Coinciding with Mobile World Congress Shanghai, Huawei’s eighth User Group Meeting took place June 28-30 at the World Expo Center Shanghai. TowerXchange was granted rare access to the strategic thinking of several of the world’s leading MNOs. While the event wasn’t focused on passive infrastructure, the implications to tower companies were clear: the drive to improve QoS and the customer experience, combined with mobile broadband rollout and progress toward 5G continues to put pressure on network capacity. Increasingly, building capacity is no longer a focus for MNOs as 62 per cent of the world’s telecom towers are now owned and operated by towercos, with the MNOs as clients.

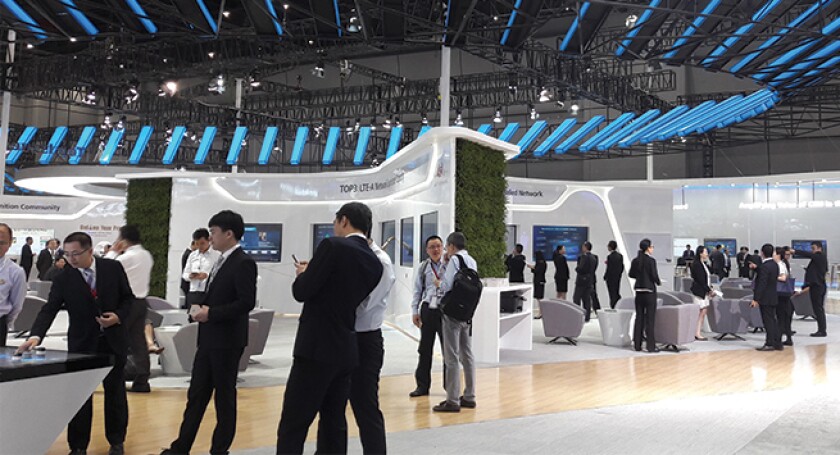

Bringing together 750+ attendees, this is one of Huawei’s key events to engage and collaborate with its clients for mutual business success. In addition to presentations from leading operators in China, Turkey, Canada, Australia, Thailand, and Denmark, there were also group discussions around various strategic issues. Improving network quality, user experience, and O&M were the focus for this group. The exhibit floor also showcased some of the latest product offerings, with the small cell, rooftop DAS, and street lamp being of most interest to the TowerXchange community.

Notable highlights came from audience polling

The economics of the business model (42.86%) and business innovation (35.71%) were the top two responses for what telcos saw as the biggest challenge to their future.

And while cellular IoT represents a significant opportunity for MNOs, many saw the relevance of industry applications scenarios (46.43%) as the most significant barrier to entry. Readiness of standards/solutions and availability of terminals in a scale were tied at (20.24%) and internal process and organizational issues last (13.1%).

When it comes to the best way to leverage video as a main mobile broadband (MBB) service, a little over half of the audience (56.25%) felt that offering attractive content was the way to go, while almost three-quarters (72.5%) felt that the MBB experience is mostly influenced by the ubiquity of data speed, as opposed to peak single user data speed or seamless video coverage QoE. Affordable marketing plans (57.5%) were seen as the best way to stimulate mobile data-demand, while content-based plans were a distant second best choice (25%).

True Corporation Thailand’s forward strategy is a three-pronged approach

Best Network

- Best network coverage and speed

- Maximum spectrum efficiency and appropriate technology

Best Fulfillment

- Digital platform, content, and new innovation services OTT and IoT

Cost Control & Productivity

- Accurate/efficient investment

- Network convergence and simplification with evolved platform

User Experience-centric Metrics at Optus (Australia)

- Seamless 720P video coverage (>95%)

- Video experience (resolution, start time, disruption time)

- Ookla speedtest results for 4G & 3G

- High accessibility: voice & data >99.5%

- Low drop calls: CS voice & VoLTE <0.5% data <0.15%

Lite Site (Streetpole) (122922)

- Development friendly, easy site acquisition

- All in one design with macro capacity

- Flexible power improving network reliability