BMI View: IHS Towers and American Tower Corporation’s acquisition of Nigeria’s towers has enabled them to cement their positions as the leading players among Africa’s big four tower firms. If Helios Towers Africa and Eaton Towers cannot outbid their larger rivals for new assets in the remaining attractive markets, they may seek scale through a merger or become acquisition targets.

In order to gain a true understanding of the strengths and weaknesses of each of Africa’s big four tower firms, we have used our telecoms forecasts, macroeconomic forecasts and operational risk data to assess the size and growth outlook across each company’s footprint in the region. In this comparison, we include all markets where tower firms own or manage at least 500 towers, estimating that a smaller presence in any market is too little to reap the benefits or be exposed to the risks.

Helios Towers Africa

Looking at the comparative data above, Helios Towers Africa is in a weaker position than its three larger rivals. Although the average urbanisation rate across its markets is slightly higher than other tower operators’ footprints, the total population and therefore total addressable telecoms market is the smallest of the four, and less than half the size of American Tower’s total addressable market.

On the operational risk side, Helios Towers Africa also faces a more challenging environment than its peers, in large part owing to the poor operational risk profile of the DRC. BMI’s Operational Risk Index is a combined assessment of the trade and investment, logistics, labour market and crime and security environments. Owing to a volatile political and security climate and underdeveloped infrastructure, the DRC has an overall Operational Risk score of 23.4 for 2016, compared with the regional average of 35.4 for sub-saharan Africa. Drilling down, it has a score of just 4 out of 100 for the business cost of crime, highlighting the considerable challenges Helios Towers Africa faces in one of its largest markets.

However, there are bright spots for Helios Towers Africa. Its portfolio of markets has the strongest mobile subscriptions growth outlook over the five years to 2020, and the second strongest growth for 3G/4G subscriptions. This is in large part boosted by the DRC, where Helios Towers Africa has thus far held a monopoly in the tower market. Strong subscription growth is also accompanied by one of the brightest macroeconomic profiles, with robust average annual GDP growth of 6.2% to 2020 across its markets. These circumstances will drive rising demand for capacity and coverage from its tenants, providing attractive organic growth prospects.

Eaton Towers

Although Eaton Towers also has a small presence in South Africa with 170 towers, by TowerXchange’s estimate, the number of towers is too small for the company to truly benefit from the market and have therefore excluded South Africa from its footprint in the comparative analysis. Nevertheless, its presence across six populous countries in Africa means its addressable market of mobile and 3G/4G subscribers is similar to that of regional giant IHS.

The main factor putting Eaton in a weaker position is the significantly weaker growth outlook for basic and advanced mobile services across its footprint. We forecast mobile CAGR of just 3.3% and 3G/4G CAGR of 13.0% across Ghana, Uganda, Burkina Faso, Niger, Kenya and Egypt between 2015 and 2020. There are a number of factors underpinning this weak growth outlook. While Ghana and Egypt’s voice mobile markets are already highly penetrated, leaving less room for growth, we also expect slow subscriptions growth in landlocked and predominantly rural markets of Burkina Faso, Niger and Uganda. Of Eaton’s six main markets, the urbanisation rate was above 50% only in Ghana, while in Niger and Uganda less than 20% of the population lived in urban areas, making it more costly to reach many consumers with advanced networks.

Like Helios Towers Africa, Eaton Towers also benefits from being the only tower player in a handful of risky markets, namely Egypt, Burkina Faso and Niger. While we believe weak economic outlooks will curtail growth in these countries’ telecoms sectors during our forecast period, over the long term their large, underserved populations present good opportunities. Egypt in particular holds considerable potential owing to is location between the Middle East, Europe and North Africa, but we do not expect it to reach its potential until it recovers from current macro pressures including currency depreciation, and high unemployment and security risks.

