TowerXchange Meetup MENA took place on March 28-30. At the show we learned how MNOs were planning to sell more sites to towercos and how the digital infrastructure industry had reached maturity in the region. As presented in our opening keynote, as of March 2022, 41,678 of MENA’s 279,852 towers were owned by towercos. That’s just 15% - proof that MENA has been a region playing catch-up with the rest of the world for too long. Now though, after some false starts, we can comfortably predict the path to towercos managing 100,000 towers in MENA, as the sector has set itself on a clear growth path.

How are towercos growing?

Following TowerXchange Meetup MENA we are happy to share the path we see for towercos reaching their first milestone of owning 20% of the region’s sites before next year.

TowerXchange predicts 63,138 towers will be owned and managed by towercos by the next time we meet in March 2023, which will be delivered largely though three signed deals. We also know of a number of other deals which will be announced or closed between now and March 2024 which will take the industry’s total scale to 100,000.

TASC Towers have signed deals with Zain for 4,551 in Iraq and 500 in Bahrain. Iraq and Bahrain should both close before the end of Q2. In Oman, Helios Towers have been working with the regulator to close on the acquisition of 2,890 towers from Omantel and expect progress very soon. In Saudi Arabia, Zain has agreed terms to sell 8,069 to PIF. These 16,010 sites are just the announced SLBs, others are in the works. We also expect to see Jazz’s 10,500 sites held in Deodar to be sold to a new owner this year.

Pakistan has seen a boost in build-to-suit activity, which has increased from less than 2,000 to 4,000 towers a year, with 90% or more built by towercos.

In Egypt, IHS Towers have an agreement to build 5,800 towers over three years. If we assume 1/4 will come in year one, with 3/8 in both years two and three, then 1,450 towers will be added by the towerco there in the next 12 months. Oman Towerco is also building 100s of sites a year. Together with known SLBs, these total some 21,460 predicted new sites built or acquired by towercos.

Can towercos grow further? Certainly. Zain announced on stage that it was planning a sale of its sites in South Sudan and Sudan where TowerXchange estimates 2,300 sites will come to market. There is also the strongly rumoured sale or carve-out and potential sale of Telecom Egypt’s 2,400 sites.

Telenor and Ufone in Pakistan are also both considering tower sales, but will wait until Jazz have sold Deodar before making their own play.

TowerXchange views all of these transactions as less certain to have closed by next year, but expects progress.

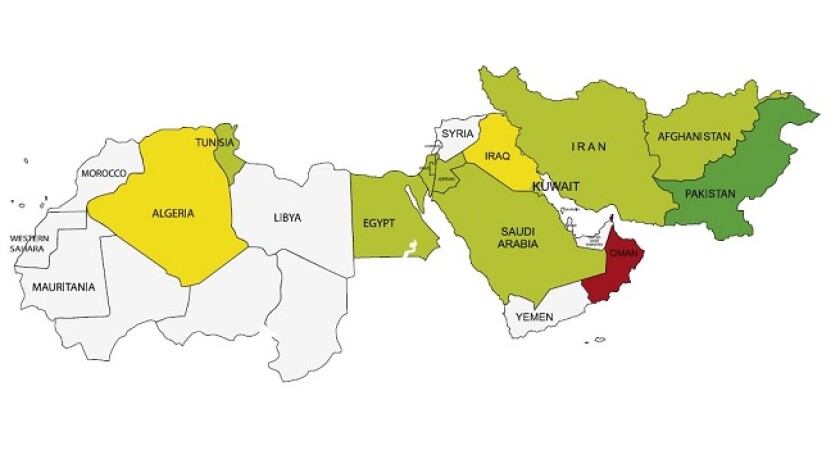

Beyond these deals we also have an official review of tower strategy by Ooredoo. TowerXchange estimates that Ooredoo own around 20,000 sites overall, and while their 6,000 sites in Algeria and Palestine look difficult to sell, the remaining 14,000 sites in Iraq, Kuwait, Oman, Qatar and Tunisia would be attractive and imminently available. However, given historic timelines TowerXchange does not wish to predict any closed deals by March 2023. We do however expect some announcements.

Add to the above solid prospects potential sales by operators in Egypt, Jordan or Pakistan or more difficult to sell towers like those of Tunisie Telecom, or Korek Telecom in Iraq and you have a path to over 100,000 towerco controlled towers in the next 2-3 years.

Realistically, TowerXchange is comfortable predicting 63,138 towerco owned towers in MENA within the year, with potential upside in announced or closed deals for a further 20,000. TowerXchange is assuming a 5% annual rate of growth in towers in MENA, and thus predicts towercos will own 21% of the region’s towers by Q1 2023, rising to 32% in Q1 2024 (see figure 1).

Where is the action today?

That was all about the future, but what about the here and now? There are three key markets which dominated discussions in Dubai, and several mid-sized markets which continue to attract widespread interest. Saudi Arabia, Egypt and Pakistan are all seeing significant investment.

In Saudi Arabia, we heard that the macro-layer rollout of 5G has now been completed, and so attention is now turning to the more difficult task of building out the Kingdom’s low-latency network.

Consolidation of Zain’s towers by TAWAL should help with this but the sale to PIF is yet to close. TAWAL has been busy connecting sites to the country’s grid and pushing out extraneous use of diesel generators. In the next year hundreds of new macro sites in the Kingdom will be required to support new projects, just as hundreds will be decommissioned to remove parallel infrastructure.

In Egypt we learned that IHS Towers have begun negotiations with MNOs to build out its 5,800 sites over the next three years. It has been four years since MNOs began their LTE rollouts, but coverage outside Cairo remains spotty. 5G is s few years away in Egypt, but with a New Capital City of 5-6mn people being built, plus large and relatively dense rural populations requiring coverage, there is a clear path to building thousands of sites a year.

