On 10 March 2016 IHS, Africa’s largest towerco, announced the acquisition of HTN Tower’s portfolio of 1,211 sites in Nigeria in a landmark deal signifying the first in-market consolidation in the African towerco segment. When closed, the transaction would take IHS’s tower count in Nigeria to 15,722 towers, 53.9% of the country’s 29,190 total (figure one). In addition, HTN’s managed services and co-location marketing agreement concerning SWAP Telecoms & Technologies 702 towers will be transferred to IHS following completion of the transaction (expected in Q2’16) rendering further Nigerian towers under their control.

What do we know about the valuation and deal structure?

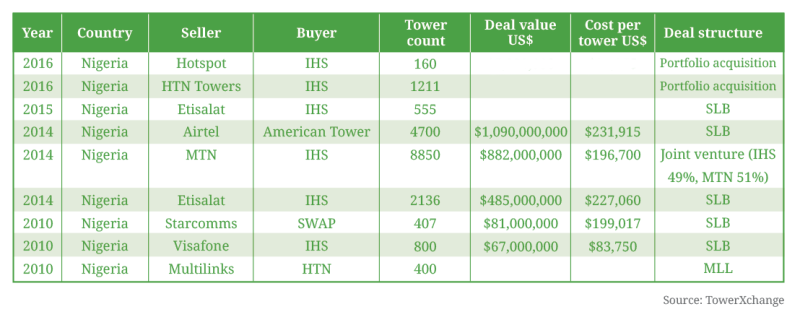

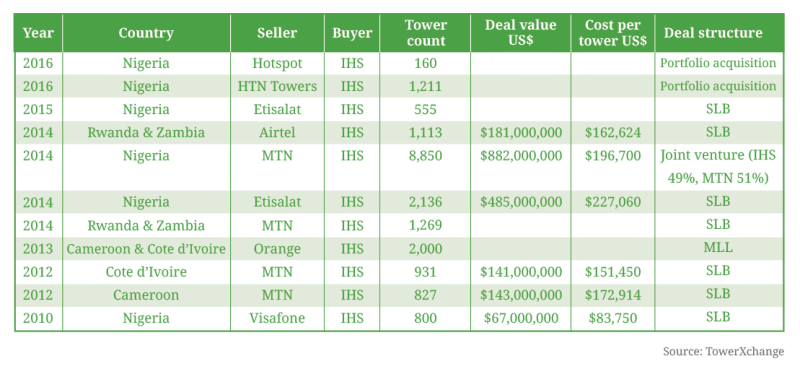

Under the terms of the transaction, IHS will acquire HTN’s entire issued share capital from investors Helios Investment Partners, Pembani Group, First City Monument Bank and other minority shareholders. Whilst IHS have declined to comment on the deal value, a look at the history of tower transactions in Nigeria (table 1a) gives an average cost per tower of US$208,548 and puts an estimate of the HTN portfolio at US$252.6mn. IHS’s transaction history in Africa over the past six years (table 1b) shows a lower average cost per tower of US$192,195, valuing the HTN portfolio at US$232.7mn. One must note however that average cost per tower represents an imperfect way to estimate transaction value as numerous factors pertaining to tenancy ratios, lease rates and location come into play.

What do we know about the health of the HTN Towers portfolio?

In the financial year ending 31 December 2014, HTN Towers achieved US$73.3mn revenue and US$31.7mn EBITDA, rising to US$36mn revenue and $19.8mn EBITDA for H1 2015 (a growth in EBITDA margin from 43% to 55%).

HTN Towers boast one of the highest tenancy ratios in Africa at 2.2 tenants per live tower, having increased roughly 0.25 every year from 2010 to 2014 (any tenancy ratio growth above 0.2 per annum is considered very healthy). Monthly TCF (tower cash flow) per live HTN site sat just under US$4,500.

