The 2015 TowerXchange Meetup Asia featured three visionary keynote presentations on the tower industry, it’s origins, the challenges we face today, and opportunities to expand the scope of the towerco business model – in partnership with customers. Here are the highlights from the presentations made by Suresh Sidhu, CEO, edotco; Akhil Gupta, Chairman, Bharti Infratel and Amit Sharma, Executive Vice President, President - Asia, American Tower Corporation.

Suresh Sidhu, CEO, edotco

Suresh Sidhu, visionary CEO of edotco, was once again the opening keynote speaker at the second TowerXchange Meetup Asia, hosted at the prestigious Marina Bay Sands Hotel on November 24 and 25, 2015.

Sidhu emphasised that the mobile industry was being shaped by multiple forces:

- Infrastructure: tower asset divestitures and shared networks

- Technology: spectrum scarcity and the rise of unlicensed spectrum; as well as data growth driving demand for cell site densification and infill sites across Asia

- Commercial pressures: declining operator profitability compounded by the need to invest in network expansion to meet demand

- Regulatory: increased scrutiny on QoS, with telecoms seen as a critical source of revenue

MNOs are up against major challenges. Long term growth in demand for mobile data has surpassed the capacity traditionally available from spectrum in many markets. MNOs are reusing spectrum at smaller and more targeted sites to mitigate the shortage. Key challenges with deploying smaller sites include access to locations (which have very specific requirements), power and backhaul – each of which can be addressed by sharing.

MNO’s subscribers are seemingly more loyal to OTT providers like Google and Facebook than to their carrier. Meanwhile, regulations continue to shape the industry: the old approach to providing access is essentially gone and operators face challenging QoS issues targets. At the same time many developing countries need access to funds and the mobile industry is often the single biggest industrial contributor the GDP; tax revenue expectations are high. There are even some markets where the regulator has revenue targets.

How can the MNOs respond to this pressure? One answer lies in the financial re-engineering offered by partnerships with the tower industry.

The tower industry also faces new challenges including consolidation of MNOs and regulatory hurdles in their newer markets. Towercos need to redefine what makes them successful. Increasingly the discussion at a customer level is moving from pure economics to instead focus on the real value delivered to clients and their end-users – this is becoming a significant part of sale and leaseback discussions.

“The towerco business appears to be extremely stable but it pays to be a little paranoid in spite of this,” said edotco’s Sidhu. Forward-thinking CXOs at towercos worry about sustainability of the existing build to suit and colocation focused tower model and increasingly consider a range of potential enhanced services, from energy solutions, tower monitoring, fibre resale, and passive and active O&M, to developing new solutions such as IBS, small cells and BTS hotels.

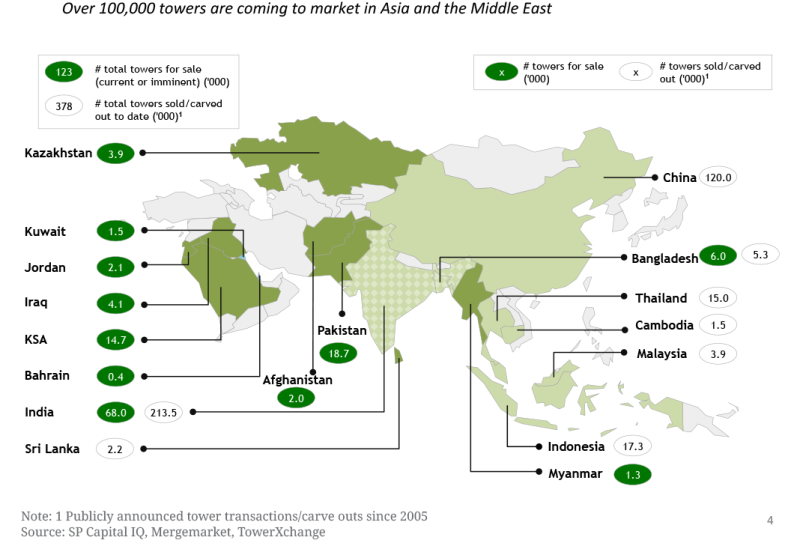

To date there have been over 400,000 towers transferred from MNOs to towercos around Asia, and there may be as many as another 100,000 for sale as the towerco model is established in new countries. As this process continues there will be a sea change in how the industry operates as operators embrace the model and start focussing resources away from infrastructure management. Towercos will take on this role and structure the focus on infrastructure to provide the best end-user experience.

