Brazil is the largest and most mature tower market in the CALA region. But have you ever wondered how and when the history of the independent towerco industry began in Brazil? In this exclusive editorial, TowerXchange retraces the path of the Brazilian tower industry from the very first deals till today’s uncertainties.

2000s

The history of the Brazilian telecom tower market dates back to the early 2000s. Interestingly, the first towerco to snoop around the country was Crown Castle who went as far as opening an office in Brazil and conducted an early due diligence on the potential of the CALA market, only to then conclude that their more imminent priorities were back in the U.S.

In the meantime, another U.S. towerco was eyeing opportunities in the country and after having set its operations in Brazil in 2000, American Tower acquired approximately 150 towers from Global Village Telecom (GVT) in 2001 and officially started the Brazilian tower industry as we know it today.

Until 2010, American Tower was one of a handful of early towercos actively involved in the Brazilian market and sealed a couple of deals such as the acquisition of approximately 400 sites from Nextel (between 2003 and 2008) and the purchase of over 200 sites from CTBC (now Algar Telecom) in 2009.

Another towerco operating in Brazil in the early 2000s was Sitesharing, an early build to suit (BTS) firm which sold its 666 sites to American Tower in 2011.

American Tower clearly positioned itself from day one as an acquisitive force in the Brazilian market while its BTS activities didn’t start in earnest until 2007, when the company built around 100 sites. In 2008, American Tower’s Brazilian site count passed the 1,000 landmark thanks to a healthier volume of BTS projects (+400 YoY).

2010s

We have to wait until 2010 to see another major tower company entering the market and, in this case, in the form of a PE-backed entity. Grupo TorreSur (GTS) was formed in November 2010 by Jim Eisenstein, one of the original executives of American Tower. GTS is backed by U.S. investment firms including Providence Equity Partners and Cartesian Capital Group (as minority shareholder).

Grupo TorreSur started its M&A activity in early 2011 and sealed three deals with Oi and Telefónica in two years. Combining organic and inorganic growth, the towerco has now reached a healthy 6,500 site count and is the largest PE-backed towerco in Brazil.

In July 2015, news sources reported that Grupo TorreSur was in talks with various potential buyers but valuation gaps were insurmountable, so the company hasn’t been acquired by third parties and remains active in the Brazilian BTS market.

In December 2012, another towerco started operating in Brazil under the name of BR Towers. Backed by Banco Bradesco PE-unit and GP Investments, BR Towers was led by the current CEO of Phoenix Tower do Brasil, Mauricio Giusti, and in two years of activity reached a considerable scale (4,630 sites) via both organic (approximately 500 sites in two years) and inorganic (three deals with Telefónica and Oi) growth.

In June 2014, BR Towers was acquired by American Tower in one of the largest deals in the history of Brazilian towers, valued at US$978mn. That deal stands up under retrospective analysis as a good example of private equity backed player acquiring assets, adding value through modest tenancy ratio growth, and quickly selling at a reasonable premium.

Around the same time, TIM Brasil hired Morgan Stanley to work on the sale of its own tower portfolio which would lead to the single largest transaction in Brazilian towers: approximately US$1.2bn for 6,480 sites. The final tranches of this deal are still closing today.

Brazilian towercos growth 2012-2016

Swap clauses: a peculiarity of the Brazilian market

Swap clauses are a distinctive trait of the Brazilian tower industry that guarantee to the buyer of a given portfolio the right to literally swap a number of towers with other sites still owned by the seller, within a certain timeframe. Usually these clauses are included in M&A transactions as a protection against unfit sites that towercos might end up acquiring as part of a deal, especially given the fact that a number of portfolios that changed hands over the past few years didn’t undergo a costly and time consuming site-by-site due diligence ahead of expedited deals.

2012-2014: the (short lived) golden era of M&As

Between 2012 and 2014, Brazil experienced a wave of M&A activity that put the country’s tower sector at the frontline of the global tower industry. Brazil and its high multiple deals were being benchmarked throughout Latin America, and by analysts and shareholders back in the United States.

In mid-2012, the Brazilian government held its 4G auction which raised over US$1.3bn and granted frequencies to the (then) big four MNOs: Telefónica, Claro, TIM Brasil and Oi. The auction awarded frequencies in the sought-after 2.5GHz spectrum as well as in the less in-demand 450MHz band, suitable for rural broadband access.

The auction coincided with the initial wave of tower deals with Telefónica divesting most of its Brazilian assets between March and December 2012 and Oi sealing most of its deals between December 2012 and December 2013.

With the license terms setting stringent targets ahead of the 2013 Confederations Cup and the 2014 World Cup, Telefónica and Oi resorted to the quickest and most obvious way to raise capital and transferred most of its tower portfolios to American Tower, BR Towers, Grupo TorreSur and SBA Communications, with the latter having entered the Brazilian market in 2012.

