TowerXchange are delighted that Analysys Mason has kindly agreed to take over our data collection and utilisation working group. The working group emerged from several successive round tables at past TowerXchange Meetups, initially focusing on remote monitoring systems, then site management and asset management systems, before combining these areas into an holistic discussion of the flow of data from sites into repositories and visualisation platforms. Contributed by Caroline Gabriel, a Principal Analyst at Analysys Mason, this article combined insights gleaned from several vendor and towerco interviews, and from the data collection and utilisation working group meeting moderated by Caroline at the TowerXchange Meetup Europe, April 2019.

The newest TowerXchange working group is concerned with one of the most challenging issues in the industry – data collection and utilisation. At the group’s last meeting in London, a lively discussion highlighted some common concerns for many towercos and their software suppliers.

In partnership with telecoms research and consulting firm Analysys Mason, TowerXchange has been conducting interviews with many stakeholders – towercos and suppliers of site management and other software. The aim is to understand the most pressing concerns and objectives to improve data usage and business intelligence, and to start to formulate a framework of best practice.

Initially, a report will be produced outlining the key challenges and solutions, which will be discussed and refined during the working group meeting at the TowerXchange Meetup Americas in Boca Raton, Florida on July 9-10. Then there will be an ongoing process of research, discussion and exchange of ideas, resulting in a rich base of case studies and recommendations on which the members can draw to support their own data initiatives.

There is a gulf between aspiration and real world data usage

The first round of research and interviews revealed that there is a deep gulf between aspiration and real world practice for many companies, and the impact of that on the business will become more serious as challenges multiply. MNO consolidation and the narrowing scope for greenfield expansion will make it critical for towercos to operate as efficiently as possible, harnessing all the information from their sites to support intelligent decision-making.

And as new network architectures proliferate, many towercos are considering expanding their business models to cover small cells, edge computing, fibre and added-value services – but with so many additional elements to manage, rich and up-to-date data inputs will be even more essential.

On the aspirational side, the attendees at the working group meeting agreed that there were several areas in which advanced data collection, analysis and visualisation would help them be more competitive and efficient. These were:

- Enabling of near-real time response to problems or to changes in network behaviour, to pre-empt issues which might have a negative business impact.

- Advanced analytics to give towercos the same depth of understanding of their assets that the MNOs often have of their equipment. That would support better decisions in many areas, from M&A to negotiation with tenants. It will also be important to support SLAs with tenants.

- Moving towards predictive capabilities, in terms of planning site additions and upgrades, or for maintenance. This would increase reliability of the infrastructure while reducing site visits and costs.

- Enabling a more automated, reliable way to share data about assets with an increasingly complex set of partners, in an industry where sharing, consolidation and co-investment with new stakeholders are on the rise.

- Eventually, applying future analytics techniques like machine learning to improve planning, operations and transactional decision still further.

All of these will become increasingly important to support the need to combine high levels of automation - the only viable way to operate very dense networks in future – with higher levels of quality of service (QoS).

In reality, though, most companies admitted they were still using Excel as their primary tool, and had significant gaps in their knowledge of their tenants’ equipment and even their own assets. Many acquire tower portfolios with very incomplete data about the equipment involved; some only monitor critical sites.

Several highlighted that it has not been traditional for most towercos to invest heavily in IT and data systems, and that has created an intelligence gap between infrastructure companies and their MNO tenants.

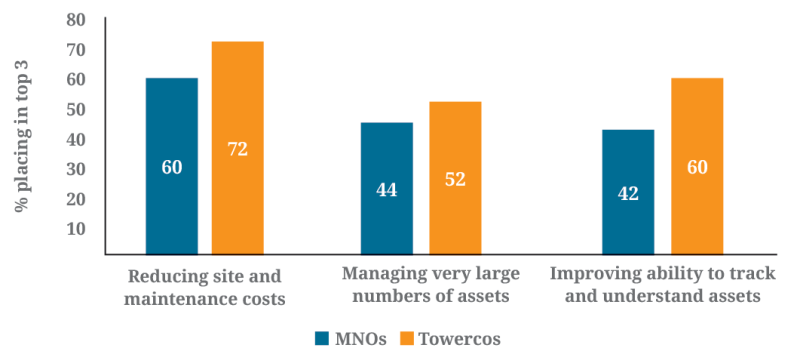

Placing in top 3 challenges re 5G infrastructure

Towercos need to understand their assets better

In addition to the business pressures outlined above, this is driving a new level of commitment to invest in core systems for infrastructure management, site operations management and business process management (BPM). Indeed, in a survey of over 40 towercos, conducted by Analysys Mason, the need for improved ability to track and understand assets emerged as the third biggest business challenge at the start of the 5G era.

