A couple of years ago, the Russian tower market was poised to be restructured by large-scale sale and leasebacks. While those processes stalled, Russia’s independent towercos have thrived, building thousands of sites, particularly urban infill lamp posts, and more recently IBS. But as Russia gears up for the race to 5G, Rostelecom is jockeying for position as a potential 5G infrastructure and network wholesaler. Could we see a Russian equivalent of China Tower – a State-owned infrastructure company?

The Russian mobile landscape

The Russian telecoms players have been under sustained pressure from years of sanctions imposed on Russia following political disagreements over Ukraine and elsewhere. One of the major impacts this has had on the Russian economy is the devaluation of the rouble, which has diminished the purchasing power of Russian MNOs who need to spend USD on active equipment in order to remain competitive.

This has been compounded by an aggressive tariff war between all four Russian MNOs (MTS, MegaFon, Beeline and Tele2) which resulted in the introduction an unlimited data tariff by MTS, which was swiftly matched by their competitors, putting downward pressure on income and margins.

The sanctions have not been all bad news, as although access to western capital has reduced dramatically, many Russian investors with capital at risk abroad have been looking to ‘bring money home’ and invest in domestic assets, despite the political risks in doing so. The Russian banking industry has been shrinking due to the economic climate and unhealthy lending practices, but as a result the banks which remain are much stronger and have a strong appetite to lend to healthy borrowers in Russia, including the big mobile network operators, who are well connected politically and can show strong growth in data consumption in Russia.

Towercos in Russia

Russian Towers

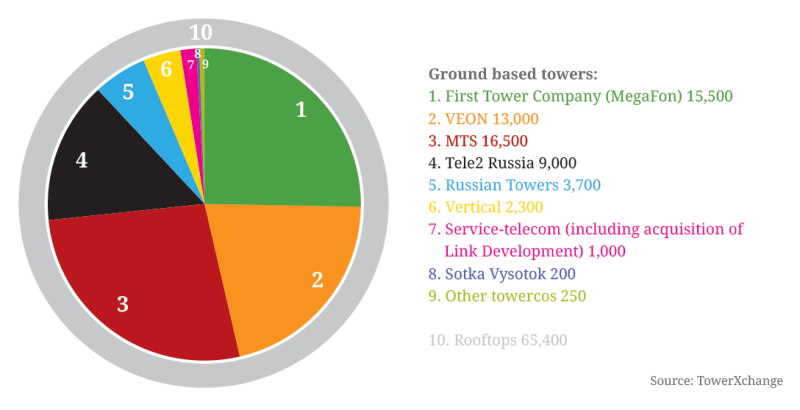

Russia’s most well established and diversified towerco, Russian Towers is achieving impressive organic growth on a national scale, despite the lack of sale and leaseback opportunity in Russia. Russian Towers is building a network which includes lamp posts, electricity grid poles, transport structures and land ownership, they have increased their portfolio by over 500 sites since January 2018, to a total of 3,700 sites, adding the equivalent of 900 new tenants to their structures in 2018 alone, bringing the tenancy ratio over 1.8x.

Towercos in Russia must constantly demonstrate an ability to work faster and smarter, to provide innovative technologies and solutions which will convince MNOs to use them instead of deploying their own infrastructure. Russian Towers have been making good use of a new law which has simplified land access in the Russian Federation, reducing cycle time from nine months to four to five weeks. They have rolled out across the country, with offices in Moscow, St Petersburg, Krasnodar, Yekaterinburg and Vladivostok, and are innovating in DAS and In-Building Systems, including the deployment of iDAS to enable seamless 4G coverage. Working with city administrators to begin implementing Smart City infrastructure, Russian Towers have been able to provide antenna, cabling and fibre for DAS solutions, as well as data rooms designed to accommodate all four Russian MNOs.

Vertical

Founded in 2013 and based in Moscow, Vertical has grown their portfolio to around 2,300 towers in total, taking advantage of Tele2’s roll-out activity in the region for much of this growth. By 2016, Vertical had gained enough momentum to take part in the bidding process for the VEON towers, and remain ambitious to grow in the Russian market.

Service Telecom

The youngest of Russia’s towercos, Service Telecom was founded in 2015 and built around 350 towers in their first year of operations. Also highly ambitious and led by a new generation of business graduates, they hope to shake up the Russian market and capitalise on the potential for rapid growth. Their acquisition of Russia’s fourth largest towerco Link Development in 2017, plus rapid organic growth, has seen Service Telecom build their portfolio to 1,000 towers across two cities.

Local towercos

There are also dozens of smaller towercos active in the Russian market serving smaller urban clusters and with an aggregate of as many as ~1,000 towers.

