Cellnex Telecom have reached an agreement to acquire Cignal, the Irish based independent telecommunications Infrastructure operator, for a deal valuing the company at €210mn. The acquisition sees Cellnex increase its European footprint with 546 Irish sites and a potential further 600 BTS sites by 2026. Cignal is expected to be at the forefront of future build and fibre projects, allowing both parties to enhance their current capabilities and support 5G rollout in Ireland.

TowerXchange: Congratulations to Colin and your team on this latest phase of your project, and to Cellnex on extending your European footprint to Ireland with your deal to acquire Cignal. First, please tell us about the infrastructure assets, pipeline of future build, and management team Cellnex is bringing on board.

Àlex Mestre, Managing Director, Global Business Management, Cellnex:

Cignal is the leading telecom infrastructure provider in Ireland providing a range of services including build-to-suit (BTS), DAS rollout, tower upgrades and fibre infrastructure rollout supporting fibre backhaul to the towers.

The Cignal management team has a wealth of knowledge and experience from 20 years involvement in the Irish telecoms market. Cignal is currently engaged with multiple mobile operators and fixed wireless broadband providers delivering BTS sites through new tower build, existing tower upgrades, rooftops and streetworks deployments. The BTS programme consists of over 500 sites which has been steadily growing year on year over the past four years. Cignal has built up a team with the capability to deliver solutions to meet the current market requirements. This is supported by key relationships with the required stakeholders to support the delivery of the required infrastructure. In addition to this, Cignal has assembled a trusted and dedicated supply chain to meet its rollout requirements.

TowerXchange: It is estimated that 200-300 new sites are built per year in Ireland to cater for densification, infrastructure upgrades and 5G rollout and more. Do you agree with this forecast and if so how do you anticipate capturing the lion’s share of new build in Ireland?

Colin Cunningham, Managing Director, Cignal:

It is certainly anticipated that between 150 – 250 new sites and infrastructure upgrades will be delivered annually for the next three to five years to cater for densification, infrastructure upgrades, 5G rollout and more. Cignal has captured the bulk of these new site requirements through our existing contracts. It is likely that these numbers will grow as the anticipated rollouts accelerate over the next 12 months. We are working closely with our customers and have the ability to quickly ramp up our resources should the demand increase at any point over the next few years.

between 150 – 250 new sites and infrastructure upgrades will be delivered annually for the next three to five years to cater for densification, infrastructure upgrades, 5G rollout and more. Cignal has captured the bulk of these new site requirements through our existing contracts

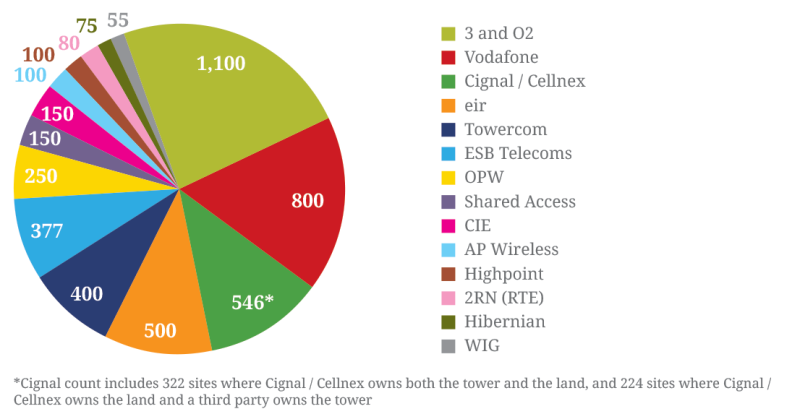

Who owns Ireland’s cell sites?

TowerXchange: We understand that eir and Three are undertaking a significant RAN refresh, while Imagine are expanding their fixed wireless access rollout thanks to investment from Brookfield. Do you foresee these being the primary drivers of lease-up?