In Pakistan we learned that the rate of expansion will accelerate, with 2,000 new sites a year in 2021 increasing to a 4,000 site per year growth rate. Pakistan has an 86% mobile penetration rate which is growing rapidly. There are 108mn broadband subscribers in the country of 220mn people which leaves plenty of room for growth for the more lucrative 4G market.

That’s good news because with total revenues of US$4bn and an ARPU of just US$1.3 the market is both a victim of high taxation and cutthroat competition. 5G spectrum is expected to be made available from March 2023, but the market will remain driven by 4G BTS for some years.

As mentioned above, we expect a buyer for Jazz’s towers to be announced this year, and we wouldn’t be surprised if Telenor or Ufone followed suit. We also heard about successful ESCO trials in Pakistan, so it appears likely that if Telenor, Ufone and Zong retain their towers that ESCOs will be the ones helping to free up energy capex for them to invest in the rest of their networks.

We also got updates on what’s happening in Oman, Iraq, Bahrain, Sudan and South Sudan as well as Ooredoo’s plans to bring towers to market. Zain are now negotiating a sale of their towers in Sudan and South Sudan. In a competitive process, TASC Towers appears to be in the lead, but until the deals are signed we will have to wait and see to discover what happens in those two challenging markets. TowerXchange estimates Zain currently own 2-3,000 sites in Sudan and about 300 in South Sudan. Oman continues to see demand for hundreds of new sites from Vodafone Oman which is currently reliant on Oman Tower Company for its new sites.

Strategy in the region

Rather than “clean” sale and leasebacks, the region is gravitating towards a strategy of retaining equity in towerco vehicles. Both TASC Towers and Zain referred to ambitions to control digital infrastructure. “TASC is an infrastructure platform” said Marc Perusat from the stage, which implies a wider ambition than just managing steel and grass.

Zain has retained a 20% equity stake in its towercos in Kuwait and 25% in Jordan and is planning to do something similar in Iraq, Bahrain, Sudan, South Sudan and Saudi Arabia. Zain’s holdco will then own both a digital services company on the one hand, and stake in a digital infrastructure company on the other.

The strategy has echoes of the African tower sales of the 2010s where MNOs were keen to hold some “schumck equity.” There was a concern that the towers may be undervalued in the sale and so equity in the towercos was retained to share some upside with the seller.

These sales saw Millicom, MTN and Vodacom build substantial equity investments in American Tower, Helios Towers and IHS Towers. However, the strategy of the MNOs in Africa was never to build a towerco platform for themselves, or to build a digital infrastructure business arm.

As the towerco model has expanded we are increasingly seeing MNOs get in on the act. Some of this is being achieved through carve-outs and independent operations like Axiata’s edotco, stc’s TAWAL or Vodafone’s Vantage Towers.

In other cases, MNOs are forming partnerships and retaining equity in their sold towers. Zain were at pains to point out that independent operations was of the utmost importance for the towercos it retained a stake in. And TowerXchange would be unsurprised if we saw many other MNOs in the region following a similar strategy.

Creating a sustainable industry

TowerXchange Meetup MENA was the meeting place for the industry, with 200 people present on site across the two days and I couldn’t begin to enumerate the different discussions taking place on site. However, a few topics were front of mind for those on site.

Sustainability was a big topic. Given low fuel prices and high solar irradiation the price of energy in the Gulf is not the problem; the challenge is seen as finding a balance between corporate strategies favouring sustainability and the realities on the ground.

Each telecom tower is responsible for 20-30 tonnes of CO2e which needs to be eliminated by 2050 if the industry is to meet its goals. This presents a huge change management issue because it is hard to get people off business as usual and business as usual is not producing the efficiency improvements or reductions in emissions necessary.

In fact, we learned that in response to supply chain shocks sales of diesel generators have reversed trend and increased in pace over the last 12 months, as people return to tried and tested methods.

Three economic challenges to the industry in MENA are holding back a pitch towards sustainability.

In some markets tower rely on good grid connections and the grid is based on cheap and reliable carbon-based generation. In such cases back-up power can be made green, but going off grid and relying on local renewable generation is simply not economic.

Fuel subsidies also make green non-grid power uneconomical too: In Egypt diesel is only US$0.43 per litre, a quarter of world price. This heavily skews any investment decisions around installing renewable backups or primary power.

A third economic challenge has been the trend towards standardised solutions at towercos. This has meant that standard power installations have been used at sites where a low-carbon solution would work and be economic. We heard at the event that this trend was reversing somewhat: towercos are moving their focus from mere operational efficiency to operational efficiency + sustainability which will involve a multiplication of site designs to incorporate more sustainable solutions.

In the interest of brevity TowerXchange won’t share more on the other topics of discussion, but in summary; 5G, small cell and IBS solutions are seen as the next big thing as macro-layer 5G reaches completion in the GCC and networks need to move to implementing mmWave solutions while supporting megaproject delivery.

Operational solutions that include improvements in site monitoring and site control are being rolled out, with TAWAL and Eastcastle Infrastructure both highlighting the potential of artificial intelligence for improving towerco operations. If you would like to join in these discussions then please join our next Meetup!

Next year

TowerXchange is planning to return to Dubai on 14-15 March 2023 and we would be delighted if you could join us again. We believe this region, as elsewhere in the world, is well suited to the towerco model. As 5G investment and increased network density creates new complexities the requirement for dedicated digital infrastructure managers will grow. You will meet those towercos and infracos at our next Meetup alongside those companies that have already signed up for next year.

A huge thank you goes to the companies that have already signed up to sponsor our 2023 show: Ascot, Asentria, Bladon, BSS Engineering, Duatron, Delmec and Polarium. See you all at the next TowerXchange Meetup!