Estimated breakdown of towers and rooftops in Russia

Russian Mobile Network Operators

MTS

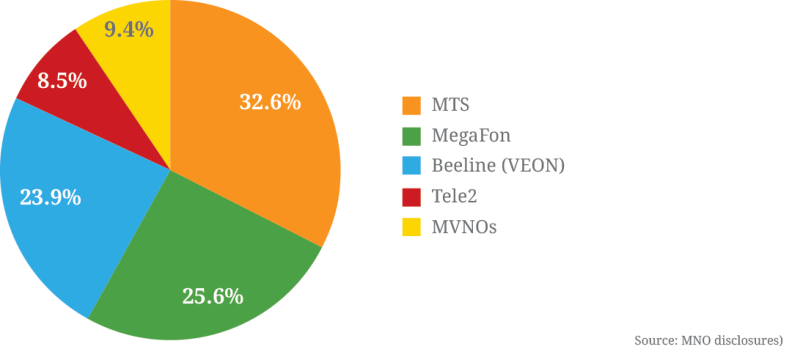

Russia’s biggest MNO, with 32.6% market share, Mobile TeleSystems (MTS) is 49% owned by Vladimir Yevtushenkov’s conglomerate Sistema, with a further 49% of the business listed on the NYSE, where it has been listed since 2000.

With a strong infrastructure across Russia, MTS has shown the least interest in selling towers, but the operator has taken steps in terms of both using third party towers and sharing their own structures. In 2016, Vice-President of Technology and IT Andrey Ushatsky stated that “Our business-model allows us to provide potential tenants with favorable financial conditions. We would also like to announce that for our partners’ added convenience, we have devised a simple contract structure that does not require long-term obligations, additional fees for access to infrastructure, penalties for early termination and other factors that potential tenants will find attractive”. It was believed that MTS would make around 30% of their 16,000 tower portfolio – ~5,500 towers) available for co-location, but there is currently doubt as to whether this operator-captive towerco has yet got off the ground.

MegaFon

Russia’s second largest operator, MegaFon controls 25.6% of market share. Owned by Alisher Usmanov, who has been named both Russia and the UK’s richest person in the past, MegaFon listed 17% of the business on the London Stock Exchange in November 2012, with less than spectacular results.

MegaFon carved out 14,000 towers into ‘First Tower Company’ in 2016, announcing that the towerco could be sold in 2018, although as yet there have been no advisors or bankers appointed to run the sale. Rumours persist that the towerco has had limited success to date in leasing up their towers, in part due to excluding Tele2 from access to their portfolio. MegaFon’s spinning out of their tower portfolio is not their only carve out of assets, as sources claim they have been marketing several of their divisions, including their legal department, to third parties for well over a year.

The biggest development for MegaFon over the last year has been the decision to delist from the London Stock Exchange, a move completed in Q318. Many commentators were not surprised by the move, given Usmanov’s position in Russian political circles, and saw MegaFon’s exposure in the West being seen as a potential weakness for the company.

BeeLine/VEON

Trading under the Beeline brand in Russia, mobile network operator VEON (formerly Vimpelcom) has 23.9% of the Russian market and also operates networks in Italy, Georgia, Armenia, Kazakhstan, Ukraine, Kyrgizstan, Tajikistan and Uzbekistan, Laos, Algeria, Pakistan and Bangladesh. Still 47.9% owned by Mikhail Fridman’s LetterOne investment business, 24.1% of shares are listed on the New York Stock Exchange following the company’s IPO in 1996, and a further 19.7% are owned by Telenor, a percentage which has been reduced significantly from 33%, including through an IPO of 70mn shares (~4%) on the Amsterdam Euronext, following controversies in VEON’s Uzbek operations.

Having carved out around 12,800 towers into National Tower Company, VEON announced their intention to sell their Russian infrastructure to a third party, following a successful sale and leaseback process in Italy with the sale of their Wind towers to Cellnex. As early as September 2016, the Russian press speculated that the successful bidders in the process were incumbent heavy hitters Russian Towers, however the deal came close to conclusion in May 2017 before VEON pulled out. VEON are now in the process of reabsorbing National Tower Company back into Beeline.

Tele2

With just 8.5% of market share, Tele2 is the smallest mobile network operator in Russia, as well as the newest. Launched in 2003 by Swedish Tele2 AB, the company took on its current form in 2013, when Tele2 sold their Russian subdivision to VTB Group, one of Russia’s largest banks, and in 2014 merged with Russian operator Rostelecom, opening up their remit to the whole of the Russian territory and giving access to new markets. The organisation has grown fast, with heavy reliance on third party network infrastructure for that growth, in particular in urban areas.

The other Russian mobile network operators, conscious that they have a strong advantage over Tele2 in terms of network coverage, are keen to lock them out of access to their networks, with MegaFon’s First Tower Company refusing to lease towers to Tele2. Reluctance to enable Tele2 to achieve full nationwide coverage is probably one of the main inhibitors for towers being brought to market, as Tele2 remains competitive on price.

Believed to have proprietary infrastructure of around 9,000 structures, there have been unconfirmed reports that the Tele2 towers are on the market. But with question marks over the quality of the network and Tele2’s position as a potential anchor tenant, as well as misaligned expectations on price, mean there have been no significant developments as yet.

