Hot on the heels of their sale and leaseback deal with Free Senegal, Helios Towers have announced a batch of deals with Airtel Africa to add 2,227 existing sites across Madagascar, Malawi, Chad and Gabon. The deal will expand Helios Towers’ footprint to 10 markets, delivering the Group’s 2025 vision to expand their operational presence to at least eight markets, well ahead of plan and expanding the group to 11,500 towers, near its 2025 target of expanding to 12,000+ towers. TowerXchange looks at what this means for Helios Towers, Airtel and the African telecom tower world.

The deal

On March 23 Helios Towers announced four deals with Airtel Africa to acquire towers in Madagascar and Malawi and enter into exclusive memorandum of understanding arrangements for the potential acquisition of Airtel’s towers in Chad and Gabon, all subject to the required regulatory approvals. Malawi and Madagascar should close in Q4 2021, with Gabon and Chad following in Q1 2022.

The deal has been split in four because past transactions had progressed further in Madagascar and Malawi with Airtel’s tower assets already established and licenced. In Chad and Gabon, Helios Towers will be required to acquire an infrastructure licence before it can proceed the transaction with Airtel.

As is becoming standard in tower transactions, a committed build-to-suit pipeline of 315 sites across all four markets has been included. This adds to the 400 BTS pipeline in Senegal that Helios Towers will commence delivering once its transaction there closes this quarter.

Helios Towers has inked two separate agreements, one for Madagascar and another for Malawi for a total expected consideration of US$108mn, which represents an enterprise value of US$124mn including estimated transaction costs and capitalised ground leases. No deal value has been announced for Chad and Gabon, but given the similar EBITDAs (see figure 1) TowerXchange expects the remaining deals to close for a similar consideration.

The deals improve Helios Towers position in several ways. As reported in the 2020 annual report, Helios Towers had an average remaining tenancy tenor of 6.8 years, representing US$2.8bn of future revenue already contracted. The deals with Airtel and Free Senegal increases this to an average of 8 years and US$4.6bn. The deal also increases Helios Towers hard currency and pegged-currency earnings, always important in developing markets, edging up the share of currencies that are Euro-pegged or US dollar-linked from 63% to 64%.

Figure 1: Helios Towers’ acquisition in four markets in numbers

helios-towers-table.jpg

Valuing the towers

One questions which towercos, MNOs and investors always want to know is “how much are my/your towers worth?” and recent transactions help to clarify that.

Sadly, there’s no simple answer here. For an MNO the value of their towers can vary depending on how much capital they want to raise; more capital raised requires higher long-term lease rates and lead to a higher overall price tag. In 2020 Helios Towers agreed a US$172k price tag per tower with Free Senegal, that’s more than in this deal, which implies Airtel has placed a lower priority on raising capital than Free Senegal.

Much like any financial assets, towers are valued by working out the future cash flow secured by purchasing the assets. Typically, this involves working out the EBITDA (earnings before interest, tax, depreciation and amortisation) of a portfolio and applying a multiple. For reference, as of April 7th, Helios Towers is valued at US$3.23bn, 14x its US$226.6 Adjusted EBITDA. In their first full year of operations Helios Towers’ new sites in Madagascar and Malawi are expected to generate aggregated annualised revenues of US$89 million and Adjusted EBITDA of US$27 million. As no deal value has been reported for each country, nor is it likely to be ultimately reported, TowerXchange has estimated the valuation of the towers in each country and forecasted the deal value for the sites in Gabon and Chad assuming a consistent deal structure across the four markets.

For Malawi and Madagascar, an enterprise value of US$124mn on a year one EBITDA of US$13mn gives a multiple of 10.5x. This means the sites are worth 10.5x their earnings before interest, tax, depreciation and amortisation. Given Helios Towers’ multiple of 14x EBITDA this implies a lot of value remains locked up in the towers.

Using a 5:8 ratio between the two markets EBITDAs (see Figure 1) Madagascar’s sites could be valued at US$48mn (US$97k per site) and Malawi’s at US$76mn (US$103k per site). Using a 10.5x multiple on the US$7mn EBITDA reported for Chad and Gabon for value the towers in each market at US$67mn (US$124k per tower in Chad and US$146k in Gabon).