By the end of 2014, both Oi and Telefónica had transferred most of their sites to towercos, with the exception of sites returned under cover swap commitments, which include many of the 1,655 towers Telefónica sold to its internal towerco Telxius in 2016. In the meantime, Nextel decided to put most its towers up for sale and sealed three deals with American Tower between December 2013 and December 2014.

While Telefónica, Oi and Nextel all divested large portions of their passive infrastructure portfolio, the Brazilian government held another auction, this time for the much coveted 700MHz LTE-suitable spectrum, but only raised US$2.39bn (versus Anatel’s target of US$3.25bn). While Claro, Telefónica and TIM Brasil all picked up spectrum blocks, neither Oi nor Nextel got involved in the auction, both starting to show signs of internal troubles.

Specifically, NII Holdings - owners of Nextel - filed for its second bankruptcy in 2015 after divesting its Chilean, Peruvian and Mexican units. After exiting the bankruptcy one year later, NII Holdings sold its Argentinian unit to continue investing in its Brazilian operations. On the other hand, Oi was just about to enter a troubled phase of failed negotiations with potential buyers (including Telecom Italia and LetterOne Holding) and falling revenues that would lead to its June 2016 bankruptcy protection filing.

During the “golden era” biennium 2012-2014, sixteen M&As took place in Brazil between MNOs and towercos at an average TCF multiple of 15.1x. In just two years, as many as 19,000 towers (over 30% of the entire national inventory) were transferred to towercos and approximately US$3.5bn was transferred to the balance sheets of the MNOs.

Brazilian tower deals: 2009-2016

The landing of the PE-backed firms

Brazil needs towers. And lots of them… During the 2016 edition of the TowerXchange Meetup Americas, panellists forecasted that the number of subscribers in Brazil will reach 300 million by 2020 (60 million more than today) which is approximately where the United States is at present. But the gap with the U.S. standards is still huge in terms of subscribers per tower (4,500 vs 1,000), average tenancy ratio (1.25 x vs 2.5x) and total number of sites (55,000 vs 140,000).

On this note, it’s important to keep in mind that Brazilian subscribers can’t be calculated using the same rationale as in the U.S. In fact, most subscribers in Brazil own multiple SIM cards, which they swap depending on the best service in the area, tariff offered for a certain call et cetera. So 4,500 subscribers per cell site don’t represent the real number of people connecting to a given cell and we can expect this number to drop closer to 3,000 if we take into account the high volume of multiple SIM cards in the country. Nonetheless the comparison still serves to illustrate the fact that Brazil needs a significant increase in the number of towers, and the number of tenants on towers, to achieve a QoS comparable to the U.S.

So if growth predictions are accurate, Brazil might need 70,000 new towers by 2020… And towercos to do the job! TowerXchange is well aware that such a volume of new builds isn’t realistic, especially under the current economic conditions, but if there’s one opportunity for Brazil to achieve greater levels of coverage and capacity in spite of its recession, it’s under the guidance of third-party telecom infrastructure experts. And while big organisations such as American Tower and SBA Communications are engaged in the BTS space, from 2011 on Brazil has witnessed the entrance of dozens of specialist BTS firms, supplementing build capacity. Here is a snapshot of the key BTS towercos currently operating in the country.

Operating since 2008, QMC Telecom’s profile raised in 2011 when Housatonic Partners, a PE firm based in Boston, acquired a major stake in the company to finance its activities in Brazil and Mexico. QMC currently has around 900 towers across CALA, including a substantial footprint in Brazil.

In August 2011, Brazil Tower Company (BTC) started its operations in the country with an initial focus on the Northeast region to then deploy throughout the nation. With tower count of over 750 sites and another 250 in the pipeline, the company is controlled by 1848 Capital and by Dr Chahram Zolfaghari, its CEO.

February 2013 saw the entrance in the Brazilian market of Cell Site Solutions (CSS) which marked the return of Goldman Sachs in the country’s private equity market. CSS is also backed by Gávea Investimentos and runs a portfolio of approximately 1,200 sites while focusing on BTS and DAS.

In March 2013, Highline do Brasil entered the Brazilian BTS market by sealing its first two deals with local MNOs and shortly after, the firm started offering iDAS solutions and street level sites. In 2015, Highline acquired two portfolios from ON Telecom (71 sites) and Algar Telecom (125 sites) and TowerXchange believes its now holds a portfolio nearing 500 sites across Brazil.