To date there have been over 400,000 towers transferred from MNOs to towercos around Asia, and there may be as many as another 100,000 for sale as the towerco model is established in new countries” – Suresh Sidhu

The requirements of infrastructure sharing are huge, and demand for solutions is increasing faster than the capability to meet it. The industry needs to respond; MNOs that have divested their assets will be happy to start building their own towers again if they feel that we aren’t keeping up with market demand. While some towerco executives are preoccupied with delivering 85% margins, others are more focused on meeting their clients’ desire for end-to-end solutions; our tenants want the most efficient assets possible and are more interested in solutions for the specific challenges they face. Increasingly MNOs don’t feel the need to own the towers.

There will be continued consolidation, and edotco also predicts increasing involvement in active infrastructure sharing. RAN sharing is prevalent in Europe, where some towercos have seen their share of tenancies fall by 20-35% as a result of network sharing. RAN sharing is coming to Asia and has been launched in Malaysia and Indonesia. Meanwhile, what role could innovations like Google Loon and Facebook Aquila play in extending rural connectivity? Innovations often start by addressing opportunities nobody else appears to want to address, like marginal rural markets, but if successful these solutions could extend from rural to core network coverage.

In the traditional model, towercos are more inwardly focused on assets as opposed to services, on the conversion of capex to opex, and tend to focus of rental of space on traditional ground based towers. Suresh suggested eight refinements to make towercos successful in tomorrow’s world:

1. Scale within country but also scale across multiple footprints

2. Delivery of operational improvements made transparent through uptime, SLA and low TCO metrics

3. The ability the structure strategic deals, leveraging balance sheets beyond a pure focus on co-locations

4. Embracing new technologies such as small cells, BTS hotels and camouflage sites

5. Enhancing the scope of towerco services to include RMS, O&M and power where appropriate

6. Standardising processes to propagate best practice

7. Engaging regulators and other national stakeholders to position towercos as a true partner to the country, and to position telecom infrastructure as fundamental to Nation Building

8. And finally to drive the development of human resources across the region, building capabilities and enhancing skill sets

Akhil Gupta, Chairman, Bharti Infratel

Renowned ‘tower tsar’ of Bharti Enterprises, Akhil Gupta’s keynote began with an examination of the origins and the future of the tower industry, reminding the audience that it is still young, and the concept is still controversial to many MNOs who consider their towers a source of tremendous competitive advantage. It is interesting to note that zoning restrictions played a part in the birth of the towerco model as they forced some of the initial cases of infrastructure sharing. After this came the development of monetisation and financial engineering for tower portfolio management, and the first instances of the sale and leaseback model. The real tower industry had its birth in Asia in India between 2007 and 2008; when astonishingly the three largest competitor MNOs agreed to cooperate and create Indus Towers, still the world’s largest towerco outside China. Operators found that while they competed on the front end they could work together on the back end.

The tower business model started to win over major stakeholders and many MNOs were convinced that it was the right thing for their business to transfer towers their towers into this emerging new class of infrastructure company. Operators are mainly focussed on sales and marketing and developing new services for their end users; however maintaining uptime is the main focus of towercos and it is a thankless, low tech, time consuming, 24x7x365 job. In some cases there were huge problems with MNO captive towers in a huge mess, poorly maintained, with “band-aid” solutions being used.

India had and still has low ARPUs, and the MNOs and realised that the opex savings could be immense when adopting the towerco model. Indian telecoms was and is experiencing huge growth, and before the advent of the towercos two thirds of capex went into passive infrastructure. Faced with all of these factors, MNOs found that the easiest solution was to relieve themselves of the capex requirement, and focus their time and resources on what they do best. In spite of their objections the operators could not continue to oppose this shift and in the end only delayed the inevitable.

There was a great need for improvement considering it was common to see four towers in one 50 square foot plot; the tower industry emerged from this. If the operators were going to spend millions of dollars why not spend it on batteries and generators instead of towers and give the money to towercos? Instead of spending US$20,000+ to get a new tower up and running why not just lease a spot on an existing tower?