Colin Cunningham, Managing Director, Cignal:

Yes eir and Three are undertaking a significant RAN refresh currently and yes through these initiatives, and the Imagine rollout, these are certainly the key drivers for lease up currently.

It is also anticipated that all the mobile operators will commence 5G deployments across their network which will drive the requirement for additional equipment deployment across the Cignal owned sites along with the operator owned sites. This will drive the requirement for investment in infrastructure upgrades and potential new site requirements.

TowerXchange: With the first commercial 5G network in Ireland launched last month by Vodafone, what do you anticipate will be required from Cellnex to support Ireland’s 5G rollout?

Colin Cunningham, Managing Director, Cignal:

Additional equipment space requirements will be necessary to support the anticipated 5G rollouts. A key requirement to support the 5G rollouts will be upgrading existing Cignal and third party owned sites. In some cases, new sites will be required to replace existing sites, which is currently part of the Cignal BTS programme delivery. The Cignal tower portfolio is relatively new with enough capacity on most towers to support the additional equipment requirements with minimal upgrade requirements in some cases.

TowerXchange: Ireland’s National Broadband Plan (NBP) to deploy high speed connectivity to reach 1.1mn people is expected to get underway in Q4 of this year through National Broadband Ireland (NBI) network. What role do you envisage Cignal playing in assisting with this rollout?

Àlex Mestre, Managing Director, Global Business Management, Cellnex:

Once the contract for the National Broadband Plan is awarded, we expect that National Broadband Ireland (NBI) will significantly ramp up their engagement with infrastructure providers in order to support the rollout of the network across the country.

At this point, it still remains unclear the extent of the final plan which will be served by wireless technology but given Cignal’s current network deployment programme, we believe we are in a strong position to assist NBI in the delivery of the wireless aspects of their rollout plans.

Colin Cunningham, Managing Director, Cignal:

However, the timeframe for commencement has continuously been delayed and at this point it is still not clear when the actual rollout will commence. In addition, Cignal will also actively engage with NBI to understand the timelines and plans for NBI’s fibre deployment across Ireland. The new fibre network will provide a platform for Cignal to deliver fibre to our own portfolio of sites which are located across rural Ireland and which will likely be located closer to fibre through the delivery of the new fibre network. Cignal is already investing in the delivery of passive infrastructure (fibre ducting) to facilitate the provision of backhaul services on our portfolio, and we expect to significantly ramp this up as fibre is delivered deeper into rural Ireland during the delivery of the National Broadband Plan.

TowerXchange: TowerXchange tracks eight independent towercos in Ireland, including Cignal / Cellnex, owning around 40% of the country’s towers between them. Do you foresee further consolidation among these players in the short to medium term?

Àlex Mestre, Managing Director, Global Business Management, Cellnex:

Cignal have already consolidated several smaller tower owners in Ireland over the past few years having acquired the Cellcom and telent tower portfolios in particular. This is an on-going engagement for the company with all the other independent towercos, and consistent with Cellnex’s consolidation strategy in the other markets in which we operate, and thus, we believe Cignal are well positioned to complete further deals in the coming months should the opportunity arise.

TowerXchange: Cellnex’s M&A team have had a busy 2019 with inorganic growth in France and Italy with Iliad, Switzerland with Salt and more recently the partnership with BT in the UK. With Ireland being the seventh country in which Cellnex now operate, can we put this deal into the context of Cellnex’s future ambitions in Europe?

Àlex Mestre, Managing Director, Global Business Management, Cellnex:

This is a deal which is fully consistent with our aim to build a true European telco infrastructure player. It endorses our track record of more than 20 deals achieved since Cellnex went public in 2015. Cignal’s acquisition further consolidates the industrial approach of our growth strategy. In this case we are not just integrating a portfolio of assets, we are integrating a talented team and management that will now continue to lead Cignal’s recent success story in Ireland, but will enhance as well our Group’s capability to encompass growth and the ability to continue to deliver the services our customers expect and require from us.