Asked to name their top three challenges, these issues were most pressing:

- Reducing site and maintenance costs (72% of towercos put this in the top 3)

- Managing a very large number of assets (52%)

- Improving the ability to track and understand the assets (60%)

Better data tools would help to address all these challenges, and make the towercos more ‘MNO-like’ in their detailed knowledge of their assets. Indeed, they have the opportunity to leapfrog stakeholders with strong data functions, by adopting the most modern, best-in-class analytics systems as well as a new breed of smart on-site devices to collect the information.

These smart devices are important to fill the significant gaps in knowledge of the towerco’s equipment, and some new equipment, such as power interface units, come with in-built sensors, while smart meters are helping to automate the billing and provisioning processes for towercos with large power supply businesses.

This is just one of the techniques which could achieve a key objective for towercos – to reduce the number of costly site visits required to identify the equipment on a particular tower. Site visits to ensure every piece of active equipment is recorded and billed for can cost thousands of dollars apiece, so automatic updates on any equipment changes would have an immediate impact on cost as well as aiding future planning.

MNOs have invested more in this to date because they manage more items on a site, while the towercos only have to be concerned with passive equipment, power, and sometimes fibre. As more of them invest in larger and denser networks, and add fibre, edge nodes and even active radio equipment on the sites, their requirement will become almost the same as an MNO’s.

However, smart devices are only one part of the solution. While understanding the assets a towerco has, and being able to monitor them, are big steps forward for many, there is a big difference between asset tracking, and monitoring of their performance – and an even bigger difference between that and proactive trouble-shooting and forward planning.

That will require not just collecting data but being able to visualise and analyse it in a detailed way. Towercos are interested in many emerging methods of doing this. Among those cited were virtual reality/augmented reality overlays of the equipment on sites, for remote monitoring and simulation of different scenarios. Perhaps a shorter term option is to make better use of crowdsourced data on active sites and usage, especially in dense environments like cities. This can provide a useful cross-check with other sources.

Open frameworks would help different stakeholders to share data

While the towercos were open about the lessons they could learn from MNOs, there are also areas where they have better knowledge than their key tenants. While operators are concerned with tracking network performance and linking that to active network management and to billing, they often lack detailed understanding of the infrastructure underneath, especially if they did not previously own the towers themselves. They are more advanced in analysing and utilising their data, but there are still big gaps in their information.

Ideally, then, there would be more open, consistent ways for towercos and operators to share information, so that each had a more complete and accurate picture as the basis of decision making (while protecting competitive intelligence of course).

Most working group members felt that open frameworks for sharing data would be helpful, and would make it easier to make well informed decisions about the performance and value of an asset, as well as how to monetise it better. In particular, it would be valuable for infrastructure network designs to be integrated easily with the MNO’s radio plan, and to correlate towerco asset tracking with MNO network performance monitoring, so that the relationships between the two could be understood and actions taken.

However, there was also strong consensus that, despite some work on open interfaces by the vendor community, this was a longer term aspiration and the most immediate priority should be to improve the completeness of the towerco’s own data and its ability to analyse it.

The challenge that relates to all of these issues is to integrate and cross-reference every source of data – the towerco’s own or a third party’s – to enable rich, forward-looking decision making and to underpin fully automated management processes. This is the heart of the workgroup’s mission, to accelerate a process which many towercos think is a remote prospect

Integration of many data sources will drive intelligent operations

The challenge that relates to all of these issues is to integrate and cross-reference every source of data – the towerco’s own or a third party’s – to enable rich, forward-looking decision making and to underpin fully automated management processes. This is the heart of the workgroup’s mission, to accelerate a process which many towercos think is a remote prospect.

One workgroup member said: “It’s like we have connected homes, but no intelligence to combine them. Some people have data on network performance, some on assets, some on power – there is no aggregation or analysis.”

There was consensus that the objectives would not be achieved until every source of data could be combined and cross-referenced – site equipment feeds with foot traffic, plus information from crowdsourcing or from Google and Facebook. That would create a rich knowledge base into which people, or automated systems, could drill down to extract smaller, actionable tiles.

Appointing a chief data officer, with experience in how to structure and integrate data, and the right questions to ask of it, will be a next step for some towercos. But for many, it still seems to be a futuristic step. “We are still getting data collection right, then we can define the KPIs, then refine them,” said one participant. Only after that would a chief data officer be able to make a significant difference to the business.

This, then, is the ambition of the working group – to listen to the views and experiences of the towercos and their suppliers; to identify areas of best practice and strong market solutions; to drive a consensus about next steps, in order to ease the path for all operators to evolve into a world of big data and advanced business intelligence.