Airtel Africa works with all four major African towercos, operates in 14 countries and recently passed 100mn customers. Ahead of his participation at Meetup Africa on the 8th October, TowerXchange sat down with Razvan Ungureanu, Chief Technical Officer at Airtel Africa, to discuss the future of Airtel Africa’s towers, and for Razvan to challenge towercos to become more customer-focused and get ready for the demands of the 5G-era in Africa.

Razvan is speaking on our keynote panel discussion "What comes next for Africa’s mobile networks?" at Meetup Africa, 8-9th October, in Johannesburg, click here to find out more.

TowerXchange: Please introduce yourself – what is your background, how did get into telecoms and what is your current role and responsibilities?

Razvan Ungureanu, Chief Technical Officer, Airtel Africa:

I am 51, born in Romania and I am married with four kids. I started working in telecoms in 1992 in Romania. I spent five years doing design work in telecoms but since 1997 I have worked continuously for mobile network operators. I began working with Orange in Romania where I helped launch their network. Afterwards I moved to the Netherlands, still with Orange, and stayed 14 years there improving and optimising their network.

I was promoted within Orange to CTIO, and moved to the Caribbean to take care of the Dominic Republic. In 2014 Orange sold out to Altice, it was a profitable operation, but geographically wrong for Orange at the time. I took the chance to move to Digicel and stayed in the Caribbean. I covered 29 countries and 14mn customers as CTO.

After two years at Digicel I got a call from a headhunter for a challenge in Africa. They showed me the Airtel Africa project, I met with Sunil Mittal (founder and chair of Bharti Enterprises) and Christian de Faria (then Airtel Africa CEO), and I thought yes, what an opportunity: 20,000+ sites, 100mn customers. And here I am in Africa now, three years in.

Total base station locations

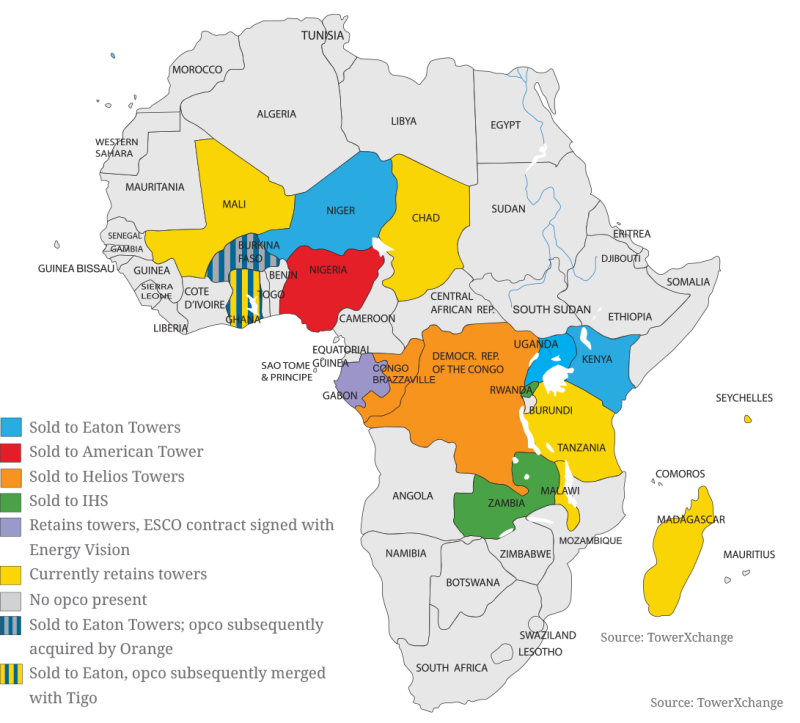

TowerXchange: Could you describe Airtel’s footprint in Africa, where its 100mn customers live and summarise your history of tower transactions and relationships with towercos across the continent?

Razvan Ungureanu, Chief Technical Officer, Airtel Africa:

Airtel is now number two worldwide based on number of customers, considering India and Africa together, after China Mobile. Airtel Africa is active in 14 countries across sub-Saharan Africa, on over 20,000 sites. Last month we reached 100mn customers. One reason I took this role was the size and span of the network. We have the Seychelles where we have 75 sites, and we have Nigeria were we have over 10,000 sites.

We work with all four major African towercos in different markets. The relationship differs depending on the contract and historical relationship in each market. In some areas we have historical lease agreements from when we sold our towers, and in others we lease space where we need it.

We are an asset-light company and we want to stay that way. Our focus is to put together the pieces of the puzzle and focus on delivering for the customer. So that includes the right marketing, the right pricing, competing in different environments, and working with the right towercos who have assets where we need them for our network.

