Tower transactions in Saudi Arabia have been spoken about for several years, with a number of stop-start processes having occurred. At the time of going to press, Zain had entered into exclusive negotiations with a consortium involving Towershare and IHS Towers, a deal which would mark the Middle East’s first tower transaction. TowerXchange examine Saudi Arabia’s mobile market dynamics and explore the history of potential tower sales and joint ventures in the Kingdom.

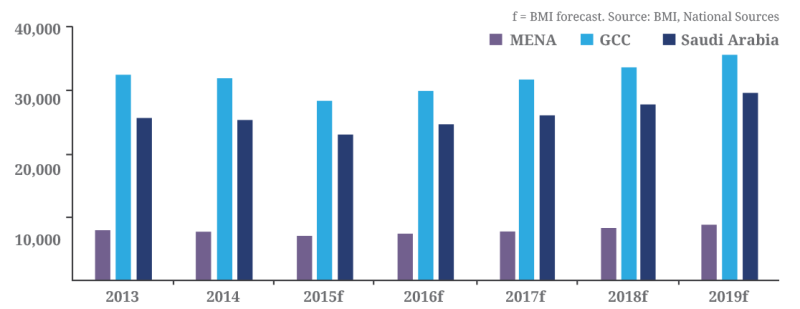

Saudi Arabia is the largest country in the Middle East in terms of land mass and the third largest country in terms of population with current figures measuring this as 31.5mn (World Bank). As an oil based economy - with the petroleum sector accounting for roughly 87% of budget revenues and 42% of GDP - the decline in oil prices has had a notable impact on the economy. But with GDP at levels significantly higher than the MENA regional average (figure one), and over 44mn mobile subscribers, the country is seen as a robust and low risk market.

Figure one: Saudi Arabia vs regional GDP per capita (US$), 2012-2019

The Saudi Mobile market

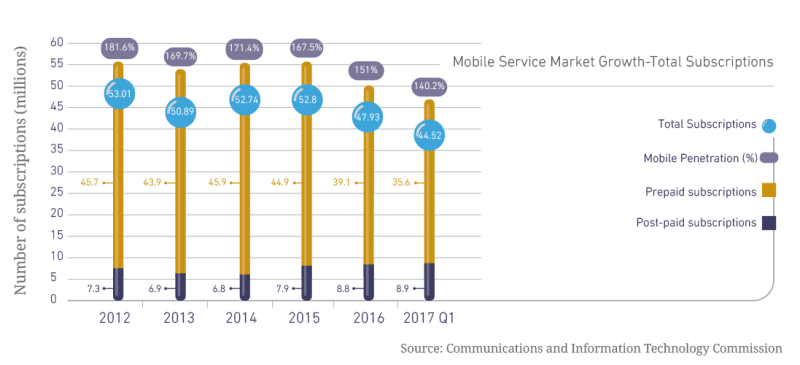

Whilst at 52mn mobile subscribers, Saudi Arabia represents one of MENA’s largest mobile markets), the number of subscribers has remained relatively constant over the past five years (figure two). The mobile market is saturated (with a mobile penetration rate of 168%), and even mobile broadband subscription growth has slowed with 2015 figures up just 15% on 2014 compared to 133% growth the previous year (figure two). The country was one of the first to rollout 4G, with all three operators launching their 4G services in 2011. 4G coverage now sits at 90%.

83% of the population lives in urban areas, particularly the major metropolises of Riyadh, Jeddah and Mecca, but the government has invested significant capital in increasing broadband speeds to rural areas, with a target of reaching 10Mb for most areas.

Figure two: Mobile market growth (total subscriptions)

Saudi’s MNOs and MVNOs

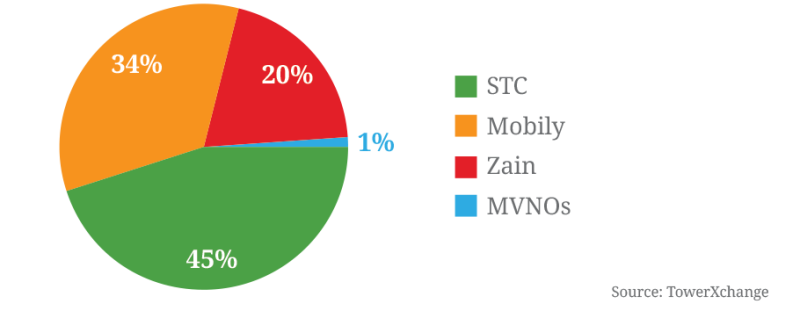

Saudi Arabia boasts three tier one MNOs: Saudi Telecom Company, Mobily and Zain; and two MVNOs - Virgin Mobile and Lebara

