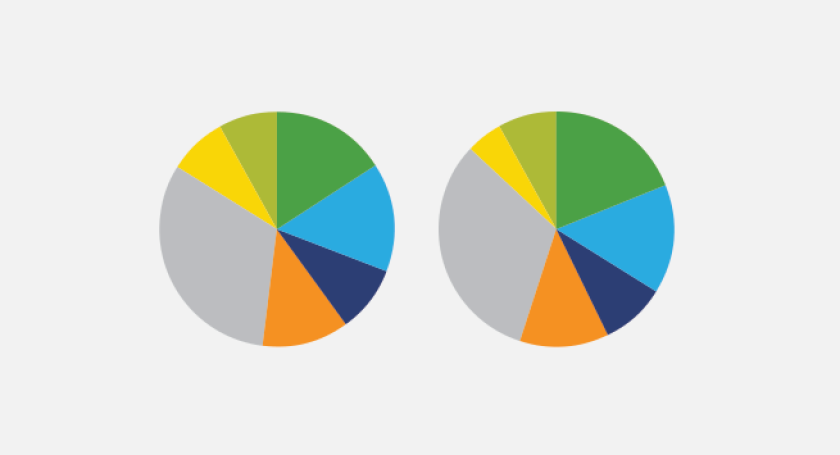

The sale of 2,500 telecommunications towers owned by mobile operator, XL Axiata Tbk (Ba1 stable), when consummated, will strengthen Profesional Telekomunikasi Indonesia’s (Protelindo, Ba1 stable) position as the largest independent tower company in Indonesia by towers and tenants.

Post-acquisition, Protelindo will operate about 14,700 towers—representing a 19% share of the Indonesian tower market—with about 24,700 tenants. By comparison, the second largest independent tower company, Tower Bersama Infrastructure (Ba3, stable), had about 11,389 towers at 31 December 2015 that were leased to 18,796 tenants.

Exhibit 1: Protelindo’s market share will increase to 19% from 16% post-XL Tower acquisition

Exhibit 1

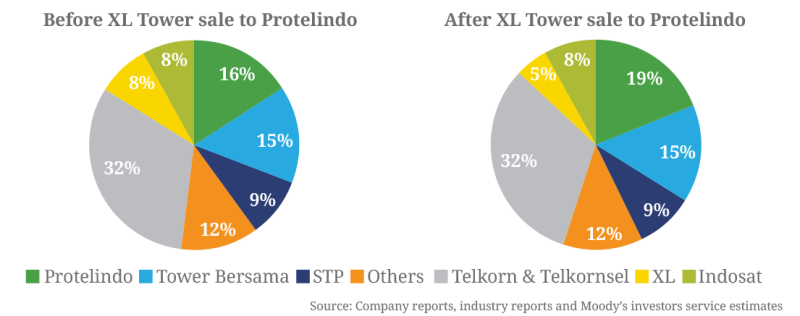

Acquisitions help tower companies achieve scale and give them a competitive edge by expanding their geographic footprint. For example, Solusi Tunas Pratama’s (STP, unrated) acquisition of 3,500 towers from XL in December 2014 cemented STP’s position as a strong, third largest independent tower operator in Indonesia.

Acquisitions have been central to the growth strategies of Indonesian independent tower companies, with more than 35% of each independent tower company’s portfolio comprising assets obtained from acquisitions. In Protelindo’s case, the acquisition of XL’s towers will increase to 58% its proportion of acquired towers to total towers.

Exhibit 2: Indonesia’s three largest independant tower opertators acquired more than 35% of their tower portfolios

Exhibit 2

The acquisition will also improve Protelindo’s tenancy mix, because 2,432 of the 2,500 acquired towers will have XL as their anchor tenant. Pro forma for the acquisition, Protelindo expects its share of revenue from mobile operators with meaningful market shares to increase to about 51% (including Netherlands towers) from 49% for the quarter ended December 2015.

The tower transaction is structured as a sale and leaseback agreement, whereby XL will lease back 2,432 towers under a ten year agreement. XL has agreed to pay a monthly lease rate of IDR10 million per tower, of which, IDR2 million is subject to an annual inflation escalator equaling the lower of 7% or Indonesia’s official inflation rate.