And towercos are the experts on tower management. The difference in asset management between towerco-owned towers and MNO-owned towers is enormous. An MNO might have one or two people who are experts in cell site power management, but at a towerco everyone cares about power. You should give the job to the one who knows best.

Airtel’s tower ownership and transactions across its 14 African markets

TowerXchange: So you would say you were generally pleased with the service you receive from your towercos?

Razvan Ungureanu, Chief Technical Officer, Airtel Africa:

Of course, but there is another side of the coin, where I wish towercos were more customer-focused. There can be a tendency for towercos to only care about a site being down inasmuch as it affects their SLA commitments. I worry there is an element of “box ticking” rather than a real customer-focused dedication to keeping the lights on.

In one market, there was a period of security issues which caused sites in affected areas to go down. Our towerco pointed to our Master Lease Agreement and said they were not responsible if a tower went down due to security issues, that it was outside the scope of the agreement and we would have to wait. But if you decide to operate in Africa you can’t act like this.

Sure there was a clause in the contract, but that doesn’t mean you are doing the right thing and it doesn’t mean you are hitting your SLA if you are excluding long periods of downtime. You can introduce specific security measures, you can refuel the site, you can work outside of the box to help your customer.

So there is a tendency to hide behind the contractual clauses rather than delivering what the customer needs. Contracts cannot specify everything, so the towercos need to show more flexibility. SLAs are generally measured by power availability but at some sites I receive 44V where I need 48V. Should that site count as up or down? At 47V my equipment can go down, so what exactly counts as uptime needs addressing too.

Overall I am pleased to work with towercos in Africa, but similar to working with managed services providers you have to manage your relationship and ensure the correct governance is in place.

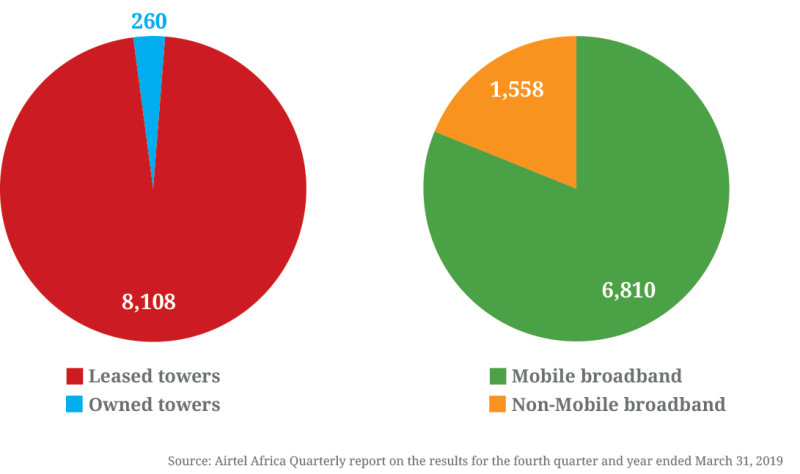

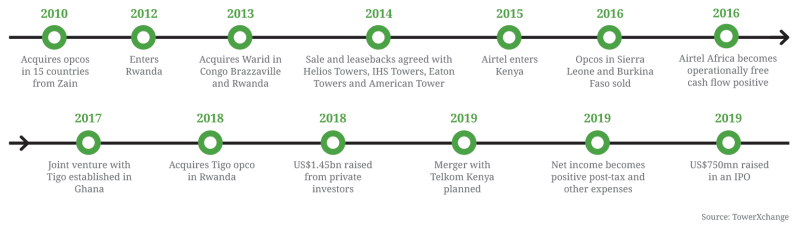

Airtel’s tower transactions in context

TowerXchange: Congratulations on raising US$750mn in Airtel Africa’ IPO in June. What was the rationale for the Airtel Africa IPO at a group level, how does it support your strategy in Airtel Africa’s 14 markets?

Razvan Ungureanu, Chief Technical Officer, Airtel Africa:

Since 2010 Airtel Africa has been making a huge investment into Africa, and we have cumulatively invested more than US$1bn. So with that investment we have accumulated a large stock of debt. Mobile network operators need to be able to raise debt to invest in their networks, it is a capex-intensive industry and the IPO was important to allow the company to create leverage in the future. If you can’t raise debt then you can’t invest in your network, you lose coverage and you can’t compete, so an IPO was always a key milestone for us.

TowerXchange: A key part of Airtel Africa’s strategy is to “Win with network” by expanding your network footprint and the total number of 3G and 4G sites – what can you tell us about new 3G sites and 4G overlays for the rest of 2019 and into the future?

Razvan Ungureanu, Chief Technical Officer, Airtel Africa:

Actually you would be surprised by the degree we are already running a 3G and 4G-ready network. Across all our markets, 80% of our sites are 3G capable and 50% of our network is 4G-ready. By the end of 2020 98% of our sites will be 3G and 80% 4G.