However, many items will confound these valuations, and the above valuations should be strictly understood as estimates. For example, as per Malawi’s regulations Helios Towers must list 20% of its shareholding locally, affecting the repatriation of profits. In Gabon, Airtel has already contracted power management to an ESCO and this will affect operations and costs in the country. Perhaps Chad’s low EBITDA margin (24% versus an average of 30%) represents an opportunity for Helios Towers to create efficiencies, or it may be a risk that the sites will have a permanently higher cost base. And while in Malawi, Chad and Gabon, Helios Towers will be the sole towerco active, in Madagascar Helios Towers will be competing with the Axian Group-backed TowerCo of Madagascar.

What it means for Airtel Africa

The deal is transformational for Airtel Africa, which retained towers in only five major African markets (plus the tiny Seychelles). Following the deal with Helios Towers only Tanzania will remain. Currently Airtel makes use of 22,909 mobile towers, the large majority of which are leased. The planned sale of 2,227 of the roughly 4,500 sites it retains would allow Airtel to become the asset light company it has aimed to be since the mid-2010s.

Between 2014 and 2016 Airtel disposed of its towers in 10 of its markets (Airtel has since exited Burkina Faso and Ghana), but deals in Chad, Gabon, Tanzania and Malawi were all ultimately cancelled due to regulatory issues. Madagascar never came to market, but speculation at the time pointed to pessimism that the regulator would give a deal the red flag.

With a decade of towerco operations now behind them, it seems Africa’s regulators have learned to appreciate towercos. Speaking with TowerXchange, Tom Greenwood told us “seven years has changed things. There are new regulators and new telecoms regimes in these countries. The world and the continent are more knowledgeable about towercos and the towerco benefits, from a rollout point of view, an environmental point of view and quality of service point of view.”

A sale in Tanzania would complete the transformation, but there is no sign of Helios Towers acquiring the remaining Airtel sites there. Responding to TowerXchange Kash Pandya, CEO at Helios Towers said the acquisitions were aligned with their strategy of expanding into new markets, and that they were “focused on geographic expansion and not on growing in Tanzania.”

In 2019 Airtel Africa went public with listings on the London and Nigerian stock exchanges. Since then the company has enjoyed double digit growth driven by Africa’s remarkable resilience during 2020 and strong macro fundamentals. 2020 saw Airtel add 1,800 sites, growing from 21,059 network towers to 22,909 sites, the vast majority of these were tenancies with American Tower, IHS Towers or Helios Towers.

Airtel Africa has improved its underlying EBITDA margin by 1%, while operating profit grew by 22.8% and leverage improved to 2.1x in December 2020 from 3.0x in March 2019. The deal with Helios Towers will further reduce its leverage and enable it to expand its 4G and fibre networks and improve services.

None of the four markets in which these transactions will occur were mentioned as a “top six” market as highlighted in Airtel Africa’s 2020 annual report, and yet they would have taken up a disproportionate amount of the CTO’s time. In the past, Airtel Africa has expressed both a desire to dispose of its remaining passive infrastructure for the right price, and a frustration with some of the inflexibility it has experienced with towercos. It appears it has now found the right balance.

Speaking with TowerXchange in 2019, Razvan Ungureanu, Chief Technical Officer for Airtel Africa said “I wish towercos were more customer-focused. There can be a tendency for towercos to only care about a site being down inasmuch as it affects their SLA commitments. I worry there is an element of “box ticking” rather than a real customer-focused dedication to keeping the lights on…. [but] overall I am pleased to work with towercos in Africa, but similar to working with managed services providers you have to manage your relationship and ensure the correct governance is in place.”

Figure 2: Airtel’s history of transactions in Africa

airtel-africa-table.jpg

The impact on Helios Towers

Adding four new markets to its portfolio will swell Helios Towers past 10,000 sites and make it the fifth most geographically diverse towerco in the world (See Figure 3), behind only prolific acquirers American Tower, Phoenix Tower International, SBA Communications and Cellnex, and tied with Vodafone-carve out Vantage Towers at 10 markets.

Figure 3: Towercos by market count

Helios Towers’ 2020 Annual Report identified clear targets for inorganic expansion, expanding operations to over eight markets, operating over 12,000 towers, by 2025. The report indicated that Helios Towers may be able to reach that target earlier than expected, and with these Airtel Africa deals, that looks set to be the case.

Speaking with TowerXchange Kash Pandya said that Helios Towers had no plans to immediately revise its target but that they would “take stock and consider what would be any new targets, but the fundamentals of the strategies won’t change. MNOs are starting to look at tower sales and our strategy is to continue to grow.”

