TowerXchange last analysed the Bangladesh telecom market in 2016, and back then, the Bangladesh Telecommunications Regulatory Commission (BTRC) was already discussing the opportunity to license tower companies in the country, as a mean to improve mobile networks while boosting investments in infrastructure. It took the BTRC two years to complete its mission but back in August 2018, four companies were finally awarded 15-year long licenses to operate as towercos in Bangladesh. In this editorial, we offer our readers an overview of the market and what to expect from the newly launched tower industry.

Back in March 2018, the BTRC issued an RFP for tower companies interested in applying for a license to operate in the country.

The rationale behind the towerco licensing regime was to boost mobile coverage across the country by separating the network and infrastructure businesses and harness the different know-how and skills of MNOs and towercos at their best. In fact, among the limitations for companies interested in the license, they could not have any relations with mobile phone or WiMAX firms in an attempt for truly separate the sectors. Additionally, licensed firms would be required to share 5.5% of their revenue with the Government and pay a 1% fee to the Social Obligation Fund (from the second year of operations).

In terms of ownership, foreign companies interested in applying would need to form a joint venture (JV) with a local entity and own a maximum of 70% stake. Once licensed, tower companies would need to start operating within six months (180 days) of being awarded.

The final goal is for licensed tower companies to own, deploy, manage and maintain most (if not all) of the telecom towers across Bangladesh, which suggests that MNOs could eventually decide (or be compelled) to sell their tower portfolios and divest an estimated total of 30,000 towers spread across the country. The new regime requires MNOs to roll back their existing co-location agreements over a period of five years (by 2023). Bangladesh’s MNOs have shared towers extensively both on a swap and on a commercial basis, with over 6,500 tenancies on third party towers in the country, representing a prevailing tenancy ratio of over 1.2x. In terms of new builds, MNOs will be able to request the approval of the regulator to deploy sites only in the event of towercos refusing to take on the project.

Once the towerco license RFP went out, the BTRC sold 19 application packs and received back eight applications. The companies that applied were AB Hightech Consortium, edotco, TASC Summit Towers, Jamuna Tower, iSON ECT Tower, State-owned BTCL, FTA Bangladesh and BD Tower Business Company Consortium. In order to apply for a license, edotco, which was previously operating in the country thanks to a no-objection certificate (NOC) from the BTRC, created a JV with engineering company Getco Group.

In August, the BTRC selected four companies to be awarded after a “beauty contest” screening process. edotco Bangladesh, TASC Summit Towers, iSON Tower Bangladesh (then renamed Kirtonkhola Tower) and AB Hightech Consortium were selected and had 60 days to pay the license fee of US$2.97mn (as well as the bank guarantee of US$2.37mn and the annual fee of US$593K). Recently, local news outlets reported that to date payments have been being submitted on time but various sources commented that the current fee regime will pose quite a financial burden to towercos.

One of the unsuccessful applicants for a towerco license suggested to TowerXchange that they still hoped further licenses might be made available after Bangladesh’s forthcoming elections.

The MNOs’ side of the story

Discussing the new regime with a local MNO, I gathered that there are positive expectations with regards to the entrance of towercos in Bangladesh, but also several concerns.

MNOs hope that the towercos will be able to bring more operational efficiency in the industry thanks to their specific know-how as well as create cost optimisation opportunities due to the scale of their operations. At the same time, towercos are expected to rationalise the current tower market by creating sharing opportunities as well as through decommissioning of overlapping sites.

At the same time though, there are questions with regards to the capability of the new entities to maintain sites as well as ensuring network availability. A task - one commentator stated - that so far “only edotco has proven capable of.” In fact, the performance of towercos in Bangladesh will have a direct impact on the QoS offered by the MNOs, who have in turn their own license obligations towards the BTRC.

Operators were left quite discontent by the previous BTRC’s move that introduced the so-called Nationwide Telecommunication Transmission Network (NTTN) operators in the country. NTTN operators are basically service providers to MNOs, mainly involved in laying fibre networks across urban centres and the BTRC licensed five companies (Fiber@homes, Summit Communications Ltd. and State-owned Bangladesh Railway, Bangladesh Telecommunications Company Ltd and Power Grid Company of Bangladesh). NTTN operators and MNOs in Bangladesh have so far failed to find the optimum tactics to operate and the whole experience has been quite dissatisfying for both parties, according to various sources. So it’s perhaps to be expected that MNOs have welcomed towercos with lukewarm enthusiasm.

Among the greatest concerns of the operators are the threat of towercos overpricing their services. A concern that, according to one of the country’s towercos “has no foundation. As the presence of four towercos, whose tariffs have to be approved by the BTRC, should ensure significant competition across Bangladesh.” Another fear is that towercos may fail to deliver high standard service and still being “protected by the BTRC, which could hamper smooth network rollouts and force [MNOs] to agree to deals that are not commercially viable.”

