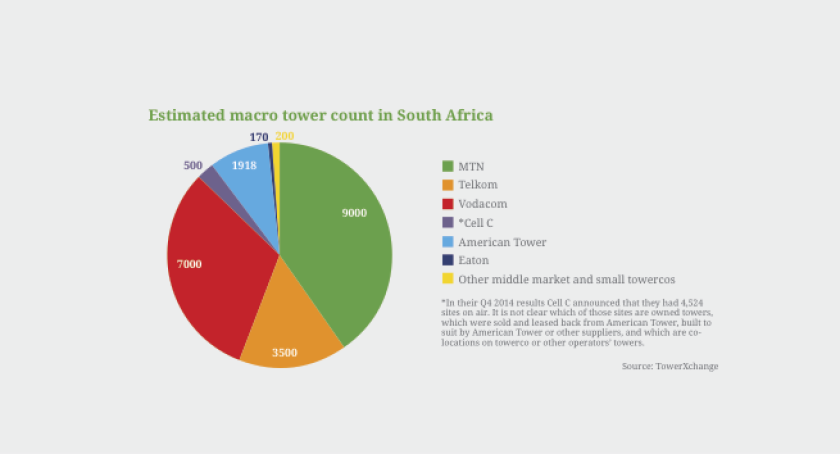

South Africa mobile market share, Q4 2014

South African operator landscape

Vodacom is the leading operator in South Africa with 31.5mn subscribers, supported by around 7,000 towers across the country. Leading the market in South Africa for many years, their market share has remained fairly stable despite shake ups from new market entrants. Vodacom denied interest in selling their South African towers as recently as September 2014, but if MTN or Vodacom did decide the time was right to sell towers, they’d have no shortage of bidders. Vodacom South Africa’s EBITDA margin was 37.4% in Q4 2014.

MTN, South Africa’s second operator, currently has 28mn subscribers, and although intensifying competition in South Africa resulted in MTN’s market share declining by 2.7% over H1 2014, with revenue down 7% and EBITDA down 1.5%, negative subscriber growth has been reversed and MTN remains in a robust position. MTN South Africa’s EBITDA margin was 32.1% in Q4 2014.

MTN stepped back from a sale to American Tower in 2013 and until recently have appeared to lack the motivation to divest their South African towers. However Telkom’s RFP may well have proven to be a catalyst for MTN reassessing this choice, as indeed Airtel’s African tower sale triggered MTN to bring their Nigerian towers to market. Reports in the press suggest MTN has again received interest from American Tower in at least part of their network of 9,000 towers, believed to be valued at $1.5-$2bn, and has been holding talks with potential buyers, including IHS, although a deal is unlikely to be concluded in 2015.

With around 19.6mn subscribers Cell C is the fastest growing operator in the South African market, growing market share by over 100% since 2013. Their introduction of a flat call-rate of 99c / min, to any network, and the lowest data rate, of 0.15c/MB has meant rapid growth in terms of market share and has challenged the high-margin stance of the other players in the market. Cell C has already divested around 1,400 towers to American Tower.

Telkom, Africa’s largest fixed-line operator, has just 2mn mobile subscribers in South Africa. The company launched its mobile business in October 2010 and was privatised in 2013. However, despite Telkom’s leading role in the fixed-line market, their mobile offering has laboured to capture market share from leaders Vodacom and MTN. As a result Telkom has launched a restructuring plan to cut R5bn in costs which remains on track which remains on track with their share price better than doubling in the last 12 months. Despite reports that Telkom would bring 3,500 towers to market in 2015, rumour has it that they will only divest 500 of their macro towers with a managed services piece running alongside. Were they to decide to sell, the full portfolio could be worth as much as $1 billion and could free up significant capital for the operator, who are also believed to have an interest in acquiring competitor Cell C.

While the status of Telkom’s stop-start passive infrastructure monetisation process remains unclear, the South African regulator recently rejected their application to share RAN with MTN South Africa via “extension of their existing roaming agreement to include bilateral roaming and outsourcing of the operation of Telkom’s radio access network.”

Strategists at Telkom are reconsidering their future network strategy at the highest level and, with interest in South Africa’s at an unprecedented high level and tower assets highly valued worldwide, now may be an excellent time for the operator to realise full value for their passive infrastructure.

