Since TowerXchange hosted the last in-person Meetup Asia in December 2019, over 350,000 towers have changed hands on the continent. The M&A tap has been turned on, as requirements for increased connectivity and data consumption are driving a steady stream of investors into the telecom tower space. With so many transactions already having completed in the past two and a half years, TowerXchange bring you the next wave of opportunities for investors to acquire stakes in Asia’s towers.

Australia – BAI Communications

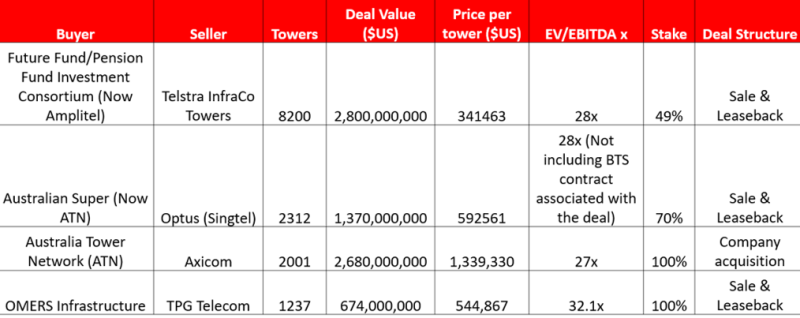

Australia has been a hotbed of tower transaction activity in the past 12 months. All three MNOs have sold their towers, and two new tower companies have been formed by the pension funds whom purchased stakes. One of these towerco’s (Optus and AustralianSuper’s ATN) then acquired the former largest independent towerco in the country, Macquarie backed Axicom, in 2022 and OMERS have acquired local up and comers Stilmark to run the towers they acquired from TPG Telecom.

BAI Communications announced in February that owners Canadian Plan Investment Board (CPPIB), AIMco, and Kindle Capital were looking to sell out in full. The sale is being run by Barrenjoey Capital and while it kicked off in April, no news around a buyer has surfaced.

With so much recent history, there is reason to believe that BAI Communications Australian towers won’t come cheap, the EBITDA ratios of operator-owned towers in Australia has been more in-line with the valuations that have come to be expected of the publicly listed US towercos .Private investors typically pay a premium for their towers, but it should be noted that as the BAI towers are not operator owned, they more likely to have a higher lease up and thus be higher value.

Figure 1 – Recent tower transactions in Australia

BAI operates 774 towers, although TowerXchange understands that they own around 600, which host MNO tenants and broadcasters including ABC.

BAI Communications (formerly Broadcast Australia until November 2019) was initially formed by Macquarie bank after they purchased Australia’s National Transmission Agency in 2002. CPPIB became majority investors in 2009. While BAI Communications owns a portfolio of broadcast and mobile towers, focus in recent years hears has been shifted to offer a range of shared communications infrastructure. They have completed several projects focused on metro and inbuilding connectivity.

New Zealand – Spark Towerco and Vodafone

The towerco fever which took hold in Australia last year has crept across the Tasman Sea to take hold in New Zealand. Spark New Zealand announced in its February 22nd earnings call that it plans to carve out 1,250 of its 1,500 tower assets into a new subsidiary that will be named Spark Towerco.

It also plans to explore the introduction of outside capital, in a model that mirrors the Australian transactions of 2021 and early 2022. While Spark confirmed they will commence a process to explore the introduction of third-party capital in the next few months, there is no certainty a transaction will proceed.

In May, a new CEO for Spark towerco was revealed in Rob Berrill. Berrill has previously led out on Spark’s infrastructure and property portfolios for a number of years, and played a key role in the design, launch and scale up phases of the Vodafone Procurement Company.

If Spark do introduce third-party capital they will retain a shareholding and remain a key anchor tenant, and are open to the towerco offering them additional services which would be removed from the Spark operating model. Spark plan to continue to invest in modernising their mobile network and improving coverage alongside the sale. The Auckland based MNO has enlisted the services of local investment advisors ForsythBarr and Jarden to run the sale process.

