March 24, in an announcement to the Saudi stock exchange, Mobily and Zain announced a Memorandum of Understanding to form a towerco with Raidah Investment Company and IHS Towers. The deal is structured in such a way as for a joint committee of Mobily and Zain to sell their towers to a new consortium consisting of Mobily, Zain, Raidah and IHS Towers in which IHS Towers would have a minority stake. The deal includes the ’approval in principal’ of the CITC’s Board, but has yet to win final approval. Theprocess to begin the transaction must be started within 30 days of the signing of the MoU. No valuation has been announced.

TowerXchange estimates that Mobily and Zain own 19,100 towers between them. The new towerco would be the 20th largest in the world, and one of the largest joint ventures. Saudi Arabia has a history of deals being announced without closing, not least including IHS Towers deal with Zain KSA. However, since the formation of TAWAL, and IHS Towers’ successful sale and leaseback in Kuwait, the mood music in the region is shifting. The regulator’s support is particularly promising. The deal is also backed by Raidah Investment Company, the investment company of the Public Pensions Authority, suggesting official support at the highest levels. Join IHS Towers at TowerXchange Meetup MENA this March 30-31. Register here.

The Saudi Market

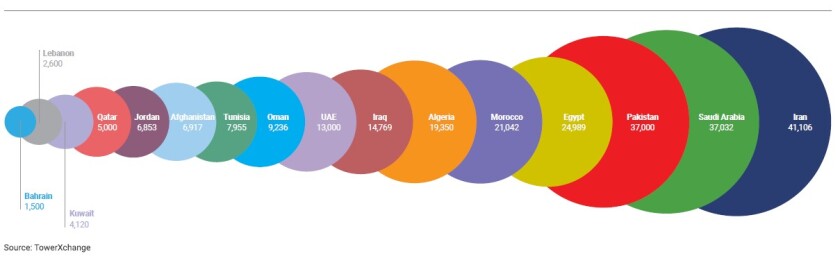

There are three MNOs in Saudi Arabia; market leaders stc, Mobily (in which Etisalat has a 27% stake) and Zain. Between them, Saudi’s MNOs own over 37,032 towers with stc having the largest portfolio, now largely controlled by its carve-out towerco, TAWAL.

Infrastructure sharing in the Kingdom has to date been very limited, with around 2% of sites holding more than one tenant. In the major cities, Riyadh and Jeddah, there has been some infrastructure sharing as part of MNO densification plans to meet growing data usage, whilst in some of the country’s holy sites where access to land is limited, infrastructure sharing has arisen out of necessity. These infrastructure sharing arrangements are typically under bilateral commercial agreements and thus far have only covered passive equipment.

With little infrastructure sharing a high degree of parallel infrastructure has developed; 95% of Zain and Mobily’s sites are reported to overlap and as such, the government is keen to promote infrastructure sharing. Various passive infrastructure strategies have been explored by each of the Kingdom’s MNOs in recent years, with TAWAL’s carve-out finalised last year and the Mobily/Zain/Raidah/IHS deal the latest plan for the remaining sites.

A culture of sharing is developing, with TAWAL having announced a 100+ site deal with ICT, a local ISP in 2020. In a similar vein, Saudi Arabia is home to several smart cities and megaprojects, each of which promises enormous demand for communications infrastructure during construction and in operation. Domestic digital infracos could see demand for 1,000s of new POPs if just a portion of the projects come to full fruition.

Valuing the deal

No valuation or deal value has been announced for the new tie-up, but it could easily carry a billion-dollar price tag.

IHS Towers’ past sale and leaseback deal with Zain KSA for its 8,100 towers was valued at US$647.7mn, including a 1,500 build-to-suit commitment. Naively increasing that deal to cover the 19,100 sites and a similarly sized BTS would produce a deal value of US$1.53bn, or US$80k per tower. This would be congruent with the IHS Towers deal with Zain in Kuwait where 1,620 towers which were first announced at US$165mn, or US$102k per tower.

If executed at the above price this would indicate a relatively low capital raise by the MNOs. Both MNOs require capital, but have proven the ability to raise outside capital and may thus be more interested in outsourcing management of their towers in exchange for a modest capital raise, a reduced cost of future rollout and a valuable share of a towerco which can be further monetised later.

Several factors will impact the valuation. TowerXchange estimates that there are 37,032 towers in Saudi Arabia and the new towerco would own 52% of them. TowerXchange understands that the CITC has issued a regulation which caps towerco ownership at 60% in Saudi Arabia, making the proposed deal the only viable one for the three mobile operators. Any other combination would breach the 60% limit.

Saudi Arabia is home to significant parallel infrastructure. At 1,115 SIMs per tower Saudi Arabia has twice as many SIMs per towers as the MENA average. While densification for 5G will soak up some of the duplicate sites, substantial decommissioning would still be required for maximum capital efficiency given 95% of Mobily and Zain sites overlap. Even though each tower will have been built with a single MNO in mind, there will be substantial co-location potential. By controlling sites belonging to both Mobily and Zain, and with IHS Towers’ experience of rationalising networks, the new towerco would have an advantage over other towercos in optimising its structure.

