Profesional Telekomunikasi Indonesia (Protelindo) announced on 15 May that it had agreed to acquire 100% of the equity in iForte Solusi Infotek (iForte) at an enterprise value of IDR1.01tn, or US$78mn. Of this, IDR 864bn (US$66mn) of the equity value will be paid in cash, while the remaining debt will be taken on by Protelindo. As part of the agreement Peter Djatmiko, Founder and CEO of iForte, has agreed to remain on as President of iForte and will enter into a long-term partnership with Protelindo.

iForte

iForte’s assets include 450 microcell towers with a tenancy ratio of approximately 1.2. The management team plans to increase the number of microcell towers to 550-600 by the end of 2015. iForte has seven hotel BTS and 700km of fibre with over 180 PoPs in the city centre and business districts in Jakarta and Surabaya, and has exclusive rights to roll out fibre in nine of the ten major Transjakarta bus routes to offer 3G Wi-Fi offload services. Finally, iForte also provides VSAT and ISP services across Indonesia. 80% of iForte’s revenue is currently derived from Telkomsel, XL and Indosat and it has also been receiving interest from Internux (Bolt) and Hutchison recently.

The deal

Although this is a relatively small transaction for Protelindo it appears to have several benefits in the mid to long-term. According to Nomura, iForte is expected to generate IDR 110bn in EBITDA this year (3% of Protelindo’s EBITDA), implying EV/ EBITDA of 9.2x, which suggests the valuation is better than other similar recent deals in this market. In addition to this it also creates room to expand tower lease EBITDA margins, which are currently 62% compared to 80%+ for Protelindo and Tower Bersama (again according to Nomura).

In the longer term this deal positions Protelindo for the rollout of 4G services in key metro markets and to enhance its capacity to better compete with companies owning similar assets such as STP.

In three to four years owning a substantial microsite footprint may be key to winning market share

STP entered the fibre market as long ago as 2012, acquiring PT Platinum Teknologi. In November 2014, STP owned 330 microcell towers (with a tenancy ratio of 1.13) and seven Hotel BTS, while it had considerably more fibre with a 2,327km network, of which over 1,200km is located in Greater Jakarta. STP also has 562 iDAS boasting a healthy 2.58 tenancy ratio. STP’s microcell, hotel BTS and iDAS business represents about 10% of its revenue. Tower Bersama owns 300 microcells.

The number of 4G subscribers in Indonesia is starting to grow rapidly with Telkomsel, XL Axiata and Indosat offering services, and in three to four years owning a substantial microsite footprint may be key to winning market share.

According to Nomura, the blended lease rate for a microcell is comparable to that of a macro site (~US$1,040 compared to US$1,160).

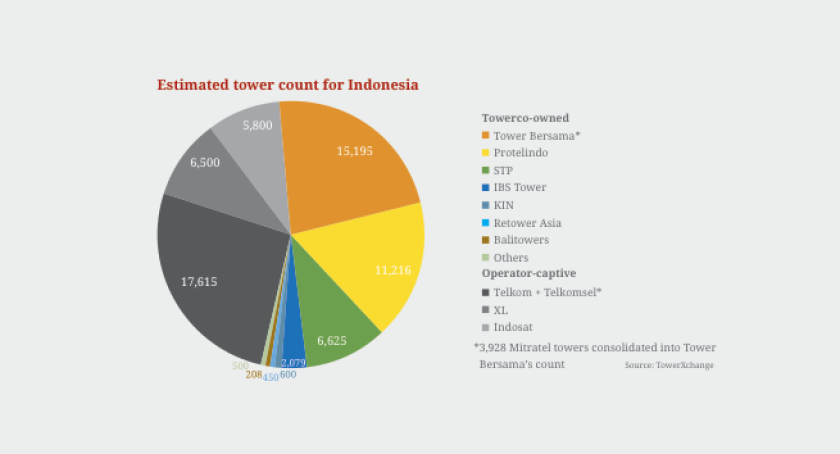

Estimated tower count for Indonesia

Changes in the Indonesian market

This deal is part of an established and continuing trend in the Indonesian telecommunications sector whereby the top telecom operators monetise tower assets whilst asking third parties to deploy and manage small cells. According to TowerXchange’s latest estimates, towercos currently own 55% of Indonesia’s ~66,788 towers between them.

According to credit rating agency Moody’s, of Indonesia’s three largest towercos, Protelindo is the most likely to continue to make acquisitions in the near term as it has greater financial flexibility to make debt-funded acquisitions while maintaining its credit rating. This is due to its relatively low debt-to-EBITDA ratio following several years of organic growth while other competitors have been more focussed on acquisitions.