Speaking about future opportunities Tom Greenwood continued that “Helios Towers’ pipeline is still very strong. In our annual report we articulated that there is a fairly focused pipeline of 10,000 sites. This is 2,500 of that, but there are other things we are busy working on and we hope to be successful and announce more deals soon. There are a mixture of sources of growth; a continued drive by MNOs to raise capital and more and more are seeing passive infrastructure less and less as a strategic asset.”

How much might this deal add to Helios Towers’ value by 2025? Helios Towers will be able to take advantage of these countries’ growing telecoms markets, and will be able to apply their Lean Six Sigma to reduce costs and improve the profitability of those operations, towers owned by towercos are also valued more highly than towers owned by MNOs.

As usual for Helios Towers, the countries it has entered are all predicted to continue to grow strongly, with compound annual growth rates (CAGR) averaging 5% per year; mobile subscriber CAGR of 5% and points of presence growth of 6%. As an independent provider of infrastructure Helios Towers can expect its tenancies to grow ahead of the 6% point of presence growth, but 6% provides a good conservative estimate for revenue growth.

Using historic data from Helios Towers, from Q1 2017-Q1 2020 Helios Towers improved its EBITDA margins from 42% to 54.7%, or 12.7 percentage points. Perhaps Helios Towers can improve performance at all its four new markets to north of 50% by rapidly applying historically effective techniques, but to be conservative we can assume an improvement in EBITDA margin of 12.7%.

Together this implies that in the four full years from early 2022 when they take control of the sites, revenues will grow from US$89mn to US$119mn and EBITDA from US$27mn on a 30% margin to US$50.8mn on a 42.7% margin. Applying Helios Towers’ current EBITDA multiple of 14x as discussed above yields a valuation of US$711mn.

This significant uplift in valuation will be bought by rationalising networks, improvement capex, new operational practices and winning new business, but it underlines the valuation creation possible through the telecom tower model.

Africa’s continuing M&A resurgence

Since 2016, there have been few SLBs in Africa, but that tide is now turning, first with Helios Towers deal with Free Senegal, now with this Airtel deal and in the future with MTN South Africa looking to monetise their towers.

As we can see, barriers to M&A have been slipping away with markets where past deals have faltered seeing a revival led by improved regulatory environments. For example, in 2019 in Tanzania, the final market in which Airtel retains towers, it put out a notice for expressions of interest in 1,400 towers but progress on the deal seemed to stall. On July 1st 2020, Tanzania removed the local listing requirement for telecoms operators, which opens the way for these towers to be sold to whichever towerco can submit the most competitive bid. Paradigm Infrastructure, American Tower and even SBA Communications have all been linked with this potential sale.

In South Africa, MTN has announced plans to monetise its 13,000 towers and is working with investment banks to value its sites and prepare them for sale. Helios Towers, SBA Communications and American Tower are all already active in South Africa, and IHS Towers would also be competitive bidders.

There are also newer towercos like Telecom Towers Africa, a new South African towerco headed by Phakama Mbikwana and Paradigm Infrastructure, backed by ex-ATC alumni Steve Harris, Hal Hess and Steven Marshall that are all focused on new sale and leaseback deals.

The acquisitions in Malawi and Gabon are also interesting because they are seen as “less suitable” towerco markets because they are current MNO duopolies, and hence have lower opportunities for lease up. If African telecom growth is seen to be robust enough in these tier 2 markets, then there are only a few remaining countries in Africa which would not support the entrance of a towerco.

Less attractive markets are receiving investment, non-tier 1 MNOs like Free Senegal are signing deals and new capital and new towercos are seeking opportunities – all very bullish signs for African telecom tower M&A. Should Africell, Viettel or even Globacom want to monetise their towers they may find a more welcoming environment than before. And should local conditions improve perhaps even TMcel in Mozambique, Unitel in Angola or MTN in Benin could find a willing partner.

How the countries compare

TowerXchange will now move to look at what the deal means in each of the four impacted markets.