TowerXchange: We had previously understood that Cignal had over 300 towers plus an additional 220 locations where they own the land. So is the 546 total the aggregation of those two numbers, and the actual live tower count closer to 300, or have you simply been building prodigiously?

Colin Cunningham, Managing Director, Cignal:

The 546 is the total sites number in the Cignal portfolio, which is an aggregate of Cignal owned towers and Cignal owned land where third party operators own the towers. Cignal has made significant progress securing the rights to either own or manage the towers on Cignal owned land and to date there are only 224 sites in the portfolio where Cignal just own the land where, again, a third party operator owns the tower.

TowerXchange analysis of Cellnex’s acquisition of Cignal

Cellnex has found an ideal partner to enter the Irish market in Cignal.

Chairman Donal O’Shaughnessy, CEO Colin Cunningham and their team at Cignal have been building and buying high quality assets in the Irish market for several years – they are the model of a well-run independent towerco. Cignal are embedded and well respected in the market: they know how to navigate planning applications, they know how to negotiate with Irish MNOs and landlords, and they are expanding their business model beyond towers to include fibre, DAS, and C-RAN.

Cignal is capturing a very significant slice of the Irish build-to-suit market, a market in which their strong competitive position will now be enhanced by an anticipated further €60mn investment by Cellnex into a pipeline which they foresee yielding a further 600 BTS sites by 2026. Cignal’s tenancy ratio (described in Cellnex’s press release as the “customer ratio”) is 2.0, representing both healthy tower cash flow, and some remaining runway for co-location growth in a three MNO market where Network Planners have long been used to utilising third party towers. Non-traditional MNOs are also starting to seek tower tenancies in Ireland, headlined by Imagine’s fixed wireless access play, which recently received its own cash injection courtesy of investment from Brookfield.

Cignal shares Cellnex’s appetite to diversify beyond traditional “vertical real estate”; to address the fiberization of towers, to leverage street furniture, to explore DAS and C-RAN type deployments, and to explore the potential co-location of edge data centres at towers, all with a view to meeting Irish MNOs’ needs as the country enters the 5G era.

Cignal’s portfolio originates from the 2015 acquisition of ~400 plots of land from Coillte, the state-owned forestry company. Cignal already owned 113 towers on these plots of land, while others MNO-owned towers were located on the remaining plots of land. Cignal now owns the structures on almost half of those sites, most of those structures being around ten years old, designed with capacity for multiple tenants. Cignal also has the wayleave rights to run fibre to those forestry towers.

European fund manager InfraVia bought Cignal in 2015 for an undisclosed sum through their Infrastructure Fund II, and InfraVia are believed to have made a very respectable return on their investment, with the Cellnex acquisition giving Cignal an EV of €210mn. As a private equity owned towerco, Cignal were very disciplined in the management and maintenance of their documentation and compliance – this would have been a very straight forward due diligence.

Cellnex has a track record of buying well-run independent towercos to enter new markets. It is a game plan they followed when they bought Protelindo’s Dutch subsidiary and Shere Group in 2016 (buying, respectively, 261 towers for €109mn and 1,004 towers for €393mn). While the consolidation of solid independent developers is a sound strategy, such entities are relatively rare in Europe – there are few remaining independent towercos of Cignal’s calibre in Europe.

In four years, Cignal and InfraVia have acquired a sound portfolio of assets, they’ve leased them up, they’ve augmented with smart build programmes, they’ve positioned themselves to be pioneers of fibre to the tower in readiness for 5G, and they have secured a lucrative sale to a very smart buyer. With Cellnex stating that the Cignal acquisition will contribute €20mn EBITDA in 2026 after BTS has more than doubled the size of Cignal’s portfolio, we can conject Cignal’s current EBITDA may be around half that, suggesting this transaction valued Cignal above 20x EBITDA. While that may sound like a great deal for Cignal, it will be a great deal for Cellnex too in terms of the EBITDA multiple run rate – there is clearly significant upside to be found in Irish towers and, together, Cignal and Cellnex are well placed to capture that upside.