Impact on IHS Towers

In August 2020, IHS Towers announced a planned IPO as a global towerco, however, no public progress has been announced since then. Perhaps the reason why has now been revealed, a truly portfolio rebalancing acquisition. For some time, IHS Towers has been following a diversification strategy to decrease the prominence of Nigeria in its portfolio. As of today, Nigeria represents just under 60% of the company’s sites. Ignoring for a moment IHS Towers’ planned minority ownership, the deal would take IHS Towers from 27,000 towers largely concentrated in Africa to 48,000 towers across three continents.

Bloomberg has reported that the towerco was aiming for a valuation of US$7bn, with IHS Towers reportedly seeking to raise about US$1 billion in New York. The increase in size due to this deal should push this valuation north. IHS Towers’ owners include’AIIM, ECP, FMO, GIC, Goldman Sachs, IFC, Investec, KIC, MTN Group and Wendel. MTN’s recent annual report explained they were divesting their remaining investment in towercos, and an IHS Towers’ IPO is necessary before MTN can effectively unload their shareholding. Similarly, TowerXchange understands that a number of the development finance organisations which have backed IHS Towers are keen to realise their investments now IHS Towers is a mature business.

IHS Towers began in 2001 as a tower builder in Nigeria. In the years that followed, the company began maintaining towers for MNOs too before eventually beginning to offer co-location services in 2009. During its past acquisitive stage in Africa, IHS Towers signed deals with MTN in Cameroon, Cote d’Ivoire, Zambia, Rwanda and Nigeria, with Orange in Cameroon and Cote d’Ivoire, with Airtel in Zambia, Rwanda and Nigeria, as well as a number of other acquisitions in Nigeria, including deals with Visafone, Etisalat, Hotspot Networks and Helios Towers Nigeria. The result is a portfolio weighted towards Nigeria and Africa’s three leading MNOs: Orange MTN, Orange and Airtel. IHS Towers has since entered Kuwait, Brazil, Peru and Colombia and added new tier 1 MNO customers. Earlier this year they acquired the 1,000-site Skysites business in Brazil, adding further scale.

The deal further opens the way for an IPO to proceed for the towerco, but it also stands alone as a major step forward for a towerco which is acquisitive by nature and which operates at a globally significant scale. For more details on IHS Towers’ position prior to this deal see our IPO explainer here.

Saudi Arabia’s deal history

Currently, TAWAL is Saudi Arabia’s only towerco, having gained operational independence from stc in April 2020, it appears that may now change. Today the towerco owns and operators 15,532 sites and has signed a deal with ICT, a Saudi communications company, among others. But it was far from the first towerco proposed.

In 2011, Saudi Telecom Company and Mobily entered into discussions surrounding the potential formation of a joint venture into which they would pool their existing tower portfolios in a bid to reduce passive infrastructure related capital and operating spend. The pair were understood to be considering selling off a 49% stake in the projected US$2.5bn venture but talks stalled and plans surrounding a joint venture were shelved. The two parties once again re-opened joint venture discussions in 2016, signing an initial three month agreement to study the joint venture in the August of that year, an agreement which was subsequently extended before the pair appointed Standard Chartered as an advisor to oversee the process in 2017. Talks once again dissolved, with the two parties reportedly unable to agree on how ownership should be shared.

In between joint venture discussions with stc, Mobily formally launched a tower sale process in 2016 after having appointed TAP Advisors to run the deal. The tower process attracted a high degree of interest, with names linked to the transaction including IHS Towers, Digital Bridge, TASC Towers, edotco, Providence Equity Partners and Towershare plus local investors and conglomerates including Saudi Aramco, Al Rahji Group and Al Zamil Group. The deal reached an advanced stage but Mobily found alternative debt refinancing options and abandoned the tower sale process.

In December 2016 Zain announced that it had entered into exclusive negotiations with a consortium involving TASC Towers and local conglomerate, ACWA Group for the sale and leaseback of their Saudi Arabian tower portfolio, with a reported deal value of around US$500mn, however this deal was also subsequently cancelled.

Finally, in 2018, Zain announcement that it had reached a deal with IHS Towers for the sale and leaseback of its 8,100 Saudi Arabian towers for US$647.7mn. However, on the 20th June 2019, the Saudi telecoms regulator, the Communications and Information Technology Commission (CITC) wrote to Zain KSA saying that ’IHS Holding Limited has not yet met the regulatory requirements for the sale and lease back of passive infrastructure’, precipitating the operator announcing the postponement of the tower sale.

It was in this milieu that stc decided to go it alone and launch TAWAL. Now, following discussions which encompass Mobily, Zain and ’ crucially ’ the CITC, it appears that another towerco is to be formed.

Conclusions

In some sense, because of regulatory action preventing Zain’s past deal with IHS Towers and capping the concentration of tower ownership, this deal is the logical next step for the Saudi telecom industry but it is also part of a broader trend.

As we have seen in Europe with the formation of Vantage Towers by Vodafone, TOTEM by Orange and by Deutsche Telekom’s combination with Cellnex in the Netherlands, MNOs now have many more options for how to monetise their towers.

Deals in Saudi Arabia have been announced before without leading to completion, but with the provisional backing of the CITC board, the experience of the IHS Towers’ team and the consistent rumours that a deal was to be done, it appears that this one has a better chance of reaching its culmination.

Join IHS Towers at TowerXchange Meetup MENA this March 30-31. Register here.