Airtel is putting 4G at the centre of our business development strategy. There is huge potential and you need the network in place to capture that potential. As soon as you launch 4G you see data usage grow, ARPUs improving and improvement in local economic performance.

We have 4G live in all 14 countries. In Uganda we have reached 100% network for 4G. We are being aggressive in Nigeria also, with 6,000 sites LTE giving us the biggest LTE network there. We are really fighting it out with MTN. But it isn’t just the flagship markets, we also have 4G live in Niger and Chad. At the moment we are just covering the capitals, but 60-70% of mobile traffic is in the capital, so even a limited 4G roll-out there is servicing most of the current demand for it. And we will go into rural areas later on as well.

The “Win with network” element of our strategy isn’t just about towers, or even the radio side and transmission. Some of our African markets still face considerable difficulties in connecting to the outside world, international connectivity can still be very expensive. We need a sustainable way to connect to the outside world before it makes sense to go for 4G. Africa is a large continent, without the fibre backbones we take for granted in North America, Europe or Asia.

Fibre in the ground is very important and by 2020 we will have 40,000km of fibre in Africa. We co-invest in a lot of fibre around Africa but it remains a work in progress. But we believe that the potential of Africa is still not fully developed and fibre will be an essential ingredient in realising that potential. The big difference versus Europe or Asia is that people only use their mobile phone, it isn’t just home internet or landline phone, but a replacement for radio, TV and news too. We need the unlimited capacity provided by fibre.

Airtel Africa in Nigeria

TowerXchange: Another areas of focus for Airtel Africa is “Win with cost optimisation” something towercos have been working towards for many years, what is your cost optimisation strategy for your passive telecoms infrastructure?

Razvan Ungureanu, Chief Technical Officer, Airtel Africa:

I have two types of contracts, one for towers we sold and another for towers we rent as required and we have more power to negotiate. If we’re in a contract to stay on a particular tower there isn’t much I can do to optimise those costs.

In fact, because of Airtel’s modernisation and investment in combined 2G/3G/4G sites we can see existing sites become more expensive as we add to tower loading and add to power demand. On the other hand, modern base stations and new equipment can be more energy efficient, so overlaying new technology can actually have a positive effect on our power usage.

Where we can control costs, I have a couple of key approaches to controlling cost. Firstly we need to control our systems and tighten up any financial leakages by monitoring and controlling costs and inputs. Secondly, once we have the basic controls in place, we will look into investing in solar, hybrid power, batteries or experimenting with other types of fuel. But for the moment we want to focus on the basics.

Airtel Africa in East Africa (Kenya, Uganda, Rwanda, Tanzania, Malawi, Zambia)

TowerXchange: When American Tower completes its proposed acquisition of Eaton Towers, Airtel Africa will be responsible for 52% of ATC EMEA’s revenues, do you see your relationship with your main towerco changing? What can you tell us about Kenya and Uganda where there will be country towercos merging?

Razvan Ungureanu, Chief Technical Officer, Airtel Africa:

In smaller markets like Kenya and Uganda we are pleased to see some consolidation. In Nigeria, with around 30,000 total towers, you can see how the country can support more than one towerco, but not in smaller countries.

In Kenya, for example, Safaricom has a large portfolio and their network is dominant. With the merger of Airtel and Telkom it wouldn’t make sense to have two towercos offering us towers, so I see the consolidation as good news. A healthy ecosystem where everyone can make money is better for everyone.

In terms of next steps, being a major customer for American Tower will give us leverage, but it also gives American Tower leverage over us. What happens next depends on how the acquisition and new relationship plays out. What I hope is we end up in a collaborative partnership and continue engagement in that manner.

Airtel Africa in Rest of Africa (Niger, Gabon, Chad, Congo Brazzaville, DRC, Madagascar, Seychelles)

TowerXchange: Appreciating you can’t divulge specifics, what are the factors you will evaluate when looking at potential tower sales in the six markets where you retain your towers (Chad, Gabon, Madagascar, Malawi, Seychelles and Tanzania)?

Razvan Ungureanu, Chief Technical Officer, Airtel Africa:

In some countries regulatory rules do not make a sale and leaseback possible, and we have to respect the laws of the country. But there is no asset which is not for sale, depending on the price being offered. Given the regulatory context, if our towers are not sold it will be because we haven’t been offered the right price yet.

Towercos needs to be separate from MNOs to work effectively, otherwise there is a conflict. You find “stability issues” preventing sharing or towers are simply “unshareable” because of “power issues.” An independent towerco is looking for reasons to say “yes” not “no.”