Shortly following Spark’s announcement, news broke that Vodafone New Zealand was also interested in selling an 80% stake in its 1,487 towers. Vodafone New Zealand is currently owned by Brookfield and Infratil. The Vodafone auction process is being run by UBS and Barrenjoey Capital (the latter of which is also working on the BAI transaction).

Bangladesh – MNO towers and AB Hightech licence

Bangladesh offers a fast-growing emerging market for an investor in towers, not to mention one of the most towerco friendly legislative environments in the world.

Mobile download speeds averaged just 11MBS (the lowest across South and Southeast Asia) during the height of the Covid-19 pandemic. Bangladesh is also very low down the telecoms league table in terms of sims per tower (4135), highlighting a drastic need to invest in telecom infrastructure.

Figure 2: Sims per tower in select Asian markets (Q2 2022)

The first opportunity to invest in towers came in 2020, when after two years of fierce negotiations on establishing a regulatory framework, three new towerco licences (in addition to incumbent edotco) were awarded by the Bangladesh Telecommunication Regulatory Commission (BTRC). One of those three towercos now appears to be inactive and as such TowerXchange understands that the licence of AB Hightech is available to other parties looking to enter the country.

In addition to taking over tower building and management from AB Hightech, there is also a significant opportunity for sale and leaseback transactions with Bangladesh’s MNOs. Between them, TowerXchange estimates that they own 23,700 towers in the country.

The aforementioned legislation dictated that not only could MNOs not build their own new towers, but that all four must make their towers available for sale or lease by November 2023. While this deadline may be extended, it is within the operators' best interests to conduct a sale sooner rather than later, to benefit from a first mover advantage, and before their already aging infrastructure is devalued even more.

Figure 3: Estimated Tower Ownership in Bangladesh

In line with the strategy across the VEON group – Banglalink are looking for a buyer for 5,500 of their 6,200 towers. It is likely that the entire portfolio will be sold to just one of the four tower companies. VEON would put the capital raised from a sale towards expanding its coverage across Bangladesh.

Although Grameenphone (Telenor) could be looking for a similar deal soon, they have near Bangladesh wide coverage already and are in a healthy financial position and so are less financially motivated. In Europe, Telenor has carved out wholly owned towercos in Norway, Sweden and Finland but has yet to divulge any plans for its Asian assets.

To give an idea of the returns that a scale play in Bangladesh might offer to a towerco, edotco Group provide a valuable case study. Present in the country since June 2013, the Axiata carve out owns 13,419 towers, and manages a further 3,775. As of Q122 it reports 19,808 tenancies for a tenancy ratio of 1.47x. In the same period, edotco Group reported revenue of 192 million RM in Bangladesh, ($US43.6 million).

India – GTL Infrastructure

While not even scratching the top three towercos in India, GTL Infrastructure’s 28,000 sites still makes them a significant player by international standards. Plagued by the financial woes that scoured the Indian market at large over the last five years, GTL has had a tough time of late, and it has been rumoured that a sale would be considered for the publicly listed Indian towerco.

India has immense build to suit opportunity. It recently overtook China as the world’s largest data consuming economy, but has just 25% of their towers. With the 5G spectrum auction and rollouts coming in H222, estimates from the industry suggest India needs to build a further 500,000 towers in the next five years. With the MNO market settling into something of a status quo, this could be the best time in half a decade to invest in Indian towers.

Considering the competition (See figure 4 for Indian tower counts as of Q222), a scale play makes the most sense for a fresh investor looking to acquire Indian towers.

Figure 4 – Estimated tower ownership in India

Taking over GTL would not be a simple task. The towerco has reported year on year losses for the last five years, and the share price has fallen 73% in that time. Worryingly, revenue has also failed to increase during that time, but recent trends in the company's stock suggest that a recovery might be on its way.

