The Indian mobile industry, and its closely tied tower industry, is going through a period of unprecedented market restructuring which merits close analysis both by local market participants and by the international tower industry, seeking benchmarks to understand the prospective impact of consolidation. In this editorial, TowerXchange summarises the specifics of both the MNO and towerco consolidation, reviews the tower assets coming to market, and forecasts the future of the Indian tower landscape.

While in the short term consolidation and capitulation of India’s myriad of minority market share carriers to perhaps five all-India carriers will prompt negotiations to cancel the leases of parallel infrastructure and lower the glass ceiling on tenancy ratios, the truth is that the perceptions of that glass ceiling had been artificially high; India’s deeply indebted carriers were never likely to survive in the long term.

Concentrating spectrum in the hands of less carriers, carriers less burdened by debt, and better able to deploy network capex, will result in more sustainable long term growth for India’s towercos, even though they will likely have to absorb a short term slowdown in growth.

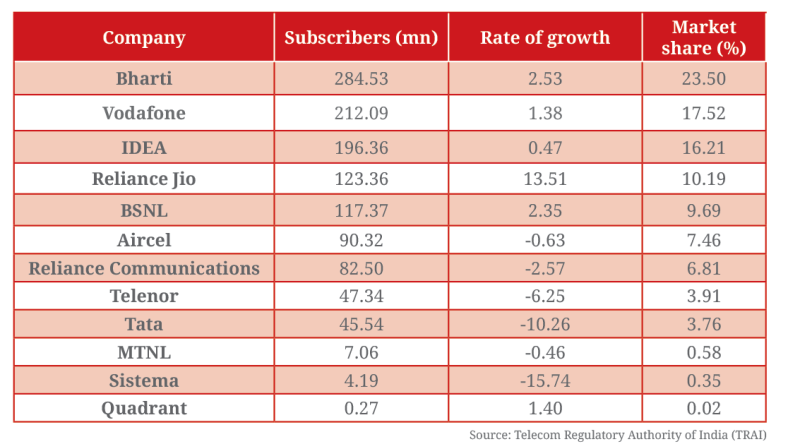

Once upon a time, India hosted well over 100 carriers, with licenses scattered across the country’s 19 telecom “circles” and four metro services. Even today, India hosts 43 licensed broadband service providers, yet the powerful top four providers (Bharti Airtel, Vodafone, IDEA and Reliance Jio), plus government operators BSNL and MTNL, share over 75% of subscribers between them, and with voice revenues slashed by Reliance Jio’s disruptive pricing model, there simply are neither enough subscribers nor ARPU to sustain more than the market leaders plus one or two niche “challenger” players.

Against this backdrop, the disarmament of India’s carriers’ passive infrastructure continues. The majority of carriers had already carved out or monetised their passive infrastructure. Most remaining operator-captive towers, and the majority of operator-owned towercos, have been sold or are now coming to market. The question TowerXchange wish to pose is; if India is to evolve into a pureplay independent towerco model, where control passes from carriers to the investment community, is a fundamental change in business model afoot?

MNOs in India by subscribers (end of Q2 2017)

MNO consolidation: 2+3, 1+9, 5+10, 6+7+11… no that one’s off!

Millions of words have been written about the consolidation of India’s MNOs, an ongoing process destined to reshape India’s mobile market and tower cash flows. When the dust settles, second and third ranked operators Vodafone and IDEA’s combined entity may have stolen market leadership from Bharti Airtel, which itself is defending its position by scooping up the distressed assets of deposed former #2 operator Tata Teleservices.

Despite refutation, rumours of a BSNL+MTNL merger refuse to go away. Meanwhile the rollup of Sistema and Aircel by Reliance Communications (RCOM) was only half finished when RCOM admitted that it would have to shut down its voice services and seek to reinvent itself as a pure 4G play. Amid all this turbulence, indeed the source of much of these troubles, Reliance Jio navigates swiftly onward, its sails swollen by double digit market growth, primarily at the expense of the faltering marginal players, most of whom are closing or consolidating.

When the storm clouds clear, what will be left standing? Bharti Airtel will ride the storm, Vodafone and IDEA will emerge as one entity, as may BSNL and MTNL. But eventually, none of these entities will own, or control, their own towers. Only Reliance Jio will retain that privilege – although even they have leased around half their macro sites from third parties, with most of the balance being city pole sites for infill capacity.