How many industries can say they make money when an existing customer pays less? But that’s how it works; the success of Indian tower companies depends on clients paying less and not more – Akhil Gupta

This was the main idea behind the leap of faith that was taken; it became imperative to come up with a solution that was win-win-win for the incumbent, the towerco and the new tenants, and this is the basis of the Indian towerco model. Incumbents could have an automatic reduction of 20 - 22% on energy charge and rental for every new tenant that joined the tower. For the towerco a tower becomes profitable as soon as the second tenant is added, and their speed to market is the same as the incumbent; there is no discrimination. How many industries can say they make money when an existing customer pays less? But that’s how it works; the success of Indian tower companies depends on clients paying less and not more.

Towercos have two main objectives; first they are focused in the disarmament of operators – seeking to disarm their manpower and make it economically unfeasible for them to build their own towers. Secondly, towercos need to promote non-discriminatory sharing so that all tenants feel comfortable. Towercos can’t have single tenant sites as they are unprofitable, and every time operators perform a cost benefit analysis of build versus lease, building a new tower is never justified, and the same with loading new equipment on towers themselves. The towerco MSA is the same for all tenants, except if they are a large customer with larger tower portfolios they receive a larger discount. The result of this model in India is that practically no operators build their own towers and many towercos have all of the operators on their towers. Over the last six years our co-locations have increased at a CAGR of 8%, revenues at a CAGR of 11%. EBITDA margins have been increased to 42.9% and profit after tax has grown at a CAGR over 50%. The beauty of the model is that it doesn’t require more towers, it requires more tenants.

There is a lot of discussion about what the future holds for the tower industry; the demand for data is great while there will continue to be a strong need for more coverage. Towercos are definitely benefiting from technology; every time a base station gets loaded with traffic the radius changes; the moment traffic comes this starts shrinking and it makes network planning go haywire. Towercos allow clients to install 3G equipment and then 4G equipment; it’s like opium and the speed to market we provide encourages them to rollout quickly. The increase in traffic determines when they will be forced to put up new towers, and, as long as they maintain the number of tenancies, the industry will continue to grow.

Towercos need to keep the operators disarmed of all things tower related, and need to do this as our clients’ requirements change. We are seeing an increase in the number of indoor DAS sites; it was Gupta’s view that some towercos may start deploying their own infrastructure to enter this market, but this could cause a problem for the tower industry. It is important for towercos to remember that they should not compete with their own customers on Wi-Fi or DAS; whatever they do it should be based on the model of open sharing, and on a white label basis.

Transmission is also critical, and with the growth of data more towers will require a fibre connection, and once they can be connected to a transport network the most efficient service can be delivered. Long distance fibre like towers is part of the infrastructure and the MNOs should not concern themselves with it. High capacity microwave links are another possibility, and at some stage submarine cables for international connectivity; all of these should become a focus of towercos.

The government of India is also promoting the creation of smart cities and these come with substantial capacity requirements which will need shared infrastructure. This will be a huge project and towercos are in a great position to play a part. It represents a great opportunity to get involved in managed services that are agnostic to operators. There will be a new market for infrastructure and this is a wonderful opportunity for towercos. Towercos do, however, need to avoid irrational pricing wars like those that have happened between operators, citing regulations and the government’s involvement. Towercos can’t get too greedy and try to make profit at the cost of customers. It is positive to have many operators, but it’s good to have a few that are strong and financially stable and can respond quickly to market changes and adopt innovative new technologies.

The tower industry is stable compared with other technology-related industries with more unpredictable revenue models, falling margins, irrational pricing, currency fluctuations, and the risk of technological obsolescence. Infrastructure management may not be as exciting as founding or investing in a dotcom, but it’s good to be in an industry that has solid, profitable cash flows. The tower industry has an important role to play and a potentially bright future, but success or failure depends on our behaviour. Towercos can’t afford to get involved in wasteful competition, or become too greedy; if operators were to suffer while towercos make money it would be disastrous; there is a need to resist temptation and work together on this going forward.

