Cellnex’ growth in the past 12-18 months has been nothing short of phenomenal. As the European tower market has hit an inflection point, Cellnex has capitalised upon this momentum, driving scale and increasing their geographical footprint. But it is not just the number of deals that is noteworthy, so is the scope and type of deals. Whilst their business model remains firmly ’tower-like’, Cellnex’ journey to becoming an augmented towerco speaks of changing dynamics in the management of mobile networks. In this interview we speak to Deputy CEO, Alex Mestre to understand the landmark deals that have transformed Cellnex, and examine the towerco’s growth prospects and increased responsibility in the European tower market.

TowerXchange: Cellnex has had a phenomenal past few months in terms of M&A across the European market, can you perhaps share some of the highlights and their significance to Cellnex’ portfolio and growth story?

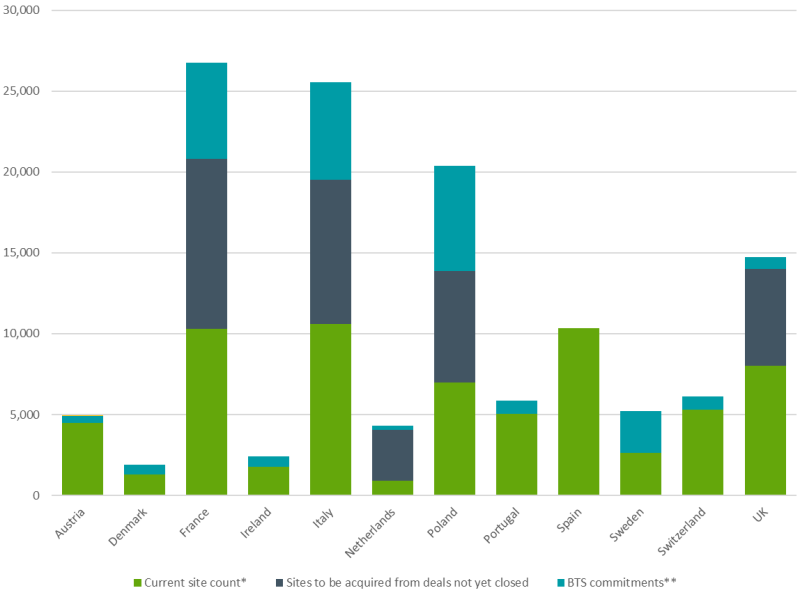

Alex Mestre Molins, Deputy CEO, Cellnex: All the deals that Cellnex has done have been important but I think that it is fair to say that a few deals have been transformational: The WIND deal in Italy in 2015, which took place in parallel with our IPO, marked Cellnex’ first step in internationalisation; the deals with Bouygues involving fibre backhaul and central and metropolitan offices evolved on the asset class that Cellnex owns; with Iliad we did three countries in one shot, impacting the equity story and valuation of Cellnex; with Arqiva we took a quantum leap in positioning Cellnex in the UK; and our recent deal with Hutchison gives us volume in six countries, opening up new interesting markets [Austria, Denmark and Sweden], whilst consolidating our position in existing ones.

We signed an interesting deal with Deutsche Telekom in the Netherlands, combining our assets and continuing the good relationship with Deutsche Telekom that started when DTCP invested with us in Switzerland [joining forces with Cellnex and Swiss Life Asset Managers in the acquisition of the Sunrise tower portfolio]. Looking at Poland, there are two aspects to emphasise: our first deal with Iliad which closed on April 1st, tells a story of supporting a partner that we have already completed deals with in the acquisition of Play; a second deal with Polkomtel marks a very interesting transaction in agreeing the acquisition of both passive and active equipment.

In between all this there have been transactions that bring a second anchor tenant in countries where we already have a presence, allowing us to work with an industrial tool kit and strengthen our position in existing markets.

TowerXchange: The Polkomtel deal is particularly interesting, with Cellnex set to acquire active as well as passive equipment. Can you explain the specifics of deal in more detail, what assets are included and how will the business model work?

Alex Mestre Molins, Deputy CEO, Cellnex: In terms of the scope of the assets, there are three layers. Firstly, there’s the ’business as usual’ passive infrastructure layer with c. 7,000 towers being acquired; secondly, there is backhauling with either fibre or radio links, something that is already in our capabilities and is already one of our typical asset classes that we manage (we do fibre backhaul with Bouygues in France and we have thousands of radio links in Spain for Vodafone and others); thirdly there is radio access network equipment.

With the deal, we are acquiring existing equipment and we are committed to renewing future equipment. In terms of the business model, we can describe it as a ’tower-like’ business case. Whilst we are acquiring adjacent assets and it is an evolution on our historic M&A model, the fundamentals of the economic model remain unchanged. We will be paid for the deployment of infrastructure and our revenues will be linked to this. The importance of this business model being unchanged has been at the centre of our discussions with Polkomtel.

On the active side, the units that we will potentially be selling are radio carriers ’ the carriers are what are most directly linked to the RAN equipment capex requirement. As stated in the announcement surrounding the deal, Cellnex will acquire around 30,000 carriers with a potential 15,000 further carriers. Every time you add a new frequency you need to add a new carrier. Importantly, whilst there will be potential new technology renewals in the future, this will be structured as a build-to-suit and so will generate additional revenues for Cellnex.

TowerXchange: Does the extension into acquiring radio access network equipment require new skill sets within the Cellnex team or is it more of an extension of services that you are already providing?