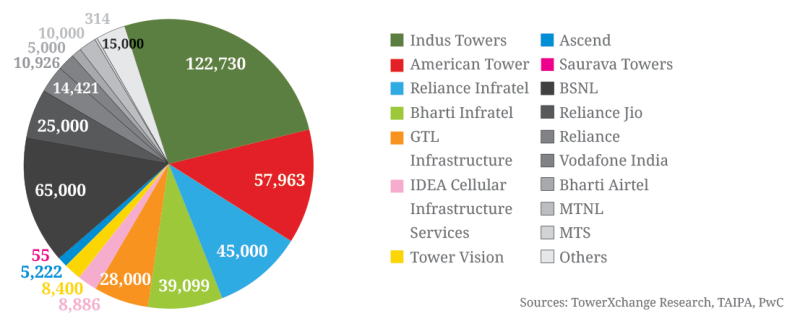

Tower ownership in India today

Implications for India’s towercos

Instead of a dozen customers, many struggling to pay their bills, India’s towercos will be left serving five stronger customers, better able to deploy network capex. While one of the pillars of justification for MNO consolidation has been the efficiencies of network rationalisation, the carriers will find that it is not easy to extricate themselves from 10-15 year leases, while 4G rollout requires densification – what look like overlapping sites today could be welcome capacity tomorrow. But where leases are reaching term, or deals can be struck, expect some equipment to come off towers in the short term.

India’s towercos may not have been able to predict the exact shape of carrier consolidation, but they knew it was coming in one form or another, and they are not as exposed as one might fear. For example, American Tower spent US$1.18bn acquiring a majority stake in Viom Networks, which itself had acquired Tata Teleservices’ towers seven years previously. But American Tower knew they could pull the trigger on the deal precisely because Viom had limited their exposure to Tata Teleservices, which now represents 5% of American Tower’s consolidated property revenue in India, and the towerco has stated that they expect to “fully enforce the average non-cancellable remaining contract terms on the leases with Tata Teleservices.”

While there is increased uncertainty around the merging carriers’ tenancies, Reliance Jio’s continuing rollout will offset any losses, and Bharti Airtel and Vodafone+IDEA will continue to compete with their own 4G programme, to the extent that some tenancy ratio growth may be sustained, particularly since the future of Jio’s third party partner of choice RCOM remains uncertain.

Granted exclusive periods of negotiation to evaluate the acquisition of their towers, both Tillman Global Holdings and Brookfield had ample time to review the financial status of RCOM, and both foresaw the carrier’s uncertain future with sufficient clarity to hold off executing the acquisition of their 45,000 tower carve out Reliance Infratel (aka Towercom). RCOM’s creditors are now faced with the unenviable task of sifting the wreckage of a tower portfolio lacking an anchor tenant. The ~30,000 sites leased to Reliance Jio undoubtedly have value, and there are some other tenants on the towers too, but the zero tenant towers may be worth less than nothing. If the investible towers, particularly those that are fiberised, can be peeled out of the portfolio, they could yet be sold, and could be packaged with the less attractive sites if the price were right. But the formerly mooted US$1.7bn valuation will have to be downwardly recalibrated.

Towers with creditworthy tenants retain significant value in India, as exemplified by American Tower agreeing the acquisition of Vodafone and IDEA’s 19,812 captive towers for US$1.2bn – US$60,500 per tower, which is well above replacement cost in India.

