With over 2,500 SIMs per tower or rooftop, almost double the European average, there is significant need for additional sites in Poland, especially after 2015 auction of spectrum for LTE. The market has also seen significant decommissioning, particularly consolidating the Orange and T-Mobile networks, which are managed by joint venture NetWorkS! Leading turnkey infrastructure provider ECS are leveraging capital injected by CEE Equity Partners to build and retain towers on their own balance sheet, creating Poland’s first mobile-focused towerco.

TowerXchange: Please introduce our readers to ECS.

Janusz Kalina, Founder, ECS:

Electronic Control Systems SA, or ECS, was established in 1999.

The company’s activity focuses mainly on the realisation of technical and technological investments in three main industries: telecommunications, ITS (Intelligent Transport Systems) and LED lighting systems.

ECS’s most important assets are our people. Currently the company employs over 200 people, including many highly qualified specialists with many years of professional experience in the industry.

The company’s headquarters are located in Cracow and we have branch offices in Warsaw, Poznan and Gdansk. ECS SA also has a plant in Finland and since mid of 2016 we have been providing services in Germany through a subsidiary company Electronic Control Systems GmbH.

TowerXchange: Please highlight your turnkey infrastructure business for telecoms in Poland.

Janusz Kalina, Founder, ECS:

ECS has successfully realised over 5,000 investments for its clients in the field of design, construction and modernisation of telecommunications infrastructure.

There are four major players in the Polish telecoms turnkey infrastructure market, of which ECS are the biggest – we’re the only contractor working with all four MNOs. For example, we helped T-Mobile and Orange consolidate from 10,000 overlapping to 4,500 shared towers, supporting them with civil works, building permission and negotiations with landlords.

ECS delivers a full set of turnkey infrastructure services – from site design and site acquisition to permitting, build, civil works and implementation. We co-operate with all the OEMs. Huawei is particularly strong in Poland, but we also work with Nokia and Ericsson on radio network optimisation, integration et cetera.

TowerXchange: How is ECS financed?

Janusz Kalina, Founder, ECS: 59% of capital in ECS is owned by a private equity fund managed by CEE Equity Partners. Most of the fund’s capital comes from the China Eximbank and the fund is headquartered in Luxemburg, so it is subject to the investment rules and financial regulations of the EU. The remaining capital, amounting to 41%, belongs to current Polish private investors.

The choice of CEE Equity Partners was not accidental. CEE has access to a €1bn fund, which gives ECS the capacity to invest in larger, more capitally intensive and complex projects, while maintaining our full independence in terms of strategy implementation and internal company processes. CEE Equity Partners is a private equity firm with a degree of infrastructure focus. The fund covers 16 CEE countries, so they have an appetite for tower projects within and beyond Poland.

TowerXchange: What can you tell us about your vision to evolve ECS into a towerco?

Janusz Kalina, Founder, ECS:

With the support of our new shareholders, since 2016 ECS has started working on the strategic goal of creating the first Polish passive telecom network operator, or towerco.

The initial vision is to build towers to meet specific operators’ needs (‘build to suit’ or BTS), and to retain those towers on our balance sheet, generating rental income, but we also have access to capital should it be possible to buy an existing tower portfolio in the future.

TowerXchange: What is the current state of your towerco project?

Janusz Kalina, Founder, ECS:

Our long term strategy is to create a towerco company in Poland.

We have just started to construct tower sites in order to lease these to operators. If there are no unforeseen delays their build will be completed in early 2017. In second half of 2017 we are going to start construction of another 100 sites including a mixture of ground based towers, rooftops and some microcells.

TowerXchange: Do you foresee any of the Polish MNOs selling and leasing back their towers, and would ECS be interested in participating in such opportunities?

Janusz Kalina, Founder, ECS:

The MNOs are not ready to sell their passive infrastructure yet in Poland, but we’re getting closer day by day to convincing them! It is hard to predict timescales.

In 2015 they seemed close to selling part of their infrastructure, but then discussions stopped. I don’t think any tower sale and leasebacks will happen in Poland before 2018, but due to fierce competition between the MNOs, the discussions could resume towards end of 2017.

TowerXchange: Please help our readers understand the mobile market context in Poland.

Janusz Kalina, Founder, ECS:

