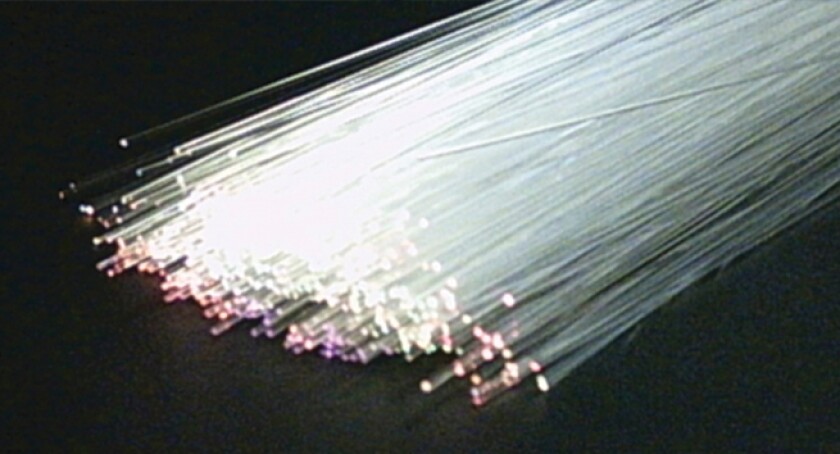

Last week Crown Castle International (CCI) announced its intention to buy Sunesys, a wholly owned subsidiary of Quanta Services, Inc., for US$1bn, a move that will further enhance CCI’s footprint in their domestic market. Sunesys owns, operates or has rights to approximately 10,000 miles (16,093 km) of fibre across the U.S. with particular concentration in metropolitan areas such as Los Angeles, Philadelphia, Chicago and Atlanta.

The news followed the recent announcement of the potential sale of Crown Castle Australia, which is currently receiving bids from firms such as U.S. based Providence Equity Partners, New Zealand infrastructure asset manager Morrison & Co, Canada’s Brookfield Asset Management and Macquarie Group’s infrastructure arm.