Rostelecom

Rostelecom, Russia’s state telecoms provider, has recently expanded ambitiously into digital services. Owners of Russias fixed line network, they are the biggest fibre owner in Russia, also offering datacentres and digital solutions. Their recently announced ‘Strategy 2022’ sets out Rostelecom’s digital transformation from a telecoms operator into an IT-company, servicing retail, business clients and the Russian Government. Already over 50% of the Rostelecom’s revenue comes from digital and content services, Internet access, pay TV, cloud-based solutions, data centers, cybersecurity and other services, and now they are undergoing significant organisational changes internally to reflect their new focus. Rostelecom is establishing new teams and centres of excellence created to boost key focus areas, such as biometrics, cybersecurity, IoT and smart homes.

Owned by the state-owned Bank for Development and Foreign Economic Affairs and the Federal Agency for State Property Management, this state-owned organisation owns 45% of Tele2, giving it substantial interests in wireless telecommunications infrastructure as well as access to Russia’s broadcast towers.

Rostelecom has also recently announced a joint venture with Nokia called ‘RTC – network technologies’, which will focus on forming ‘a portfolio of innovative, high-tech infrastructural solutions’ around backbone network infrastructure, the network management of data centres, the virtualisation of corporate networks, Internet of Things and next-generation mobile communication networks. Advanced technologies offered by the joint venture will include private wireless networks (P-LTE, P-IoT), certified SDN and SD-WAN networks, infrastructure for IoT and 5G networks, positioning them for playing a critical role in the rollout of next generation technology.

MNO subscriber market share in Russia

5G in Russia

As with the rest of the world, the economics of 5G are still unclear in Russia, and the rollout of 5G infrastructure needs to be driven by a combination of state incentives and support, and visionary infrastructure providers with access to large pools of capital. However, unlike much of Europe, placing antennas on city infrastructure will not be as bureaucratic in Russia, which has recently amended land laws to cut cycles times from nine months to four to five weeks in order to enable new sites to be built more quickly. Further changes in permitting processes could further accelerate roll out of infrastructure in cities.

Although the four Russian MNOs are currently locked in a tariff war, and do not have the capital to build four parallel 5G networks, it’s in the interests of the Russian government to facilitate 5G rollout in order to bring huge economic gains to the country. Indeed, with the U.S., China and Russia all keen to gain the edge in terms of 5G rollout, 5G been compared to a modern-day ‘space race’.

There is a growing sentiment among government stakeholders that the most suitable vehicle for the Russian government to use in order to roll out 5G infrastructure quickly may be their own telephony and digital provider Rostelecom.

Rostelecom: Russia’s answer to China Tower Corporation?

To date, only Rostelecom and MegaFon have access to Russia’s 5G spectrum, with MegaFon trialling 5G in Moscow and St Petersburg in 2018, and Rostelecom doing the same with partners Nokia and Ericsson in different locations.

Rostelecom owns much of the infrastructure needed to support 5G rollout but only owns a handful of high towers, lacking the wireless infrastructure needed for 5G. Their stake in Tele2, which owns ~9,000 towers in Russia, could be augmented to a controlling stake of around 55% through the transfer of assets from Russian banks and insurance companies, which would effectively make Tele2 the mobile wing of Rostelecom, and give them access to towers in Moscow and St Petersburg.

The option which would give Rostelecom national reach, however, would be to acquire the ~15,000 towers which MegaFon claims to be bringing to market, or to do a deal to work collaboratively with MegaFon in order to use their infrastructure. Combining the towers of Tele2 and MegaFon could result in a network of ~24,000 towers across Russia, which, combined with Rostelecom’s existing fixed line network, data centres and infrastructure, would put them significantly ahead of any one of the European towercos focussed on preparing for 5G rollout.

The notion of a state-owned towerco is something to an anathema to most Western tower industry professionals, who operate in markets where infrastructure was mainly sold off in the 1990s and has gained value and scale through market dynamics. However, State ownership of communications infrastructure is still more common than it might appear at first glance: Hungarian Antenna Hungaria was acquired from TDF by the Hungarian government in 2014; the Estonian government owns 51% of broadcast towerco and datacentre provider Levira; The German state owns 32% of Deutsche Telekom, and therefore carve out towerco Deutsche Funkturm; in Turkey, the government has recently established a new towerco PTT Kule with a current focus on high towers but a remit which could encompass much of their 5G infrastructure… and of course State-owned China Tower Corporation (CTC) owns almost twice as many towers than the rest of the world’s towercos combined.

In Russia, there has been a trend towards state capitalism over the last few years, with both the explicit and less obvious renationalisation of assets in a variety of different sectors. As world powers race to rollout 5G and capitalise on the benefits that establishing the first use cases will bring, it may be that Russian government stakeholders are keen to consolidate infrastructure assets in order to help them spearhead a push in this direction.

What will this mean for Russia’s towercos? Just as independent towercos in China still play a vital role despite the presence of CTC, Russian towercos will still be critical in building and deploying smart technologies serving important niches in the market. Russian Towers’ work in building relationships and technologies, as well as diversifying their portfolio, is helping them to future-proof their offering. Besides, if the Russian state did decide to create a towerco it would take months, if not years, to set up.