TowerXchange draws some insights on what the Eaton Towers acquisition will mean for American Tower from our own research and notes from Nick Del Deo, Senior Analyst at MoffettNathanson LLC; Spencer Kurn, Communications Services: Analyst – Towers & Infrastructure at New Street Research; and Jonathan Atkin, Managing Director at RBC Capital Markets. The deal further increases American Towers’ scale and diversifies its holdings further, gaining further exposure to growth markets in the developing world while developed world prospects slow.

If you would like to know more, Eaton Tower’s CEO, Terry Rhodes will be taking part in TowerXchange Meetup Africa, in Johannesburg, on October 8-9th, click here to register or email Anna Mayhew at amayhew@towerxchange.com for more details.

A positive reception

As TowerXchange’s earlier Deal Analysis details, on the 30th May American Tower announced that it planned to acquire Eaton Towers for US$1.85bn. That valued Eaton Tower’s sites at $336k each. These 5,510 sites will be added to the 170,000+ towers already owned by American Tower when the deal closes, which is expected before the end of Q4 2019, subject to the customary conditions precedent and regulatory approvals.

Breaking down the revenue and lease terms, Jonathan Atkin, Managing Director at RBC Capital Markets discusses says “the approximate tower count/revenue mix is ~660 Burkina Faso (15% of revenues), 1,375 Ghana (22% of revenues), 1,320 Kenya (24% of revenues), 660 Niger (13% of revenues), and 1,430 Uganda (26% of revenues). The weighted average remaining tenant lease term is over six years and the weighted average remaining ground lease term is over eight years. The land owners are generally mom-and-pop entities, similar to other markets.”

Nick Del Deo, Senior Analyst at MoffettNathanson LLC called it an “entirely sensible deal for American Tower.” This sentiment was echoed by Spencer Kurn, Communications Services: Analyst – Towers & Infrastructure at New Street Research, saying American Tower is “acquiring ~5,500 towers across five countries in Africa from Eaton Towers…we estimate the transaction to be ~1.5% accretive to AFFO per share. This is a solid deal for AMT: it will drive higher organic growth for the overall company, increase scale in three of their existing African markets, and of course be financially accretive.”

American Tower share price

Revenue potential

On aggregate the deal expands American Towers EMEA footprint substantially. Nick Del Deo says “This deal increases the size of American Tower’s African revenues by over 40% and its EMEA revenue but about one third.” In his exclusive comments to TowerXchange, Terry Rhodes said that the deal’s value was secured on proving profitable growth in Eaton’s portfolios. Jonathan Atkin is reassured by the security of Eaton’s revenue too: “About half of Eaton’s revenue is either USD-denominated or pegged to the EUR, helping to mitigate but not eliminate (country) risks.”

About half of Eaton’s revenue is either USD-denominated or pegged to the EUR, helping to mitigate but not eliminate (country) risks – Jonathan Aktin, RBC Capital Markets

Atkin also said he believed American Tower “has underwritten the transaction with the expectation of seeing a low-double-digit property revenue CAGR, ranging by country from very high-single to low-double digits…the Eaton portfolio saw >20% organic revenue growth in recent years (across all five of its markets), tapering to an aggregate rate of roughly mid/high-teens during the current year, based on our discussions with industry contacts. We understand Eaton has been able to lower its unit build costs over the last several years from initially ~US$130k to US$80k, resulting in a shorter payback period on initial investments, especially in cases where BTS projects attracted more than one tenant.”

Scale and scope

The Eaton deal concentrates some risk for American Tower and diversifies it away from others. You can’t miss the concentration of revenue from Airtel Africa to be created by the deal. But Eaton Towers is quite different from Viom Networks, which American Tower bought at a much lower cost per tower because of the high risk of consolidation and churn in India. As Nick Del Deo notes Airtel Africa “has recently raised equity to reduce debt and, per press reports, is considering an IPO to further improve its capital structure. American Tower already does business with Airtel Africa in three of the acquired markets (Ghana, Kenya, and Uganda) and is presumably comfortable with the outlook for this customer.” And as Jonathan Atkin notes, concentration in revenues from multi-country operator Airtel Africa also diversifies revenue sources away from Nigeria, balancing out American Towers’ geographic exposure.

The logic of towerco deals becomes very apparent when looking at a company of American Tower’s scale, as Spencer Kurn explains “Tower M&A tends to be positive for AMT (and other tower companies) because it drives a virtuous cycle of compounding returns. The transactions tend to be accretive to both organic growth and AFFO per share at the outset, thereby giving tower companies more scale and capacity for additional deals, which also tend to be accretive and provide more capacity for more deals, and so on. While we have been skeptical of AMT’s acquisitions in India for quite a while, we think this deal in Africa is a step in the right direction.”

M&A tends to be positive for AMT (and other tower companies) because it drives a virtuous cycle of compounding returns. The transactions tend to be accretive to both organic growth and AFFO per share at the outset, thereby giving tower companies more scale and capacity for additional deals, which also tend to be accretive and provide more capacity for more deals, and so on – Spencer Kurn, New Street Research

Synergies

With consolidation in three markets, the deal is expected to produce some significant cost savings in tower management. Jonathan Atkin suggests he “expects to see some expense synergies in the context of its African business based on its existing operations in the region. For context, American Tower already operates ~2,300 towers in Ghana, ~700 in Kenya, and ~1,500 in Uganda.” As MoffettNathanson’s Nick Del Deo notes, the deal “allows for meaningful SG&A efficiencies…the company noted it expects to bear incremental SG&A of about US$10mn annually, or just 4% of revenue, for these towers. To put this in context, the SG&A burden for its EMEA business in aggregate is about 10% of revenue. The tower business is known for its significant operating leverage and this is a case in point.” Some reduction in headcount is certain, but TowerXchange would add that Eaton Towers already had a relatively lean structure, employing only 200 people, while regulators often condition considerable reemployment of local staff in merger approvals.