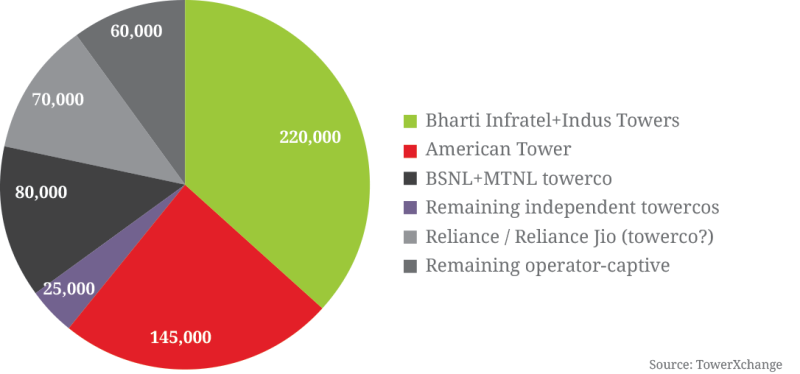

The big prize for investors with an appetite for Indian towers remains the potential merger and balance sheet re-engineering of Bharti Infratel and Indus Towers.Vodafone has openly discussed the prospective sale of their 42% stake in Indus Towers, suggesting a US$5bn valuation.

TowerXchange see the merger of Bharti Infratel and Indus Towers, which operate largely in different circles, as increasingly inevitable, creating a 162,131-tower supergiant into whose gravitational field remaining independent tower portfolios, such as Tower Vision and Ascend, could be drawn. With Bharti Airtel continuing to monetise their own stake in Bharti Infratel, the merger of Infratel and Indus would likely be bankrolled by a consortium of private investors or infrastructure funds, which could ultimately see carrier stakes in the combined entity dropping below an aggregate total of 50%, which would in turn see the company reclassified as a pureplay independent rather than operator-led towerco, perhaps triggering a gradual change in organisational philosophy, of which more in our conclusion.

A close second on Indian tower investors’ shopping list would be the ~65,000 towers on BSNL’s and the ~10,000 towers on MTNL’s balance sheets,, many of which are in unique and highly desirable locations, and which have been minimally leased up to date.

Forecast tower ownership in India in 2020

If investors don’t want to pay the premium buying into Infratel-Indus or BSNL-MTNL towers may require, India also offers turnaround plays to get one’s teeth into. GTL Infrastructure is seeking to enter its next, most important, phase of turnaround by refinancing, easing debts and perhaps in the process settling the issue of Aircel’s unfulfilled network investment obligations (Aircel sold 17,500 towers to GTL Infrastructure back in 2010, but then had many of its licenses cancelled amid the license scandal of 2012, and was unable to fulfil contractual network investment commitments). Indeed the GTL Infrastructure refinancing could include a world’s first - an MNO buying back its towers as Aircel seeks to release itself from the aforementioned obligation.

Turnaround-oriented investors notwithstanding (and any such investors are likely to prefer a roadmap wherein distressed portfolios are “cleaned up” with a view to a sale), TowerXchange sees two, maybe three primary prospective consolidators in India, thus we foresee a consolidation of India’s towers into two to three huge portfolios in the mid term.

The most obvious and active consolidator is American Tower, which has already rolled up Essar Telecom Infrastructure, Viom Networks and the aforementioned Vodafone and IDEA towers. Could an investor like Brookfield or Tillman Global Holdings yet directly acquire a substantial Indian tower portfolio? The challenge is finding an opportunity that is both investible, and for which they won’t simply be outbid by American Tower. Perhaps the most likely tower portfolio within which the big funds could put their money to work is the Infratel-Indus combine.

Conclusion: evolving toward a pureplay independent towerco model

If operator stakes in the Bharti Infratel-Indus Towers axis are so diluted that the MNOs relinquish control, and if American Tower continues to roll up operator-captive towers and towercos in which operators retain a stake, will India’s operator-favourable pricing and contract structure endure?

Outside of China, India offers the lowest tower lease prices in the world. Lease rates are discounted when additional tenants are added to towers. Amendment revenue (fees for overlaying a new network technology onto an existing tower) are effectively non-existent. This all adds up to an operator-friendly business model. If the operators relinquish their stakes in their towers and towercos to investment funds, there may be nothing to stop the new owners from gradually evolving India toward a more typical, commercial, pureplay towerco business model.

TowerXchange see two parallel themes emerging in Indian towers: the continued consolidation of investible towers into two large portfolios (American Tower and an increasingly investor-led Infratel-Indus combine); juxtaposed with a number of tower turnaround plays – continuing the recovery of GTL Infrastructure and “cleaning up” the residual tower portfolios of RCOM and other faltering carriers. Once those turnarounds are complete, expect to see that they also succumb to the gravitational fields of India’s emerging pureplay independent towerco duopoly.