If we were to divest our towers we would handle that internally, we have a special department called Merger & Acquisitions that can take care of any tower sale. We worked with banks on our IPO of course, but we have the capabilities internally to handle a tower sale.

Airtel Africa timeline

TowerXchange: The end of May saw a request for expressions of interest in a sale and leaseback of your 1,400 towers in Tanzania. What can you tell us about the rationale for the potential sale and how its completion would help your operations in Tanzania?

Razvan Ungureanu, Chief Technical Officer, Airtel Africa:

The tower sale is part of our strategy, and it is something we would very much like to go ahead if the price is right. I cannot go into details, as you understand, but we have very good reasons for proceeding with the sale and leaseback in Tanzania now. The situation of Airtel Tanzania has been clarified following the last transaction with the government taking a 49% stake. Our situation has become much clearer.

TowerXchange: What plans does Airtel have for increased energy investment? How widely deployed are hybrid and renewable energy systems?

Razvan Ungureanu, Chief Technical Officer, Airtel Africa:

We are beginning to invest in hybrid solutions more seriously when gensets need replacing. Renewables are not a major area of spending at the moment, solar is the only technology we are experimenting with.

Solar works well on 2G sites, but now we are deploying 2G/3G/4G on sites and we need a new solar solution with more power. A 2G site will consume 1kW but with new technology overlays the sites pull 2kW and above which requires a lot of space. We are also worried about maintenance of solar sites, often they are isolated and there is nobody there to wash them and so their efficiency is decreasing all the time. Then you have the theft of the panels and the need to protect them.

We still have a lot of diesel gensets and it makes no sense to replace them. In a number of countries we are still managing our power and as a need arises we are replacing our old gensets with new technology, but we have no specific replacement programme for our diesel assets. Remember, our main investment is still in the active part of the network and not the passive part.

We are looking at hybrid systems that combine diesel gensets with batteries and automatic systems that switch intelligently. We are also doing lots of active monitoring of the systems, monitoring the batteries, fuel levels and all that.

Revenue per site per month (US$)

TowerXchange: Has Airtel’s ESCO partnership in Gabon met your expectations? Do you continue to see ESCOs as a viable complementary partner to towercos in markets where you have yet to divest your towers (Chad, Gabon, Madagascar, Malawi, Seychelles and Tanzania)?

Razvan Ungureanu, Chief Technical Officer, Airtel Africa:

We started working with Energy Vision in Gabon because we wanted to keep our options open for a future sale of the towers, but didn’t want to continue managing the energy. We currently have no plans to extend this model to other markets because typically towercos don’t like to acquire towers without also taking over control of the energy assets.

My hope for ESCOs is that they begin to go beyond servicing just MNOs. ESCOs need to think about minigrids and about selling energy to other customers. We would benefit from better pricing and a more stable supply if we were one of many customers. There is a huge need for energy in Africa, MNOs are served, but there’s a much bigger demand ESCOs can fulfil.

Airtel Africa in numbers

TowerXchange: Please summarise your vision for the future of Airtel Africa and the tower industry.

Razvan Ungureanu, Chief Technical Officer, Airtel Africa:

Airtel Africa’s future is as a 5G operator across all of Africa. In three years’ time 5G will be live across all of our network and I am not sure towercos are ready for that. But Airtel Africa needs them to be ready.

Simply put, the ecosystem readiness is not there. The towers are not ready for the extra power consumption, wind load increases, weight, and the pressure of connecting the towers to fibre. 5G will require a big programme of investment in fibre backhaul as well as tower upgrades, and African towercos are still lagging in provision of fibre to the tower.

In my view tower stability and structures are not ready for all the extra equipment which will be installed in mass 5G roll-outs. Antennae will be larger when we start using Massive MIMOs, wind load will increase and power demand will jump. For energy production, there are still too many failures, fuel delivery is still too irregular and theft remains a problem. The industry is improving, but behind the curve required to deliver the revolution in connectivity Africa needs.

Towercos are still operating as if we remain in a 2G world, but the fundamentals of the business need rethinking. If the tower industry doesn’t deliver then we will have to develop our own strategy. I don’t want to be back in the macro tower game, but if I need a 20 meter pole in a city to connect a hotspot then maybe it is possible to do that without a towerco. Towercos have to move towards offering IBS, DAS and small cells, as in the United States, but all of this is still too limited in Africa. And it may be that 5G will see RANsharing becoming more widespread, and they have to be ready for that too. Airtel Africa has ambitious plans for network investment in Africa, and I hope the tower industry can support us in achieving them.

Razvan is speaking on our keynote panel discussion “What comes next for Africa’s mobile networks?” at Meetup Africa, 8-9th October, in Johannesburg, click here to find out more.