Alex Mestre Molins, Deputy CEO, Cellnex: If you look at the different services that we provide from our legacy deals, we are already very involved in managing active equipment. For instance, in Spain and the Netherlands we provide turnkey services to broadcast customers and so there is a massive amount of active equipment there. We are also very active in public safety emergency networks, where we provide active equipment ’ it might be for different frequency bands but it essentially the same type of equipment. Whilst historically our European expansion through M&A has been focussed more around passive infrastructure, we have the capability and experience to offer full service provision. It is also important to note that with the Polkomtel deal, we will also be inheriting a team of individuals experienced at running the radio access network for the operator.

TowerXchange: What brings an MNO such as Polkomtel to outsource active equipment? Could we see more deals like this?

Alex Mestre Molins, Deputy CEO, Cellnex: RANsharing between MNOs has been happening for a number of years, typically under 50/50 bartering type agreements. The operators will decide which population or geographical area they want to cover (usually in suburban and rural areas) and then will split the region in two, assigning half to each operator. Such a model lacks flexibility.

We have seen the inclusion of active equipment in some infrastructure sharing joint ventures ’ particularly in the Nordics.

A dedicated entity such as a Cellnex that has evolved to being an augmented towerco (we don’t want to call ourselves a netco as that encompasses elements that extend beyond our remit) could facilitate and enable these RANsharing agreements in a more flexible and sustainable manner. You can draw parallels between the outsourcing of the RAN and the outsourcing of passive infrastructure. Historically passive infrastructure used to be shared via barter arrangements, but the entrance of towercos brought efficiencies to the sector and created a sustainable business model with long term visibility on cash flows. The same business model exists for sharing of the RAN, augmented towercos can be a long-term partner that facilitates sharing.

Historically you have really only seen RANsharing in legacy technologies, with the difference in deployment of new technologies being seen as a competitive advantage. With 5G that is changing; you are seeing operators engaging in RANsharing from day one.

It remains to be seen how repeatable the model we are set to explore in Poland is in other regions but we have the right ingredients to test the model; there is a very innovative player like Polkomtel that is willing to make the step to sell active infrastructure, and then in Iliad we will have another anchor tenant which has a very pragmatic approach. The Play deal has been just closed on April 1st and so we have been unable to engage in discussions regarding RANsharing, but the rationale looks reasonable and it is the right time to embrace the new model.

TowerXchange: With developments such as the formation of Vodafone’s Vantage Towers and Orange’s TOTEM, both with an appetite to explore JVs and M&A, are we seeing a material shift in the type of tower strategies operators want to follow in Europe?

Alex Mestre Molins, Deputy CEO, Cellnex: Today in Europe, we currently find ourselves in a moment that we have always dreamed of being in, where all MNOs are open to discussions around towers. Those discussions involve majority control, minority control or no control at all, and Cellnex has a preferred setting, but the key fact is that all MNOs are making proposals around their towers.

There are different possible outcomes, and these outcomes may evolve over time, as we have seen with Telefonica and SFR [both of which created their own towercos, Telxius and Hivory, prior to those entities then being sold to independent towercos], nothing is set forever.

As to how the market will mature, it may take a while for things to play out and for things to settle, but we believe that in the long run, the game should be based on a neutral host model, with that neutral host being more credible if independently owned. If a towerco is vertically owned it still serves the need of the MNO parent. That being said, we see the formation of MNO owned towercos as positive as it means that towers are on the table.

TowerXchange: We have spoken at length about Cellnex’ inorganic growth but homing in on organic growth, what is Cellnex’ outlook, what factors are underlying this and what steps is Cellnex taking to maximise their organic growth potential?

Alex Mestre Molins, Deputy CEO, Cellnex: We see three levers for organic growth. Higher frequencies will necessitate increased points of presence which will in turn require both an increase in tenancies on existing sites as well as the rollout of new sites.

Thirdly, as part of our organic growth, there are efficiencies to be captured by avoiding the building of a new site if there is an existing site nearby, or by consolidating two existing sites. It is logical to think that if we have two anchor tenants in a market, and committed BTS pipelines for each anchor, we should be able to consolidate and achieve these kinds of synergies

Watch a video showing Cellnex’ European site evolution here

TowerXchange: With the rollout of 5G we have heard various statistics about the exponential increase in the power demands and carbon footprint of telecoms networks. As such a significant player in the European telecoms market, what role does Cellnex see itself playing in managing the carbon footprint of Europe’s networks?

Alex Mestre Molins, Deputy CEO, Cellnex: It is an important point to note that when compared with pre-existing technologies on a per bite basis, 5G is more energy efficient. Additionally, the benefits enabled by 5G, such as enabling interpersonal connectivity without the need to travel by car or by air, will have a net positive impact on reducing energy consumption. That being said, with many more bites set to be used, and 3G and 4G networks set to remain in place, networks will become more energy intensive.

To remedy this, as part of our ESG 2021 ’ 2025 (which was approved by the board in December) Cellnex has committed to ensuring that 100% of power consumed comes from renewable sources by 2025. As of today, we have PPAs in place that mean 40% of our power is certified as green. As well as committing to purchasing green certified power, Cellnex is directly deploying renewable energy solutions. One example of this is the rural site we have developed which uses both solar and wind power, and which is entirely self sustainable. This design is part of the plans that we are developing in several countries with the Next Generation EU Recovery fund to bring network coverage to rural areas.

Cellnex has signed up to the Science Based Target initiative (SBTi) and Business Ambition for 1.5?C commitment, working to keep the global temperature increase below 1.5?C and improving upon the 2?C limit laid out in the Paris Agreement. We expect to reveal further details on our plans to achieve this in June.

Alex Mestre and the Cellnex team will join TowerXchange Meetup Europe on 25-27 May, for more information, please visit https://meetup.towerxchange.com/europe