Amit Sharma, Executive Vice President, President - Asia, American Tower Corporation

According to Amit Sharma, the growth rate of the Indian market is now arriving at “the sweet spot;” 3G hasn’t really taken off, 4G is being launched, and the entrance of a greenfield operator (Reliance Jio) is prompting incumbent operators to significantly upgrade their networks. Capex is expected to increase between 30-50%, but MNOs don’t want to invest most of that in steel and cement – and that’s where towercos can help. At the same time ARPUs remain quite low in this market; this is somewhat offset by rural mobile penetration which is at 20% currently and is expected to treble over the next five years. With smartphones using five to ten times more data than non-smartphones it’s plain to see where the increase in demand will come from. MNOs across India are putting US$15bn into network upgrades and spectrum auctions.

Currently the prevailing tenancy ratio in India is around two, and this is expected to increase to 2.5 in the next five years; meaning there will be approximately 225,000 new tenancies, representing huge room for growth. Amit Sharma predicts that this period of growth should last between three and five years.

However the tower industry also faces challenges, not least of which being regulation. To date it seems that some regulators want us one day, and don’t want towercos the next day; regulators are of two minds about the role of the tower industry. Regulations can put restrictions on what towercos can and can’t do, limiting the amount and flavour of equity available, and sometimes limiting the scope of their business. In the long term this is not sustainable, but in the short term it doesn’t seem that regulatory restrictions are going away.

Licensing, license fees and royalties are another aspect; many countries treat the tower sector as a goose that lays golden eggs, but they don’t apply much creativity into promoting its growth; instead they focus on how they can wring more out of the industry, as we have seen in markets where they are attempting to introduce licensing for towercos. This is happening both in Africa and Asia. In some cases every municipality wants a piece of the towerco pie and this can lead to one time fees for tower deployments, and in some cases ongoing fees which can add 10, 15 or even 20% on to the cost of a tower which is passed on to the towerco and its clients. Regulators don’t see this as an issue as they are charging a proportion but this goes against the grain in some countries where the regulators are also trying to develop and make connectivity ubiquitous.

As operator margins are increasingly getting squeezed, MNOs are looking at every element of the ecosystem and seeking more efficiency. In many cases the cost of capital is very high, which puts the tower industry between a rock and a hard place: the customer expects their lease costs and opex to decline but the towerco model needs escalators to absorb these additional levies and taxes.The towerco model works: financial investors gravitate toward the predictable returns we generate, so we need to find a solution to these additional costs before the model is compromised..

To address this, the tower industry needs to think about its role in the ecosystem in three, five, and ten years from now. MNOs are becoming consumer facing, service delivery focused organisations. This leaves the tower industry to run both passive and perhaps active infrastructure on a massive scale, and we must evolve further and become an even more efficient minutes factory; the cost per megabyte needs to decrease. The dividing line between MNOs and towerco needs to go. It makes no sense for the MNO to send a technician to visit a site to confidure the base station, then three days later for the towerco to send a technician to service the diesel genset: these jobs can be done much more efficiently by one or other stakeholder. There are still efficiencies to be achieved and redundancies to be eliminated, and towercos are often better at identifying and acting on these than MNOs.

Towercos need to widen their scope; provide maintenance of backhaul and active infrastructure; they need to identify opportunities to offer white label services such as Wi-Fi. Services like this can be deployed by operators, but they will require more DAS small cells; again the neutral host, sharing model will work best to achieve this.

The tower industry needs to act together to achieve enhanced industry-wide best practices; no towerco is a standalone business – Amit Sharma

Finally, we have to run our operations even more efficiently. There is still room for improvement. Choosing the right energy solutions can make a difference; there are challenges such as pilferage that need to be overcome, and above all issues related to uptime and operational efficiency that escalate customers costs need to be eliminated. Towercos should extend the scope of what we do, but do so in partnership with our customers, not as a land grab.

The tower industry needs to act together to achieve enhanced industry-wide best practices; no towerco is a standalone business, and events like the TowerXchange Meetup can play a critical role in facilitating this. India and Southeast Asia are on a roll and many are making the move from voice to data; we have to work together on robust network quality and coverage, increase the number of tenancies to deal with the challenges presented by cost pressures, regulatory limitations and license fees.