Africa Mobile Networks (AMN) has nearly 2,000 sites live after a flurry of activity. AMN has targeted rural areas which were previously uncoverable with a low-cost tower and a revenue share model different to the towerco business as usual. AMN has vertically integrated passive and active telecoms infrastructure, to drive down costs. AMN is now expanding into semi-urban areas with a turnkey solution and a plan to reach 5,000 sites by 2023 on its way to becoming one of Africa’s biggest towercos. TowerXchange sat down with CEO Mike Darcy for the first time since 2019 for an update on the innovative towerco.

Africa Mobile Networks will be taking part in TowerXchange Meetup Africa on October 5-7 online and in Dubai on October 12-13. Join them here.

TowerXchange: It’s been two years since TowerXchange interviewed you (and what a two years), can you please outline how things have gone since mid-2019?

Mike Darcy, CEO, Africa Mobile Networks:

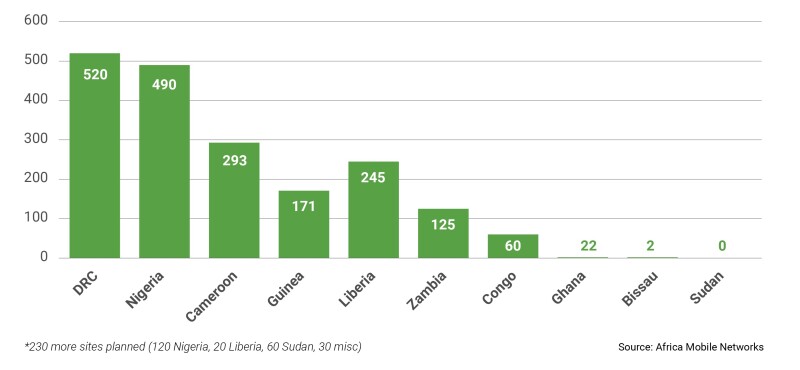

To set the scene, Africa Mobile Networks (AMN) did a fairly major fundraising in 2018-2019, which had been primarily led by Intelsat. Intelsat invested US$25mn in AMN with some others taking the total investment to some US$30mn. We used that investment to kick off our first major build phase from late 2018 into 2020 which saw us build close to 2,000 sites in ten countries.

2021 has been a relatively slower year for us because we have deployed most the equipment which we been bought with our previous fundraising. Since our first major build phase wound down, we have been working on the next phase of fundraising to finance our next step. At the end of June we closed a deal for nearly US$40mn with a Metier-led consortium. The consortium includes CDC Group (the UK’s development finance institution and impact investor), DEG (Germany's development finance institution), Proparco (the private sector arm of the French Development Agency), Mauritius Commercial Bank’s Equity division and other leading financial institutions and investment managers.

As far as I am aware, this is the first time that an investment in rural connectivity has been made as a purely financial investment. Intelsat and Facebook’s initial investment in us was strategic – they thought what we would do would benefit their core business. But Metier and its consortium are expecting a pure financial reward. It’s a key milestone for investing in rural connectivity for it to stand on its own two legs.

We are now once again in the process of deploying these funds. The circa US$40mn will allow us to go from 2,000 towers today to over 5,000 towers by 2023. It will also allow us to expand into a couple more countries.

We have equipment is in the supply chain for our next 1,200 sites, and we hope to have this all deployed from the middle of 2022, to take us above 3,000 sites in 2022, and to 4,000 or more during 2023.

AMN has also moved beyond being just an infrastructure company, with our acquisition of Range Networks Inc. Our core business remains building small towers in rural villages to deliver a service economically, but the acquisition of Range allows us to build our own radios, reduce our cost base and increase our flexibility.

Figure 1: Africa Mobile Networks site count

Mike Darcy, CEO, Africa Mobile Networks:

We have developed a new product: a 20m lattice tower with a new business model. This is the service which we intend to use to take on conventional towercos in the battleground which exists between the rural core focus of AMN and urban core focus of the Big Three towercos. There is a space in semi-urban/semi-rural markets for us to take on the conventional towercos.

Our 20m tower is different to our core business, which relies on lightweight poles and a revenue share model. Our lattice towers are a build-to-suit product for the towerco on an opex model; much more akin to a traditional towerco, but with AMN’s lower cost-base and our own radio. AMN is in a better position because we offer a full turnkey solution. MNOs do not need to sign a tower deal with a towerco then sign a separate deal with Huawei, Ericsson or Nokia.

We all respect the big towercos and I think they’ve built up fantastic businesses, but they haven’t needed to go too far out of their basic toolbox of best practice towerco processes. The towercos’ IPOs and industry consolidation have endorsed the model. Their business model has worked great for them and their tenants, but there are new challenges. As towercos start to saturate the available urban markets and finish acquiring the last high value Tier 1 tower networks, how are they going to expand? They are going to have to go further afield and come into competition with AMN. And to that I say: may the best man win.

TowerXchange: With your first 2,000 towers behind you, and a healthy EBITDA margin it is safe to say you’ve proven the model. What’s been easier than you expected?

Mike Darcy, CEO, Africa Mobile Networks:

There are some things which surprised me positively. The performance of our Nigeria team has been utterly outstanding. The AMN model has always been about removing cost from the process, so we developed smaller sites which could be constructed in a single day, to reduce the associated costs. On occasion our Nigeria teams have installed three sites each in a single day. Can you imagine three sites in one day? This can only happen where sites are located nearby to one another, but it is a total transformation for that area which has previously been a connectivity dead zone.