Madagascar

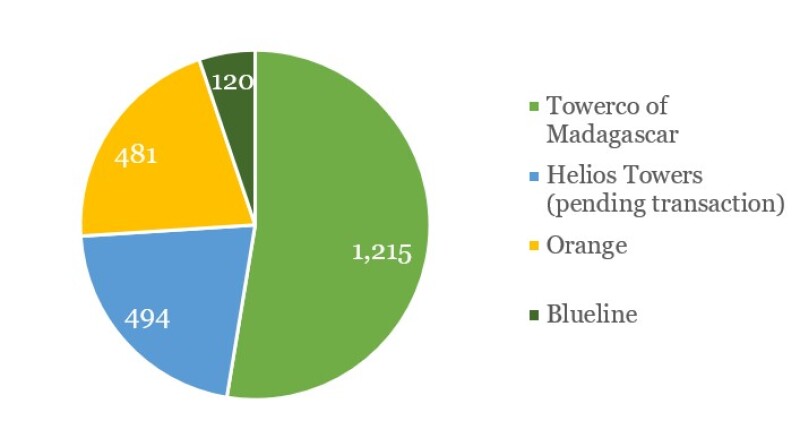

Figure 5: Madagascar – Estimated tower ownership

Telma, Orange and Airtel operate in the Madagascan market, with Blueline the country’s newest MNO. Telma launched 4G operations in 2015, with Orange and Airtel following in 2017. In May 2020, Telma claimed to have completed its LTE-A rollout. Towerco of Madagascar (TOM), was spun out of TELMA in 2011 but now acts as an independent towerco operates a portfolio of over 1,200 sites in the country.

Operations in Madagascar are complex with Airtel previously reporting that 50% of its sites are off grid. Orange has also issued an unsuccessful ESCO RFP in the market to help manage the challenging operational environment. TOM has been extensively evaluating a number of different energy options including a pilot of a wind project in the country.

Competition with TOM will provide a different dynamic to the market to Malawi, Chad and Gabon where Helios Towers will be the sole independent towerco. However, Helios Towers has experience working in competitive towerco markets in Ghana and South Africa. Kash Pandya remarked to TowerXchange that “Helios Towers don’t mind competition. We compete in South Africa and in Ghana and have good relationships in other markets. I think the MNOs will be receptive. There are some frustrations from the other MNOs that use TOM and we think we can come in and provide an alternative to TOM.”

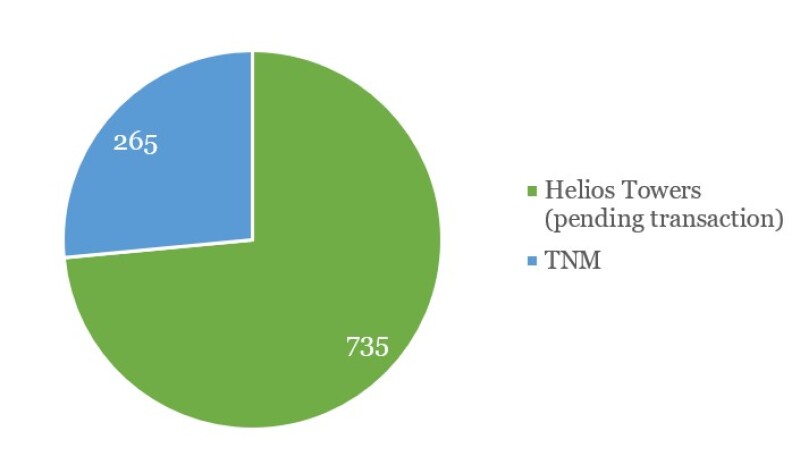

Malawi

Figure 6: Malawi – Estimated tower ownership

Airtel reached an agreement to sell their towers to Eaton Towers back in 2015 but the deal was cancelled, a refreshed regulatory scene appears to have enabled this deal. There are two MNOs in the Malawian market, Airtel and TNM – with Afrimax Malawi targeting business customers and offering limited opportunities for lease up outside of central business districts. There are two other licence holders, Celcom and Access, but neither has established operators. Given these three operators require new network infrastructure but have yet to establish it themselves, the entrance of Helios Towers and the new regulatory regime may see this market grow above expectations.

Tom Greenwood remarked “There are only two MNOs there today but like our other markets, this is a very high growth market with a large and growing infrastructure gap. We very much like the dynamics of the market and towercos create a more favourable environment there by offering an open access network to all. That will be good news for the regulators and the people. Over time new mobile operators may come in but our business case doesn’t rely on that.”