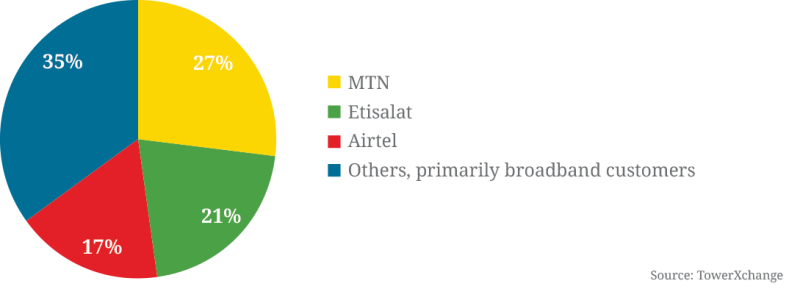

In the first half of 2015, 65% of HTN’s adjusted revenues came from three credit worthy, tier one GSM operators: MTN, Airtel and Etisalat with a further 16 broadband and telecommunications customers sitting as tenants on HTN towers, joined by broadcasting, transmission and corporate tenants (figure two). Over 70% of HTN Towers’ adjusted revenue now comes from the big three Nigerian MNOs.

Figure one: Who owns 29,250 Nigeria’s towers? (Pro rata for the closure of the IHS-HTN deal)

What degree of improvement capex do IHS anticipate?

Given IHS’s excellent reputation and strong SLA results, we asked the amount of improvement capex anticipated to bring the towers up to IHS’s standard. “We are purchasing quality assets and as such, the capex required is targeted at replacing equipment at the end of its life” explained our source. “HTN has implemented hybrid battery solutions across over three quarters of its tower sites and the majority are connected through remote management. Going forward HTN’s towers will be further enhanced with alternate solar optimisation and seamlessly integrated into our portfolio to ensure the tower uptime continues to match our industry standard of over 99%. All tower sites will also be connected to our state-of-the-art network operating centres so that we can effectively monitor them 24/7.”

Table 1a: Tower transactions in the Nigerian market

Table 1b: IHS transactions in the African market

What do we know about the location of HTN’s sites and their overlap with IHS’s existing portfolio?

“HTN has a complementary, attractive urban-centric portfolio with significant coverage in Lagos and Abuja and almost half its towers in Nigeria’s top 10 cities”. The exact amount of overlap between the two portfolios is unknown but HTN’s IPO documentation suggested that just under 10% of their sites were within 100m of an IHS tower”.

Why does Nigeria represent an important market for IHS?

Nigeria is Africa’s largest economy and is the largest market in Africa in terms of mobile consumption with 151.2mn mobile connections. It has a healthy competitive MNO environment with six operators and new data providers entering the market as data usage in the country continues to grow apace, with 37% YOY growth in mobile broadband usage. There is still potential for substantial amendment revenue for towercos with 3G still being rolled out and LTE being piloted.

In the press release announcing the HTN Towers acquisition, Issam Darwish, IHS Executive Chairman and Group CEO said “We remain committed to the Nigerian tower market where coverage levels are yet to mature and explosive data growth continues. The growing data traffic and increased smartphone use presents an exciting market opportunity for IHS, with the potential for up to 40,000 more towers required to meet this demand.”

IHS was born in Nigeria and already has a substantial presence in the country with 600 staff on the ground and an existing portfolio, prior to the proposed HTN Towers acquisition, of 14,511 towers following sizeable acquisitions from MTN and Etisalat in the past two years. Nigeria is IHS’s largest market in terms of tower ownership, accounting for 67% of their total portfolio of 23,333 towers (figure three) and the acquisition further strengthens IHS’s position as the leading mobile infrastructure provider in the country.

Figure two: HTN Towers customer mix H1 2015

Could we see any further acquisitions by IHS in Nigeria?

Inorganic growth opportunities are limited in Nigeria, where only Globalcom and NATCOM’s towers remain on MNO balance sheets. There exists some potential to absorb portfolios of some of Nigeria’s smaller towercos in a country where 79% of towers are held by independent towercos.