Operational risk profile of the top five markets (by population size)

The Big Two

IHS and American Tower stand out as the companies with the strongest growth outlook in Africa because of their presence in the region’s two most significant markets, Nigeria and South Africa. American Tower benefits from a presence in both countries, resulting in the largest addressable mobile and 3G/4G markets among the four tower firms, while South Africa offers a significant boost to the average GDP per capita across its footprint. As the biggest tower operator present in the South African market, combined with its strong financial position owing to its global reach, American Tower is in a good position expand its presence in South Africa when towers come to market.

However, American Tower’s presence in Nigeria and South Africa, both of which are dealing with severe macroeconomic issues that are unlikely to be resolved in the short term, weighs on the GDP growth outlook across its footprint. Moreover, both markets also have difficult telecoms regulatory environments, posing additional risks to all operators. In Nigeria, tight SIM registration regulations, MTN’s fine and postponed license auctions are dampening investment and growth, while the South African government’s inability to agree on spectrum licensing policy is preventing mobile operators from deploying full scale LTE networks.

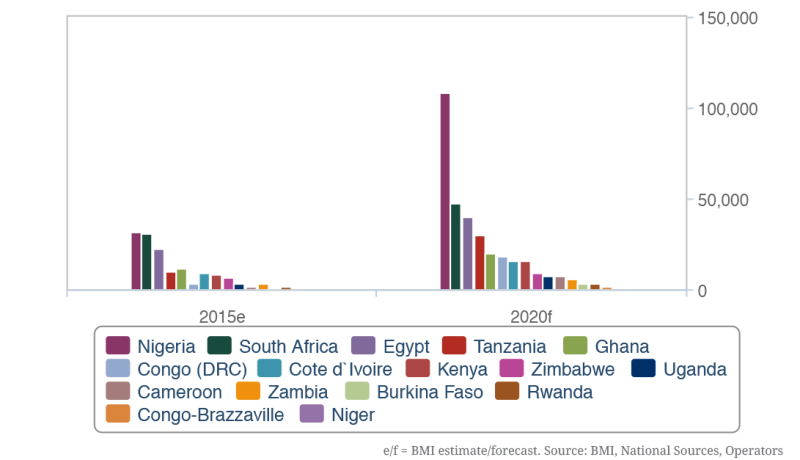

IHS draws its strength from its dominance of the Nigerian market, having acquired MTN and Etisalat’s towers and announced the acquisition of rival HTN Towers in March 2016. It has further solidified its presence in Nigeria through its acquisition of the broadband infraco licence for the North Central Zone in 2015, for which it will roll out wholesale fibre optic networks in the region around capital city Abuja. Despite the regulatory challenges noted above, Nigeria’s huge population makes it the most exciting market in the continent, with the 3G/4G subscriber base expected to more than triple to 108mn between 2015 and 2020, by our forecasts.

While IHS currently has no footprint in South Africa, the company has cultivated a deep partnership with MTN, which would make them strong contenders, alongside American Tower, should MTN SA’s towers come to market.

IHS also benefits from being the sole tower operator in countries with rapidly growing telecoms markets and bright economic prospects. BMI’s country risk team forecasts Cote d’Ivoire to be the fastest growing economy in Sub-Saharan Africa over the five years to 2020, which we expect to have positive knock-on effects in demand for more advanced telecoms services from consumers and enterprises alike. Meanwhile, Viettel’s entry into the Cameroon market has sparked strong competition and opened demand for data services.

Nigeria By Far The Most Attractive Market

3G/4G Subscriptions Forecast (000)

What Next?

IHS’ impressive footprint across many of Sub-Saharan Africa’s most promising markets make it a highly investible company, positioning it well for its touted IPO over the next two years. By contrast, Eaton Towers and Helios Towers Africa will have to pursue other options in order to remain competitive against their larger rivals. One possibility is that the two smaller players will merge to form a larger regional player. Airtel is still under discussions to sell its towers in the DRC, and should a second tower player acquire them then Helios Towers Africa will be faced with competition in all of its markets, which could accelerate a move towards consolidation. More likely, they will become acquisition targets for IHS or American Tower, or a third player, such as SBA, looking to enter Africa’s high growth telecoms markets.