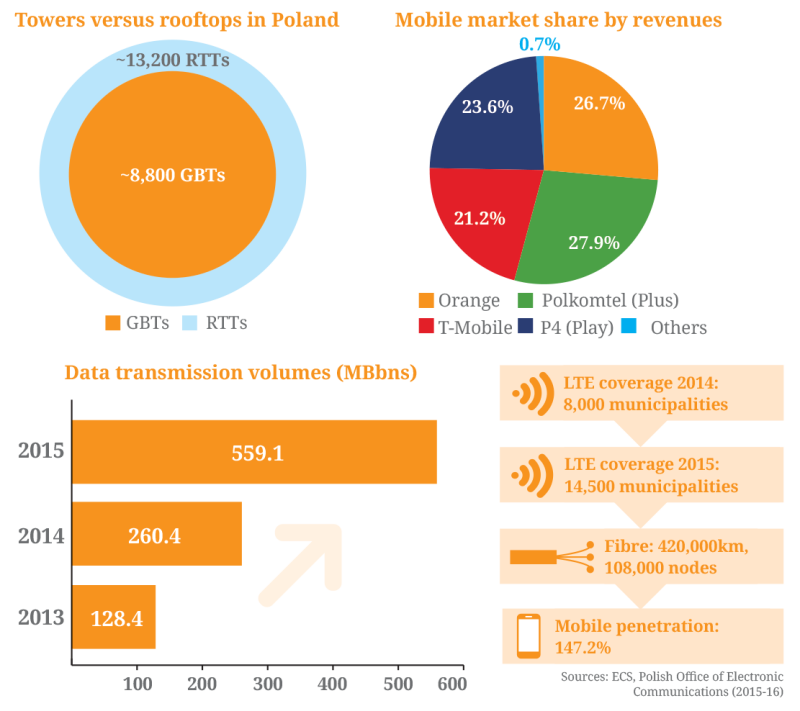

The mobile market in Poland is a balanced, competitive market led by Orange, Play and T-Mobile, with Plus as a solid fourth operator. Aero2 also has a small market share. It’s a mature market with SIM penetration around 150% and more than half of subscribers on mobile broadband.

The Polish tower market had been in limbo in 2015-16 due to the LTE frequency auction creating budgeting uncertainty – MNOs can’t do radio planning if they don’t know their frequencies or what they will cost. Now the auction was finished at the very end of 2015, with prices three to four times higher than some expected, network expansion has recommenced. We’re expecting the majority of the process to be completed by end of 2017 with as many as 3-4,000 sites rumoured to be needed nationwide. Then the market will start to focus on other strategic undertakings such as assets and towers, and a new technology upgrade.

With the LTE rollout at around 50% completion, this is currently the primary driver of growth; Poland has virtually 100% voice coverage. As such there is no natural network expansion requirement, but there is a need for gradual densification.

TowerXchange: How are Poland’s MNOs currently managing their networks?

Janusz Kalina, Founder, ECS:

T-Mobile and Orange are co-building through joint venture NetWorkS!, although it’s not clear whether that joint venture will continue or it may be sold.

Orange and T-Mobile retain ownership of the tower assets – they are not on the NetWorkS! balance sheet, so it’s essentially a maintenance and services business. For example, when ECS gets a PO from T-Mobile or Orange, our contract is with them, not with NetWorkS! They didn’t combine their old legacy towers into the joint venture, only new build undertaken since the partnership was formed. While NetWorkS! could be used as a towerco platform to lease up the towers to the country’s other MNOs, it doesn’t seem like T-Mobile and Orange are thinking about that.

Poland’s other two MNOs are Plus and Play. Play was built as a local roaming partner to Plus, but it is gradually becoming more independent, although they still depend on the Plus network. There have been rumours of a prospective merger of assets or operations if the regulator allowed.

TowerXchange: And what’s the size and structure of the tower market in Poland?

Janusz Kalina, Founder, ECS:

There are a total of around 22,000 sites in Poland, a mixture of around 60% rooftops and 40% ground based towers.

Founded as a company of Orange, but now owned by Alinda, Emitel operates Poland’s national broadcast and television tower infrastructure and they’ve leased some of their towers in strategic locations to MNOs. Emitel have the advantage that they own 450 towers in Poland, many with unique locations in mountains where others cannot build. As such, we don’t really compete directly with Emitel, but if we ever did, tenants may find that they’re not as flexible as ECS can be on time to market and price.

There are no other towercos yet in Poland. We know at least one international towerco is researching the market, but we feel the big listed towercos may wait for a large scale sale and leaseback opportunity before attempting to enter the Polish market.

TowerXchange: Please compare the microcell and rooftop markets in Poland with the macro tower market.

Janusz Kalina, Founder, ECS:

Microtowers are currently a small part of our activity, but building and leasing them out can be profitable at the right time and place – for example the potential of in-building solutions depends on the number and value of subscribers typically found in the building. We recently met with one of Poland’s leading MNOs who were discussing a bigger pilot of lamppost microcells, but at present they still represent maybe 0.5% of the market.

Use of rooftop sites is not as restricted as it is in Germany, but there are still problems with the structural capacity of many rooftop masts, and with the inflexibility of some landlords, which mean some rooftops can be impossible to co-locate. Rooftops are generally not as attractive as towers, but we’re open to using either.

TowerXchange: Please sum up your vision for the future of ECS.

Janusz Kalina, Founder, ECS:

We are striving to secure a contract for at least 100 sites from each MNO, and have started construction this year.

We think there will be more opportunities to acquire a package of passive infrastructure in 2017-18, either in Poland or in another country.

Introducing ECS Founder Janusz Kalina

Janusz Kalina is the company’s founder and Supervisory Board member, overlooking strategic initiatives and clients. A graduate of the Cracow University of Technology, Faculty of Mechanical Engineering, he has over ten years of experience in the realisation of investments in mobile network problem solving. His goal is for the company to stay one step ahead of the competition, keep the position of one of Poland’s most innovative companies and expand to other European markets. Under Kalina’s leadership, ECS maintained a very high level of profitability as well as constant and dynamic growth of income in subsequent years, rising from 0.4mn in the first year of operating to around 100n today.