Malaysia, Myanmar and Vietnam – OCK

Malaysia, and specifically Kuala Lumpur, serves as home base for as many as three pan-Asian towercos. In addition to edotco and EdgePoint Infrastructure, OCK Group are a tower manufacturer and installer, turned towerco that own 4,300 towers in Malaysia, Myanmar and Vietnam. It has been rumoured for some years that OCK’s is up for sale, but fresh fuel appears to have been added to the fire as of late. OCK’s 500 towers in Malaysia would certainly be appealing, but it is perhaps Vietnam that offers the biggest opportunity.

A market yet to be penetrated at any significant scale by towercos, OCK’s portfolio of approximately 2,700 towers is the largest of any independent player.

Management and ownership of towers in Myanmar could prove to be a challenge – as any buyer would likely have to work with the unsavoury military Junta government to find a local partner, in the same vein as M1 Group upon their purchase of Telenor’s opco in the country.

Private Equity CVC and market leaders Irrawaddy Green Towers have also been in legal disputes over a transaction that was agreed just before the Junta took power. Ownership of Myanmar-based towers has also been cited as an inhibitor to a public listing of edotco.

Indonesia – Protelindo

Indonesia’s largest tower company (29,011 towers) is looking to raise US$1billion and has considered an equity sale of 15-20%.

Protelindo has been busy on the acquisition front itself, and spent about the same amount on over 6,800 towers and 750km fibre from STP Towers at the end of 2021. Shares in Protelindo jumped 4.6% in wake of the news, which was reported by Bloomberg on June 15 2022. Protelindo is listed on the Jakarta Stock Exchange.

Talks are understood to be ongoing, with pension funds and infrastructure funds the target of the sale. Protelindo President Director Ferdinandus Aming Santoso commented that Protelindo would consider raising the money through debt and equity.

In addition to their strong tower portfolio, Protelindo have been avid investors in fibre across Indonesia. Protelindo’s most recent acquisition was the acquisition of a 90% stake in PT Solusi Tunas Pratama (STP Tower), announced in September 2021 which saw them inherit 6,700 towers and around 6,000km of fibre.

Some of Protelindo’s most notable tower acquisitions include two deals with XL Axiata (collectively acquiring over 4,000 towers), their 2019 deal with Indosat Ooredoo, the acquisition of towerco PT Komet Infra Nusantara (KIN) and its 1,400 tower portfolio in 2018, and a 2012 deal with Hutchison 3.

Protelindo’s 2015 acquisition of iForte provided the springboard for the company to grow its fibre and business from 750km to 70,000km in the space of seven years.

Figure 5 – History of tower acquisitions by Protelindo

Philippines – Globe Telecom and PLDT’s remaining towers

A new favourable regulatory framework, immense build to suit opportunities and the prospect of significant SLB deals with incumbent MNOs Smart (PLDT) and Globe Telecom has spurred huge interest in the Philippines. The first of these deals has already been completed, with edotco and EdgePoint acquiring 5,907 towers from PLDT between them in April 2022 for just under $US1.5bn.

The first 3,012 of these towers have been transferred to the two towercos, who are now the new leaders in the market with the rest of the towers due to be transferred by the end of the year, and PLDT already mulling a sale of the remainder of its tower assets (7,067 sites) next year.

PLDT competitor Globe has also begun a process to raise a similar amount, by selling half of its own portfolio of 12,194 sites.

The Philippines is an extraordinarily attractive market for potential investors in Asian towers. In addition to EdgePoint and edotco, numerous infrastructure funds and towercos both domestically and abroad have established local operations in line with the DICT’s Common Tower Policy.

Anyone looking to invest in the tower space should note that Independent tower companies in the Philippines must be at least 20% owned, or in a consortium with, companies with at least five years of experience constructing, owning, operating and/or maintaining towers in the country.

Want to learn more?

Later this year from 29 November - 1 December TowerXchange is gathering the who’s who of APAC towers for TowerXchange Meetup Asia. Across three days of networking and discussions about the present and future of the industry we will dig deeper into the transactions that have shaped the market and you will have the opportunity to meet the sellers and potential buyers of the next wave of Asian tower M&A. For more details contact Jack Haddon, Head of Research, APAC, (jack.haddon@towerxchange.com)