With, however, a potential 40,000 additional towers needed to meet growing data traffic and smartphone usage in the country, significant growth can be expected in the country’s build-to suit market which remains a critical focus for IHS following their acquisition of HTN Towers.

Figure three: IHS’s African tower counts, pro rata for the completion of the HTN Towers deal

Commentary on IHS’s acquisition of HTN Towers, by Kieron Osmotherly, Founder & CEO, TowerXchange

This makes sense. After the music stopped on the game of “who will buy Nigeria’s towers”, HTN Towers was left without a proverbial chair to sit on as IHS scooped the Etisalat and MTN towers (the latter in a joint venture with their anchor tenants), and American Tower entered Nigeria through the acquisition of Airtel Nigeria’s towers. Apart from an on-off deal to consolidate HTN and SWAP, HTN had little prospect of inorganic growth, and two fierce competitors for organic growth, with IHS and ATC Nigeria poised to split the BTS market between them. No wonder Helios IP and other HTN Towers backers had been seeking an exit for over a year, culminating in coming to the brink of an IPO in Q4 2015.

Before readers ask, no we don’t know the value of the IHS-HTN deal. Within the main body of this article, we’ve hinted at a US$232.7-252.6mn range. Factors driving value: HTN has been EBITDA positive since FY2012 (making US$37.1mn adjusted EBITDA on US$78mn adjusted revenue in FY14), has a high tenancy ratio at 2.2, and a strong operating history against SLA and MTTR KPIs. HTN Towers has also largely recalibrated their revenue mix away from an initial reliance on CDMA operators, with over 70% of their revenue now coming from tier one GSM operators. Factors limiting value: uncertainty surrounding the NCC fine on MTN and it’s implications for capex spend in 2016 and beyond; the presence on HTN’s balance sheet of a residual ~300 of an initial 491 zero tenant towers acquired from Multi-Links; and the simple fact that HTN’s towers are the most leased up in Africa – insofar as there is a glass ceiling on tenancy ratios, this portfolio is closest to it. How much value can IHS add?

This is where IHS is the most logical consolidator of HTN. IHS has scale, and an excellent track record of delivering on client expectations. Their sites have been extensively modernised, as have HTN’s, while IHS can readily integrate HTN Towers’ portfolio into their state-of-the-art NOC. This integration should proceed swiftly and smoothly, once the deal is closed.

While the deal is pending approval, the presence of the world’s largest independent towerco, American Tower, in Nigeria should calm any regulatory concerns about IHS’s market share in terms of tower count creeping toward 54%.

What are the implications for IHS? This is not a transformational transaction. IHS were a West-Africa / Nigeria-centric towerco play of substantial scale before this deal, they still will be afterward. The characteristics of the business, through the lens of investors in a prospective future IPO, would be far more substantially affected by a substantial acquisition in Saudi Arabia or South Africa, which may or may not happen later this year.

Does this transaction mark the start of in-market consolidation of SSA towercos? Maybe, but I doubt it. We could see a few more middle market towercos rolled up; HTN Towers’ agreement to manage and market SWAP Telecoms & Technologies 702 towers transfers to IHS as part of this deal, and could be a precursor to a full acquisition. But do I expect IHS to acquire Helios Towers Africa or Eaton Towers in 2016? No. Never say never, but we think those assets will come to market in 2017-18.

IHS has consolidated their position as the leading tower company in Nigeria, and in SSA. Whilst we don’t know the economics to comment on value, in terms of fit, this is such a no-brainer that the only question is why the deal didn’t happen sooner.

Join all the leading stakeholders in the African tower industry at the TowerXchange Meetup Africa being held on 19-20 October 2016 at the Sandton Convention Centre in Johannesburg. TowerXchange Meetups are invite only retreats for the top 250 executives in telecoms infrastructure. For more information visit click here or contact Laura Dinnewell, Head of EMEA, TowerXchange at ldinnewell@towerxchange.com or Kieron Osmotherly, CEO, TowerXchange at kosmotherly@towerxchange.com