In 2013, Global Tower Partners and its 15,700 sites (across the U.S., Panama and Costa Rica) were acquired by American Tower in a deal valued US$4.8bn. The masterminds behind GTP went on to form new entities with GTP’s Founder and CEO Marc Ganzi creating Digital Bridge and Dagan Kasavana (in charge of M&A at GTP) launching Phoenix Tower International. Backed by Blackstone Tactical Opportunities unit, Phoenix Tower International operates a separate entity - Phoenix Tower do Brasil - in the country, where it currently runs a portfolio of approximately 700 sites built via a mix of organic and inorganic growth (In Q2 2015 T4U sold its 500 sites to Phoenix Tower do Brasil for an undisclosed amount).

Selection of PE-backed towercos in Brazil

Although with different missions and visions, PE-backed entities tend to have a relatively short lifecycle and a 3-7 year refinance / exit strategy in mind. However, with most of these firms having entered the market around 2012-2013, their plans might now be stalling due to the current economic situation and forex crisis affecting Brazil.

Times of forex volatility usually put a stop to transactions and this might require PE-backed companies to extend their horizons beyond their anticipated hold. This may be unavoidable since it could be very tough in today’s economy to achieve the multiples upon exit Brazil witnessed in the past.

2015: TIM-AMT

By 2015, Telefónica, Oi and Nextel had sold most of their assets, leaving only Claro and TIM Brasil’s tower portfolios operator-captive.

América Móvil’s strategy has been consistent throughout its CALA operations. The operator tends to retain its towers, with the only exception made for the 10,800 sites it transferred to Telesites as a result of the imposition to break its dominant position in Mexico by IFETEL. Therefore, we don’t expect its ~8,000 Brazilian sites to come to market anytime soon… unless Telesites enters the Brazilian market!

On the other hand, TIM had previously hired Morgan Stanley to advise on the divestment of its tower portfolio and by Q4 2014, it announced a sales and leaseback (SLB) transaction with American Tower which to date remains the largest deal in the history of Brazilian towers.

According to the deal, AMT entered into a SLB agreement with TIM Brasil for the purchase and leaseback of its 6,480 towers for an estimated US$1.2bn (TCF multiple 15.7x). To date, the deal hasn’t finalised yet with the fifth (and last) tranche of towers expected to be transferred before year end.

2015: a halt to plans

With few towers left on MNO balance sheets to buy, Brazilian towercos still had high hopes for the country’s densification plans. With thousands of towers needed to bring the Brazilian telecom sector up to par with more modern markets and the past spectrum auctions setting tough deployment targets for MNOs, BTS firms geared up for a few busy years ahead!

However, 2015 proved them wrong as the already weak Brazilian economy was hit by one of the deepest recessions in its history and shrank 2.6% in just one year. Along with its economic turmoils, Brazil had to face a political crisis with the then President Dilma Rousseff, dealing with a number of allegations of wrongdoings, culminating with her official impeachment and removal from office in August 2016.

Facing one of the toughest years in the history of the Brazilian economy, the country’s MNOs considerably reduced their investment plans while international towercos such as SBA and AMT dealt with a deep forex crisis affecting the Brazilian Real, whose exchange rate touched an all time low in September 2015.

Committing to huge investments during these shaky times isn’t ideal for either MNOs or listed towercos. Therefore both large BTS projects and any M&A activity among towercos had to be put on hold, leaving PE-backed towercos (many of which are increasingly impatient for a profitable exit) waiting for better times.

And while 2016 started on a similar path with hardly any new search rings being assigned, towercos reported slight improvements in Q3 with a few projects being assigned by MNOs, while economists predicted some (slight) economic improvements by Q4.

The Oi saga

As if these issues weren’t enough to ensure Brazil holds a spot on the podium as one of the most complex markets TowerXchange analyses, June 2016 had another shock in store.

On June 21, Oi filed for the single largest bankruptcy request in the history of Brazil, with debts amounting to US$19.2bn and creditors including three state-owned banks (Banco Nacional de Desenvolvimento Econômico e Social, Caixa Econômica Federal and Banco do Brasil) and various private institutions.

Oi was initially granted sixty days to submit a recovery plan but its creditors have refused the restructuring proposal presented on September 5, arguing that while it includes favourable conditions for current shareholders in the event of a positive turnaround, leaving bond investors with considerable losses if things don’t go as planned.

Therefore, the largest group of bondholders is now in talks with Egyptian billionaire Naguib Sawiris to prepare an alternative proposal that would help Oi recover while safeguarding their interests. The telecom mogul has previously shown interest in investing in the troubled telecom operator and expressed its positive views on the potential of Oi to recover with a capital increase and a solid business plan.

In the midst of this saga, the Brazilian government has been assessing possible amends to the current bankruptcy protection law, in an attempt to ease an intervention into Oi in light of the internal disputes between shareholders and creditors.

According to Reuters (citing local news sources) “a government intervention in the debt-laden carrier would remove Oi’s current management and board of directors, while keeping a committee of financial controllers. Industry watchdog Anatel would initially intervene in Oi for a year, with the possibility of extending it up to three.”