And the technology which we’ve developed at Range has been exceptional too – we’ve avoided the usual IT snafus. We have deployed our new RAN in Liberia and our core network integration with MTN and our system just worked perfectly. Voice quality is better, coverage is better and we proved our new technology on its first deployment.

TowerXchange: Now for the flip side of the coin. What’s been much harder than expected?

Mike Darcy, CEO, Africa Mobile Networks:

The thinks which are more difficult are what you’d expect. Building low-cost towers is a logistics game and at times getting stuff from factories in China to villages in Africa is hard. There are customs pre-inspection checks, it can take time to get space on a ship and every delay reduces the time your site is active and earning money.

We also underestimated the weather in parts of Africa, where it can get very bad. The rainy season is a big issue and can reduce the amount of sunshine our solar panels receive. Similarly, the trucks used for site construction are affected by the bad weather.

But we’ve found regulators to be helpful, and for our customers to be happy to be working with us. So overall the process hasn’t been so painful.

IHS Towers, NuRAN and others are looking at a revenue share model based on Open RAN technology. What do you think of the challengers adopting the “AMN model”?

Mike Darcy, CEO, Africa Mobile Networks:

For a long time, rural Africa had no coverage. There were several projects attempting to solve this problem and without exception they failed and those sites were switched off because they were not economical. AMN has a different approach. People are looking at AMN are thinking they can sign a contract and begin doing what AMN is doing, but that won’t work.

The challenge isn’t building a base station, it is making a base station work in areas with US$1 ARPUs. AMN has pushed its unit costs down as much as possible and we ask for a large share of the revenue, because we have to. That’s how you get the ROI to make these sites sustainable. Your R needs to be high, which is a function of the commercial terms you agree, and your I must be as small as possible. Some companies are entering our space with a per-site cost three times higher than ours, and with a cost base like that you cannot get an "I" high enough to create a sustainable ROI.

My view is that there are many people that have come into our space and I don’t have any problem with that whatsoever, competition is generally a good thing. Most of those companies are going to find this is a really difficult business to be in and won’t be around for the long-term. Companies failing will show how well AMN does what we do.

TowerXchange: With 2,000 sites you must have a mixture of high-revenue and low-revenue sites. What proportion of sites are duds and what do you do with them?

Mike Darcy, CEO, Africa Mobile Networks:

Our business is not so different from being an operator. Most MNOs get most of their revenue from the top 20% of their towers, they would have 20% of towers which are unprofitable and 50-60% of sites washing their face, but which are important because subscribers value coverage very highly. You cannot just run the most valuable sites, and all networks such as ours have a bunch of sites not doing that well.

We do find some sites underperforming, and where we identify our bottom-performing sites we recycle them. If a tower doesn’t make much money then the tower is moved. That self-imposed churn allows us to increase average traffic and average revenue in a continual process of recycling our worse performing sites.

Because our business model is based on a revenue share we are taking the operator risk and we reserve the right to choose the location and configuration of our towers. This works for both parties as we are incentivised to find the most profitable location for a mobile operator, while still expanding their coverage.

This strategy of recycling sites is what led to our opex model being born. Without exception, when we speak with an operator, they will present us with 100 sites and will only cover 20 which match our criteria. By offering sites on an opex basis, operators get the coverage where they want it and we do not need to take on any operator risk.

But with opex sites, just like with our revenue share sites, we offer to relocate if the site is not performing. For US$5,000 to cover our costs we will relocate one of our pole-based sites (relocating a lattice would cost more) to try a new area. This creates good incentives locally to use-it-or-lose-it and enables us to make our own sites more profitable and our customers’ sites more sustainable.

TowerXchange: How is your site typology changing? Are you updating or changing your power set up?

Mike Darcy, CEO, Africa Mobile Networks:

We are calling the new version: Version 3. Version 1 was launched in 2016 with lead acid batteries, which required a ground-based cabinet. In 2018 we launched Version 2 which incorporated lithium-ion batteries and a cabinet attached to the pole. This was safer, required less maintenance and had a better solar system, up to a 250W peak load. Our Version 3 launched in 2021 with a slightly fatter pole, bigger solar panels, bigger batteries and an upgraded power systems that can reach 500W peak.

Our improvements are not dramatically reducing costs anymore, but we are increasing performance even while faced with shortages and sourcing challenges. We have gone from a low power version to a higher power version without increasing the cost.

Availability on our sites is still increasing, despite the troubles with rainy seasons mentioned above. Our contracts are for >99% end-to-end availability. That means our power system needs to be better than 99.7%, our VSAT better than 99.5% and equipment better than 99.9%.

TowerXchange: You recently raised more capital. Do you still feel capable of reaching 20,000 sites with AMN? What is your remaining trajectory?

Mike Darcy, CEO, Africa Mobile Networks:

20,000 is a very doable number. I believe 20,000-30,000 is the addressable market for revenue share across all of Africa. 10,000 sites by 2026 is what is firmly in our business plan. That is what the investors have invested in.

A lot of these sites will be in existing markets like Nigeria and the DRC. Liberia is even more positive than we expected. We will continue to build in existing markets and will add more countries, like Benin and Cote d’Ivoire. Madagascar is also a target for us – but at the moment I cannot say with which operator.

We should complete 3,000 sites by the middle of next year and 4,000 by the end of next year and 5,000 by 2023. We have all the equipment in our supply chain for the 3,000 sites, so once it arrives, we must just assemble and install. If we are still an independent company within five years’ we will IPO.

Africa Mobile Networks will be taking part in TowerXchange Meetup Africa on October 5-7 online and in Dubai on October 12-13. Join them here.