The valuation

The EBITDA multiple paid for Eaton Towers’ sites was 13.2x, which was lower than the 17-18x paid for its South African assets previously by American Tower. Eaton Towers used a “locked box” on its December 31 2018 results to secure a 13.2x multiple, but confident of profitable growth in its operations the multiple on current EBITDA will be lower when the deal closes later this year.

Nick Del Deo thought the price per tower was noticeably higher than other tower deals in Africa, but the multiple was in a similar region. He remarked it was “lower than the ~16.7x American Tower paid for Airtel’s Nigerian towers in 2015.” And that several “publicly traded emerging market towercos trade in this general range as well.” Jonathan Atkin explained the difference in multiple between South Africa and Eaton’s five current countries by differences in American Tower’s cost of capital: “The discrepancy in multiples reflects the differing country-risk profiles (South Africa is the lowest WACC market in AMT’s African portfolio) and what we believe, based on our discussions with industry contacts, to be a nonmarketed deal in this week’s announced transaction.”

Over the past year, (Airtel Africa) increased its number of towers by 1,300, from 19,700 to 21,000, with essentially the entire change attributable to leased towers, which are now 16,600 of the total – Nick Del Deo, MoffettNathanson

Multiple arbitrage?

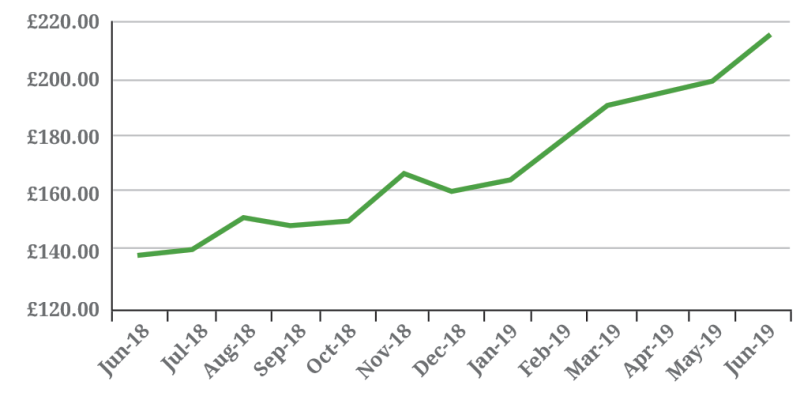

American Tower’s share price closed at US$204.68, up 1.7% on the 31st May, and it was trading at US$214.68 on the 19th June. And as discussed analysts expect the deal to be about 2% accretive to adjusted funds from operations per share. There could also be a multiple arbitrage because of American Tower’s digestive capacity for smaller (but still substantial) towercos. With a US$1.85bn purchase price versus American Tower’s US$116bn enterprise value, investors may scale up Eaton’s towers to a similar multiple to those already owned by American Towers, as described in a note by Jonathan Atkin. However, as illustrated above there is enough revenue upside, synergies and diversification benefits to make this a great deal for American Tower in its own right.

What does it mean for the future?

American Tower cannot acquire Eaton Towers without attention turning to Helios Towers and HIS Towers. Spencer Kurn suggests “it could pave the way for more (bigger) deals in Africa in short order. IHS Towers and Helios Towers, with ~20K and ~7K towers, respectively, may be looking to sell after unsuccessful IPO processes last year. If AMT can strike deals with these companies at similar terms, it would be positive for the equity.” TowerXchange’s own analysis suggests that based on Eaton’s multiple, both Helios and IHS could achieve similar valuations to those sought at potential IPOs last year.

Comparing Eaton’s December 31 2018 EBIDTA of US$140mn and American Tower’s 13.2x multiple on that might give us the best indication of IHS Towers and Helios Towers’ potential valuations. Eaton Tower’s EBITDA margin of 58% (US$150mn EBIDTA versus US$260mn revenue) is higher than the 52% reported by Helios Towers, but lower than the 67.5% reported by IHS Towers on their 6,597 bond-financed Nigerian towers (effectively a snapshot of just 27% of the IHS’s towers). A 13.2x multiple would therefore value Helios Towers at US$2.576bn, a valuation that puts Helios close to, but below, the US$2.8bn they reportedly sought when exploring a potential IPO in 2018. Using the 13.2x multiple on the publicly available IHS figures and adjusting for their scale generates a valuation of US$10.4bn, similar to the US$10bn mooted when IHS explored an IPO. See the TowerXchange Deal Analysis for a full breakdown of the Eaton Towers deal implications for IHS Towers and Helios Towers.

For American Tower, the deal also solidifies a long-standing relationship with Airtel Africa. Airtel Africa has already embraced tower leasing rather than ownership and only retains towers in five of its markets. “Over the past year, (Airtel Africa) increased its number of towers by 1,300, from 19,700 to 21,000, with essentially the entire change attributable to leased towers, which are now 16,600 of the total,” according to Nick Del Deo. With this deal closed, American Tower is in prime position to acquire any further African towers which come to market.

If you would like to know more, Eaton Tower’s CEO, Terry Rhodes will be taking part in TowerXchange Meetup Africa, in Johannesburg, on October 8-9th, click here to register or email Anna Mayhew at amayhew@towerxchange.com for more details.