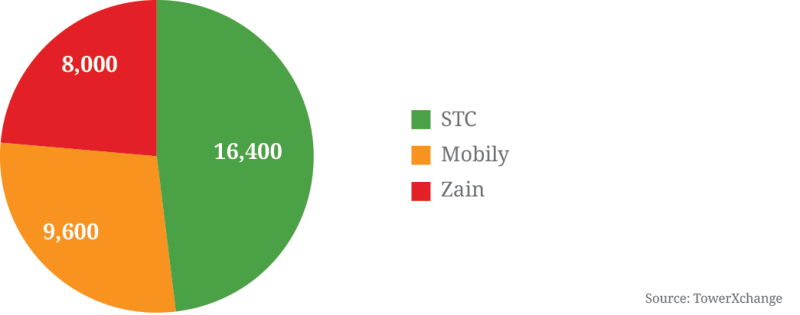

Saudi Telecom Company (STC) is the leading operator within the Kingdom of Saudi Arabia with 45% of the market share. The government owned operator also has a footprint in Kuwait, Lebanon, Jordan, Bahrain and South Africa as well as interests in India, Malaysia and Turkey and owns over half of Saudi’s estimated 34,000 towers.

Mobily is 27% owned by the UAE’s Etisalat which has a footprint in 14 countries across Africa and the Middle East. Mobily saw its shares fall by more than 50% following the discovery of accounting irregularities over a year ago. Following the news, Mobily appointed Ahmad Farroukh (former CEO of MTN South Africa) as its new CEO and Kais Ben Hamida as its CFO. Ben Hamida is the former CFO of Egypt’s MobiNil, where he oversaw the sale of 2,000 towers to Eaton Towers, a deal which was subsequently cancelled after his departure. Mobily is reported to have a portfolio of 9,600 towers.

Kuwaiti-owned Zain is Saudi’s third largest operator in terms of market share although it has been the leader in terms of market growth. The operator, with a footprint in eight countries in the Middle East (Bahrain, Jordan, Kuwait, Lebanon, Iraq, Saudi Arabia, Sudan and South Sudan) has been struggling with long term debts of US$2.95bn after paying a high license fee to enter the already well penetrated KSA market. With such a highly leveraged balance sheet, the operator has been evaluating strategies to reduce its debt burden. Zain has a portfolio of 8,000 towers in the Saudi market.

In addition to the three MNOs, Saudi Arabia has two MVNOs: Virgin Mobile and Lebara, which commenced operations in 2014 on the STC and Mobily networks respectively. A third MVNO, Axiom Telecom was expected to be launched on the Zain network but had its license withdrawn due to failure to meet set deadlines. Subsequent tenders for an alternative MVNO have been delayed. The MVNOs were introduced to target niche gaps in the market and as such, their market shares are expected to remain relatively modest.

With low subscriptions growth, there has been intensive price competition between each of the players and ARPU has witnessed a steady decline.

Figure three: The market share of Saudi Arabia’s MNOs and MVNOs

Figure four: Ownership of Saudi Arabia’s estimated 34,000 towers

Infrastructure sharing and independent towercos in Saudi Arabia

Infrastructure sharing in the Kingdom has to date been very limited, with less than 2% of sites believed to have more than one tenant. In the major cities, Riyadh and Jeddah there has been some infrastructure sharing as part of MNO densification plans to meet growing data usage, whilst in some of the country’s holy sites where access to land is limited, infrastructure sharing has arisen out of necessity. These infrastructure sharing arrangements are typically under bilateral commercial agreements and thus far have only covered passive equipment.

With little infrastructure sharing there has developed a high degree of parallel infrastructure; 95% of Zain and Mobily’s sites are reported to overlap and as such, the government is keen to promote infrastructure sharing.

TowerXchange has been made aware the growing interest amongst local tower management and construction companies to build and retain portfolios of towers. Advanced Communications and Electronic Systems (ACES), an EPC and system integrator in the Saudi telecom market is reported to have a modest portfolio which STC and Mobily are leasing space on, whilst tower manufacturer Al Babtain is looking into retaining towers to diversify their business model as MNOs’ appetite for significant new tower construction continues to decline. With no major tower transactions having been completed in the country, there is however as yet, no significant independent tower market.

The electricity grid and power costs

In terms of power requirements, around 90% of of sites are on-grid with an extensive and reliable grid infrastructure across much of the country. What’s more, electricity prices in the Middle East are substantially lower than those in other regions, with some reports suggesting them to be one fifth the level of the global average. With increasing pressure on the economy however from declining oil prices, subsidies relating to electricity prices are gradually beginning to be withdrawn which will have an impact on site opex.