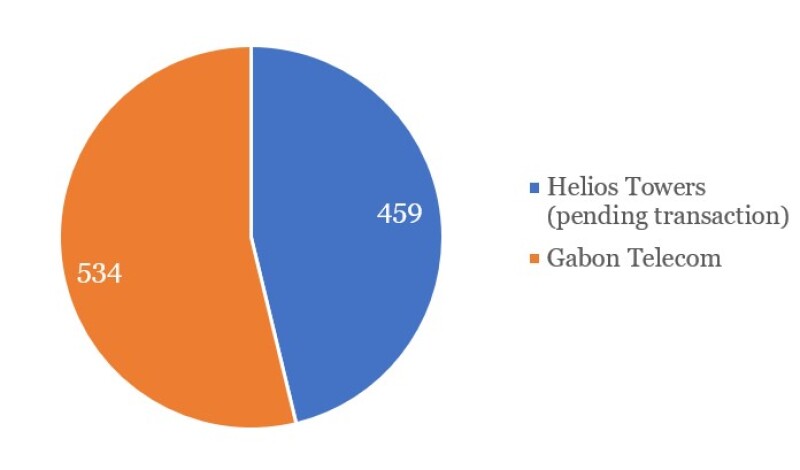

Gabon

Figure 7: Gabon – Estimated Tower Ownership

There are two MNOs in the market since Gabon Telecom merged with Moov to create the country’s largest operator ahead of Airtel. Since the merger the two have moved into rough parity, with Gabon Telecom having 53% market share to Airtel’s 47%. Airtel’s efforts to monetise their towers in Gabon previously never made much headway, and so they currently work with Energy Vision, an ESCO which manages power at their sites.

The electricity grid is okay in the main cities but the grid is much less extensive in rural areas leading to 30-35% of the country’s 1,000 sites being off-grid. No decisions on what will happen to Energy Vision’s management has been made, with Kash Pandya saying Helios “will be reviewing it. They are doing a good job but we haven’t used an ESCO before. For Helios Towers if they are providing a good service there is no reason to stop.”

Gabon Telecom and Airtel have deployed LTE, but despite comments in 2019 by the Telecom Regulator no moves have been made to roll-out 5G. 4G coverage is still largely limited to cities with rural areas still underdeveloped. ARPUs are high for Africa, with prepaid customers at 4,903CFA (US$9.02) and postpaid 48,650CFA (US$89.46), although postpaid represents less than 2% of the market.

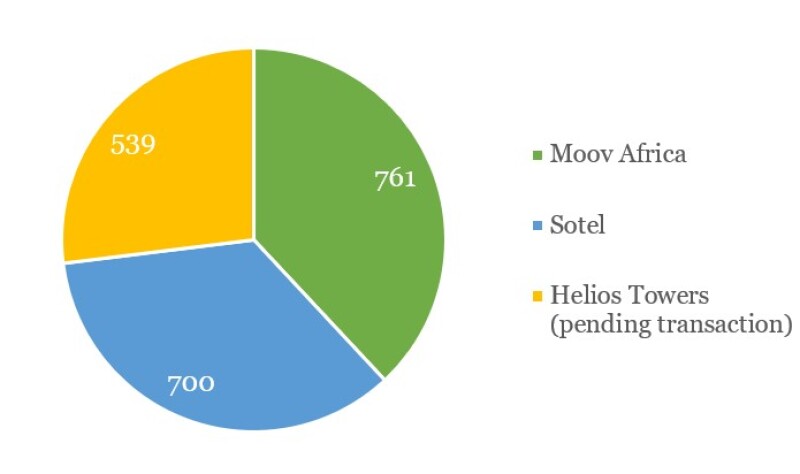

Chad

Figure 8: Chad – Estimated Tower Ownership

There are three MNOs (Airtel, Moov Africa and Sotel) and an estimated 2,000 towers in Chad, a country where electrification sits at just 9%. Tigo sold their opco to Maroc Telecom in July 2019. To address power issues, Millicom’s Tigo had signed an ESCO contract with Camusat’s Aktivco.

Airtel had previously agreed the sale of their towers to Helios Towers prior to the transaction being cancelled because of an unfavourable regulatory environment, but as in these other markets, it appears both parties are confident that has changed.

Chad has the lowest EBITDA margin of the four markets which Helios Towers will be entering into, indicating the complex and difficult operational environment. The country is vast with security issues hampering operations. However, the country will benefit from Helios Towers attention and expertise in deploying hybrid systems and improving site autonomy.

Summary

The deal is transformational for Airtel Africa, helping it shed passive infrastructure in four hard to manage markets. For Helios Towers it allows the company to leapfrog to its 2025 goals in a deal with a known and trusted partner. And for the wider ecosystem it not only indicates that over 2,000 sites will be requiring serious upgrading over the coming years, but also that the pipeline for further sites passing into towerco hands is larger than it has been for the past several years.