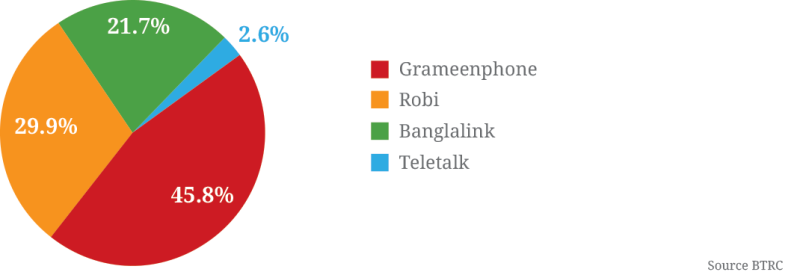

MNOs market share - August 2018

Bangladesh and the 4G era

All of the above is particularly relevant for MNOs as they have just recently started to launch their 4G networks across Bangladesh. In fact, the BTRC issued four licenses to launch and operate 4G services back in February this year. Two of the MNOs, Grameenphone and Banglalink, applied for new frequencies in the spectrum auction, while Robi and Teletalk are currently utilising existing frequencies to offer 4G services.

4G is a priority for MNOs as the country is actively working to bridge the digital gap via initiatives such as the Vision 2021 and Digital Bangladesh to offer better mobile services to its growing number of subscribers. According to a recent country report by the GSMA, Bangladesh reached over 85mn unique subscriptions (or half of the population) by the end of 2017. With 1.7 sim cards per subscribers, the total number of mobile connections by year-end was over 145mn.

In spite of the growing number of subscribers, the GSMA states that mobile internet access is still low at 21% in 2017, and it suggests that “Prioritising efforts that target barriers to adoption – including network quality, spectrum availability at affordable prices, taxation, affordability of services, lack of usability and skills, and local relevance – will be key to closing the digital access gap.”

The divestment of tower portfolios combined with the outsourcing of infrastructure deployment to towercos could sensibly and relatively quickly boost network investments. Additionally, by reducing their own capex, MNOs could reduce prices and make access to mobile services more affordable.

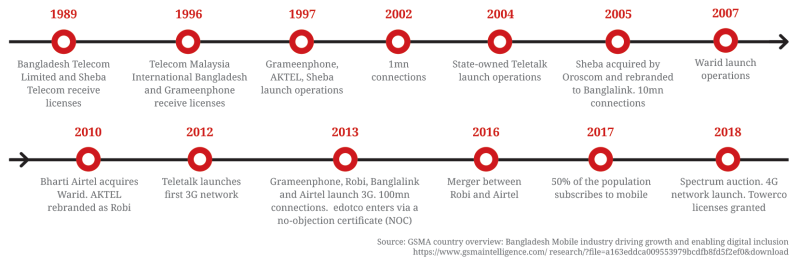

A timeline of the Bangladeshi mobile industry

The tower landscape: what to expect

As seen above, the move to rationalise the tower industry is part of a bigger picture aimed at further digitalising Bangladesh. With 30,000 towers, the tower network is extensive and in need of consolidation. In fact, one of the first tasks towercos might get involved in is the decommissioning of under-utilised towers on one hand while incentivising MNOs to share existing assets to avoid duplicate sites (and free up unneeded land to be repurposed).

In spite of the need for a more rational tower landscape, Bangladesh does present considerable build-to-suit opportunities for towercos, with several BTS plans being discussed by MNOs and towercos. This will also affect any sale and leaseback deal that might be on the cards, as the valuation of a portfolio with duplicate / naked sites might not be immediately attractive for the seller. But as MNOs might be incentivised now to divest their portfolios, the first ones to sell might get a better deal as towercos might be keen to scale their portfolios and start pushing for infrastructure sharing.

One of the first portfolios to come to market might be that owned by Banglalink (approx. 9,000 towers), which first expressed its interest to divest its assets back in February 2017.

While towercos might not need to build thousands of towers across Bangladesh like they are deploying elsewhere across Asia, the requirements of 4G networks still present considerable business opportunities for the newly licensed entities. Refurbishing and strengthening old sites to give them structural capacity for co-locations, while contributing to cell site densification in urban areas via new site typologies, should be at the top of the list of priorities for towercos in Bangladesh.

Bangladesh’s newly licensed towercos

edotco Bangladesh entered the market in December 2013, via the transfer of ownership of Robi’s towers for US$145mn. To date, edotco owns and manages more than 9,821 sites in the country and has been operating thanks to a no-objection certificate (NOC) while waiting for the licenses to be issued. With edotco Group as foreign shareholder, the firm partners with Greencon Tower for its local shareholding.

TASC Summit Towers is the largest fibre operator in the country and have so far connected hundreds of towers to its network. One of the towerco’s foreign shareholder, TASC Towers, is mainly active in the Middle East (Jordan, Lebanon and UAE) but has been eyeing opportunities in other regions such as Africa too. TASC Summit lists Summit Corporation Ltd. as local partner and Global Holding Corporation Private Ltd. as additional foreign shareholder.

iSON Tower Bangladesh (now renamed Kirtonkhola Tower) is part of the iSON Tower group, with operations in Africa, India and the Middle East where they offer co-locations, network deployment as well as manage with license to lease services. iSON’s local shareholder is Confidence Tower Holdings while ECP Tower Singapore is its foreign partner.

AB Hightech Consortium is owned by various local shareholders including ADN Telecom, AB Hightech International, ZN Enterprise, Synergy Logistic and Orange Digital and by foreign shareholders China Communications Services International and Changshu Fengfan Power Equipment Company.

Further reading

http://www.amtob.org.bd/home/industrystatics

https://www.gsmaintelligence.com/research/?file=a163eddca009553979bcdfb8fd5f2ef0&download