Pressures from landlords

MNOs have reported significant upward pressure on lease rates from municipalities and landlords, which is not only having an impact on their bottom line but is also adding to workloads as the operators look to renegotiate.

Other operational challenges

With a desert climate, Saudi Arabia experiences extreme temperatures whilst high levels of dust can create present further complexities. All MNOs however have become adept at dealing with such conditions and as such, no major operational challenges have been cited.

The regulatory environment

The Saudi telecoms market is regulated by the Communications and Information Technology Commission – a well established institution which manages spectrum auctions, the Universal Service Fund and all other aspects governed by the telecommunications act.

Tower processes and joint venture discussions

In June of 2011, Saudi Telecom Company entered into discussions with Mobily regarding the creation of a captive, joint venture tower company to more cost effectively manage the two companies’ tower portfolios. It had been proposed that the two would then look to sell a significant stake in the new venture – but talks stalled.

Talks of tower sales then resurfaced in late 2014 when Zain appointed Citi to oversee a potential sale of their towers. The following announcement by Mobily that they were also considering a sale of their tower portfolio, considered by many bidders to be more attractive than that of Zain, shifted the focus of a number of bidders to the larger operator. In March 2016 it was reported that Zain were in the process of narrowing down potential bidders whilst Mobily reported they had received a number of offers during which time Saudi Telecom Company also announced they were looking at a potential tower sale or joint venture. STC reportedly approached the Mobily bidders as well as Zain and Mobily directly to discuss a potential sale or acquisition.

What were the MNO motivations to sell towers?

In an interview with Bloomberg at the end of May, Saudi Telecom Company’s CEO Khaled Bin Hussain Biyari confirmed that their motivation to sell towers was more about creating operational efficiencies than raising capital. STC’s tower opex costs are known to be significantly higher than the national average and with the company possessing a healthy balance sheet, a deal would most likely be structured to focus on reducing opex rather than maximising cash released.

This motivation is in stark contrast to Zain who, with a highly leveraged balance sheet, are more inclined to seek a higher valuation of their towers in order to reduce their debt burden.

Mobily was also likely to seek a higher valuation than STC, with the MNO also burdened by significant amounts of debt – however a sale by the operator is thought to be as much about improving EBITDA multiples as it is about raising debt.

Who were the 2016 bidders?

Whilst no formal announcements were made, several bidders were linked with the 2016 processes.

Both Digital Bridge and Providence Equity were known to have an interest in acquiring the Saudi towers. The Digital Bridge bid reportedly had the backing of state owned Saudi Aramco and emerging markets focused buyout firm Abraaj Group, whilst Providence were believed to have the backing of an unnamed Middle Eastern investor. As well as Saudi investors partnering with Digital Bridge and Providence Equity, two Saudi investors linked with the process were Al Rajhi Group and Al Zamil Group. Quippo international (the ownership team behind India’s Viom Networks who sold to American Tower) was also reported to be an interested party. TASC Towers, in partnership with Saudi conglomerate, ACWA Group and Towershare were two further reported names at the time.

STC & Mobily: cancelled sale, JV study, future uncertain

On 1 August 2016, Mobily and Saudi Telecom Company announced that they had signed a three month agreement to explore the formation of a joint venture as an alternative to selling their towers. This agreement was subsequently extended prior to the two MNOs issuing an RFP for an advisor in the first half of 2017 to help them assess their options. The two MNOs were known to have an interest in bringing a third party to the venture, with an open mind as to whether this would be a majority or minority stakeholder; and also had to decide how many of their combined network of 26,000 towers would be incorporated into the JV. In recent months however, it was announced that the joint venture was on hold as the two MNOs consider all their options.

Zain: exclusive negotiations ongoing

In December 2016 it was announced that Zain had entered into exclusive negotiations with a consortium involving TASC Towers and local conglomerate, ACWA Group regarding the sale of their towers (reportedly for a sum of about $500mn).

In August 2017 it was then announced that Zain had entered into exclusive talks with a consortium involving Towershare and IHS Towers, with the negotiations “superseding all prior arrangements”. A period until 28 September 2017 has been granted for the talks.

Zain had already entered into exclusive negotiations with Dubai headquartered, Towershare to sell their Kuwaiti towers and with Towershare having recently sold their Pakistani business to edotco, the company has an appetite to build up their portfolio. IHS Towers has a footprint in five African countries, and given the challenges presented by the Nigerian market could well benefit from diversifying their geographical footprint as they gear up for an expected liquidity event in the next 18-24 months.

At the time of going to press, TowerXchange eagerly await news on the transaction, a transaction which would mark the Middle East’s first major tower deal.