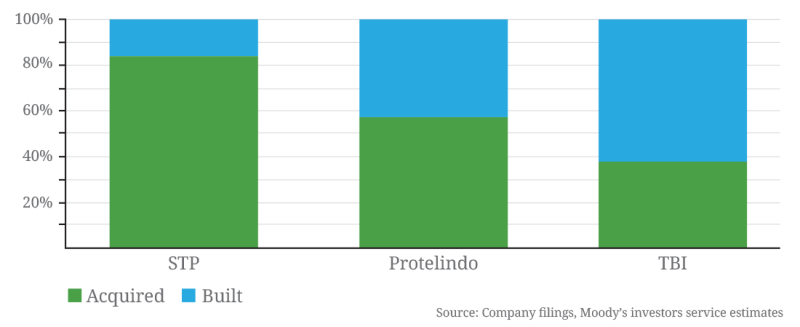

Over the last two years, Protelindo has significantly improved its scale and credit profile. Its leverage has strengthened through EBITDA growth, supported by a significant increase in the number of tenancies on its towers. Protelindo increased its total tower tenancies to about 21,000 at 31 December 2015 compared to about 14,800 at 31 December 2012. As a result, adjusted EBITDA doubled to IDR3.8 trillion during this period.

Hence, Protelindo’s financial metrics are resilient and can easily accommodate this acquisition. Protelindo will fund the acquisition primarily through a IDR3.0 trillion (US$227 million) bank loan. The remaining IDR568 billion (US$43 million) will be paid with internal cash. The company’s strong financial profile, and the EBITDA-accretive nature of the tower business, means that the additional debt will not materially weaken Protelindo’s leverage or interest coverage metrics.

Exhibit 3: Protelindo’s can maintain leverage within its current rating threshold despite tower acquisition

Exhibit 3

The acquired towers will also boost Protelindo’s pro-forma revenue and EBITDA by about IDR490 billion and IDR390-IDR400 billion. Given Protelindo’s growing EBITDA from a higher number of tower tenancies, we expect the company’s leverage to gradually improve.

The acquired towers have a tenancy ratio of about 1.5x, where the majority of colocation (multiple mobile operators leasing space on the same tower) contracts are with Hutchison 3 Indonesia (H3I, unrated), an indirect 66%-owned subsidiary of CK Hutchison Holdings Limited (A3 stable).

About 65% of the acquired towers from XL are located in the more densely populated Java/Bali region, which increases the marketability of these towers to the larger, more creditworthy mobile operators. This will help Protelindo grow the tenancy ratio on the acquired towers.

Protelindo’s own tenancy ratio stands at 1.7x.

Higher tower tenancy ratios indicate a tower company’s effectiveness in adding co-locations; thereby driving higher EBITDA margins. Protelindo’s ability to increase co-locations on its towers is therefore critical in its ability to deleverage quickly following the acquisition.

As for XL, the sale will improve the company’s reported leverage, because XL plans to use the IDR3.57 trillion (US$270 million) proceeds from the sale of its non-core assets to repay debt. In addition, XL has also announced a rights issue to repay its US$500 million shareholder loan from parent company, Axiata Group Berhad (Baa2 stable), which will further reduce its adjusted debt to about IDR31.5 trillion from IDR40.5 trillion as of December 2015.

To XL’s benefit, the rental costs for leasing back the towers from Protelindo will be below prevailing average tower rental rates in Indonesia. However, the lease deal with Protelindo will increase its consolidated rental expense, which we capitalise and add to gross adjusted debt under our standard adjustments.

Still, even after factoring in our operating lease adjustment, we expect a net reduction in adjusted debt following the tower sale and rights issue, and expect XL’s pro forma leverage to improve to about 2.6x from 3.3x as of December 2015

Both Protelindo and XL expect to complete the transaction by 30 June 2016. The deal is subject to certain conditions, including a joint audit of the towers under consideration, and the reassignment of the co-location tenancy agreements to Protelindo from XL.

Any imminent ground lease renewal risk for Protelindo is mitigated by XL’s agreement to renew all ground leases coming due over the next 12 months on these towers. There are no remaining regulatory approvals required, and XL will not require any consent solicitation from its banks, because these towers are not pledged as collateral on its bank loans.

XL is unlikely to dispose of any more of its towers, because the company believes its remaining towers are strategic in nature.