TowerXchange’s sources suggest that Telkom’s legacy urban sites are highly desirable on the basis that they were built several years ago, before site permitting rules were tightened up, meaning the portfolio could be extremely interesting to trade buyers.

Estimated macro tower count in South Africa

Tower assets

Only 10% of South Africa’s towers are managed by independent towercos, with three of the top four operators retaining their own networks. There is already widespread bi-lateral tower sharing in the market, particularly between Vodacom and MTN, meaning any tower transaction would face a complicated path to convert so many swaps into commercial leases but on the plus side, it also means tenancy ratios would likely start nearer two than one, which significantly increases the valuation that could potentially be realised from a divested portfolio.

Network roll-out

According to ITWeb, MTN is investing R10bn in capex in 2015 (US$835mn), closely followed by Vodacom with R8.5bn (US$711mn) and Cell C with R5bn (US$417mn).

Although three of the South African MNOs have commenced roll out of 4G (Vodacom has around 2,000 LTE base stations, Telkom has 1,300 and MTN 1,000), the main factor delaying LTE rollout is not technology or coverage but spectrum allocation.

The South African government has suggested it wants to use the next round of spectrum licensing to introduce more competition in the wireless broadband space, but this translates in the short term into a five year wait (to date) for the Independent Communications Authority of South Africa (ICASA) to assign sought-after spectrum.

The result of this is that although 4G is being heavily marketed, availability is limited in most of the country. The two most likely scenarios – releasing spectrum to the existing players or the introduction of a new MNO/MVNO would both be well served by an independent towerco landscape in South Africa which could offer fast and deep penetration of the market.

Who will be interested in the South African towers?

Although the strong transport and power infrastructure in South Africa make it a much easier market to operate in than any of its SSA neighbours and may well open up this process to towercos with less of a frontiersy appetite, it seems likely that the bidding will be dominated by Africa’s ‘Big Four’ towercos who all have the experience and relationships to deliver in the region.

There’s no doubt American Tower have an interest in this opportunity in South Africa. As the biggest independent player in the market to date, they have proven relationships in place and a base from which to grow. Indeed, there are already reports that they are speaking to MTN about acquiring their towers. The 1,400 towers purchased from Cell C are already generating return on capital invested of approximately 20% in local currency and American Tower managed to increase the tenancy ratio from just over one to nearly two ‘tenant equivalents’ per tower within three years of their acquisition – South Africa has proven a successful and profitable market for American Tower.

Of the other ‘Big Four’ players in Africa, Eaton already manages 170 BTS towers in the country, and their imminent acquisition in Egypt and associated capital raise demonstrates that they are still in the market to grow their portfolio in Africa through large scale tower deals. IHS’s control of the independent tower market in nearby Zambia and scale as the largest independent tower owner on the continent will undoubtedly lead them to assess the opportunities in South Africa. In addition their relationship with MTN in other African market, including over 9,000 towers in Nigeria, has made them serious bidders in the process, with some industry publications reporting that they are already in discussion with MTN for the tower portfolio. It seems likely that Helios, with broad experience of working in African markets, will have an interest in this profitable region.

Towers in South Africa are operated under a simpler ‘steel and grass’ business model – towercos don’t have to get their hands dirty engaging with the energy supply chain as they do elsewhere in SSA. As such, South Africa could attract additional bidders including both International towercos and private equity and institutional funds with an appetite for this asset class. We would expect the number of bidders, should MTN’s South African towers come to market, to exceed ten.

Historically MTN has favoured retaining substantial equity in joint venture towercos in their most investible markets, retaining 49% equity in joint venture towercos with American Tower in Ghana and Uganda, and an unprecedented 51% equity in their joint venture towerco with IHS in Nigeria.

Conclusion

The Telkom and MTN portfolios together represent ~12,500 macro towers, or around 56% of the South African tower market. If both sale processes were to be completed within the next year, it would mean a significant shift from a 17% towerco presence to independent toweros controlling almost 90% of the market (factoring in continuing organic growth). With planned LTE rollouts and only 9% of the market served by wireline infrastructure, South African telecoms will see a huge rise in mobile data over the next few years, creating a very attractive market for whichever towerco or towercos manage to secure the assets.

It remains to be seen whether MTN will expedite the sale process in order to be the first to market and whether the South African market will be dominated by one player or split between two or more towercos, as we saw in Nigeria, but there is no doubt that the process will ignite the competition in the African market once again.