There are indications that new President’s Temer administration might be unimpressed with the efforts being made by Oi’s management to resolve its internal disputes and reach a satisfactory agreement with its shareholders and creditors. And this might prompt the amendment of the existing bankruptcy protection law that would enhance the level of control of the government over MNOs.

On the towerco front, the latest Oi news date back to Q2 earnings calls when SBA announced it is pursuing a total of US$16.5mn in the MNO’s reorganisation plan but added that Oi has already resumed payments for amounts subsequent to their filing. Seemingly, Oi has resumed payments towards AMT who is pursuing in full the US$7mn revenue reserve linked to the carrier.

The restructuring of Oi could be good news after all for the tower industry. In fact, after having filed for bankruptcy, Oi is currently fulfilling its financial obligations towards suppliers (including towercos) on time. However, we don’t expect the reorganisation of the company to happen anytime before Q2 2017 so for now we can only hope Oi gets out of this crisis stronger and more competitive than before.

Telxius (and Telesites)

Created in early 2016, Telxius is a global infrastructure firm owned by Telefónica. To date, Telxius manages 16,000 telecom towers across five countries and 65,000km of submarine fibre optic cables connecting Europe and the Americas, including various networks connecting the United States with Central and South America.

In April 2016, Telefónica announced the sale of 1,655 Brazilian sites to Telxius for an undisclosed amount and we believe that the portfolio represents the majority of towers that were still in the hands of Telefónica. Therefore, we don’t expect the operator-led infraco to grow its Brazilian count thanks to additional transfers of assets and only via future BTS projects Telefónica might assign.

So while in Europe Telxius owns 13,350 sites and could leverage its strong presence and scale, in Brazil we don’t expect it to be a real game changer.

On the other hand, we recognise the potentially disruptive effect Telesites could have in Brazil, should América Móvil decide to replicate its Mexican move and transfer Claro’s ~8,000 Brazilian sites into its infrastructure unit. However, to date the move has never been hinted and, beside some BTS projects in Costa Rica, Telesites’ activities remain limited to Mexico.

Brazil - Estimated tower count: 54,851

Brazilian independent towercos

Conclusions

Over the past few years, Brazil delivered a high volume of deals which resulted in towercos now owning around 70% (38,500) of the total tower inventory (55,000) of the country. And while at TowerXchange we remain convinced that the tower market should be rationalised with towerco-on-towerco consolidations, the time might not be right for the next consolidation phase to start.

The fragmented Brazilian tower ecosystem is filled with PE-backed towercos which have been created on the premises of a successful and lucrative exit in a relatively short period of time. However, since the golden years of the Brazilian tower industry (2012-2014), the local economy has hit new lows and is now in its deepest recession ever. The Brazilian Reais has depreciated so heavily against the U.S. Dollar that returns expectations of PE-investors may have to be recalibrated.

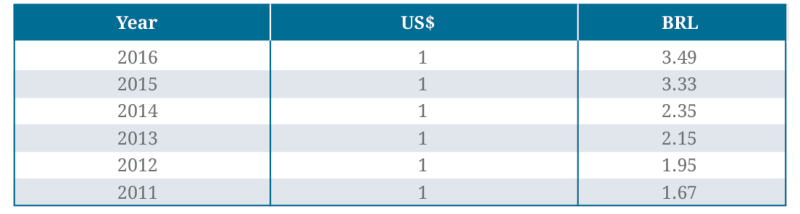

Average US$/BRL exchange rate 2011-2016

Just to explain this, investing US$100mn back in 2011 was 109% more expensive than it is today. A factor which might seem positive for those (lovers of risky business) considering any type of investment in US Dollars in Brazil today but for those that rid the wave back in 2011-2012 means the virtual impossibility to bring revenue generated in Reais back in the States at a profit. Which leaves us wondering what’s the future for PE-backed towercos?

On a more positive note, the bankruptcy of Oi - which clearly disrupted the market at first - might not be bad news for the Brazilian industry since there is hope for the reorganised entity to participate on a more level playing field with competitors and perhaps, in due course, resume network investments. And at the end of the day, no towerco wants to do business with a distressed MNO.

The alternative which has been echoed lately sees América Móvil interested in acquiring Oi’s operations, as declared by its AMX’s CEO Daniel Hajj in a recent interview with Brazilian newspaper Valor Econômico. And this could be now an easier deal since TIM Brasil seems officially out of the picture as a potential buyer.

While 2016 has been a tough year for Brazil, we foresee a slightly brighter future for the months to come with economists relatively optimistic about the country’s overall outlook. It might take some time for the telecom tower sector to fully recover and for the next wave of M&A to resume but when it does, we are bound to see some action in Brazil with various PE-backed towercos juggling their investors’ financial expectations with the reality of two years of slow growth.