AustralianSuper and Singtel backed Australia Tower Network (ATN) have made a number of headlines already in 2022. The latest news coming from the 4,383 site towerco is the unveiling of its new name – Indara Towers. The rebrand reflects the organisation's ambitious strategy to empower Australia’s digital future by providing a growing range of digital infrastructure solutions and services beyond towers.

Indara’s Chief Executive Officer, Cameron Evans, said the organisation selected Indara, relating to ‘strength’ and ‘powerful force’ in Spanish because it speaks to reliability, connectivity and collaboration, and the powerful impact that digital infrastructure will continue to have on Australia’s increasingly digital communities.

Reflecting on the news, TowerXchange recaps ATN’s formations, explores the two major deals the company has brokered in 2022 to expand its portfolio and looks ahead to predict the new assets and services the business could invest in providing next.

October 2021: Optus finds buyer for tower portfolios

Singtel owned Optus, who enjoy the second largest mobile market share of Australia’s three MNOS, announced at the end of 2020 that they were looking to monetise their 2,312 mobile network towers and rooftop sites.

The towers attracted interest from Brookfield Asset Management, IFM Investors, American Tower, Symphony Consortium (which consisted of Stilmark Holdings, Atlantic Tele-Network International and Canadian pension fund OMERS), QIC, Axicom (Australia’s largest independent towerco at the time) and other Australian investors.

In the end though, it was Australian pension fund AustralianSuper that won out, and by taking a 70% stake in ATN they found themselves in control of the largest independent towerco in Australia. Telstra carve out Amplitel is still 51% owned by the market leading MNO, so despite its 8,200 sites, it does not meet TowerXchange’s definition of an independent towerco.

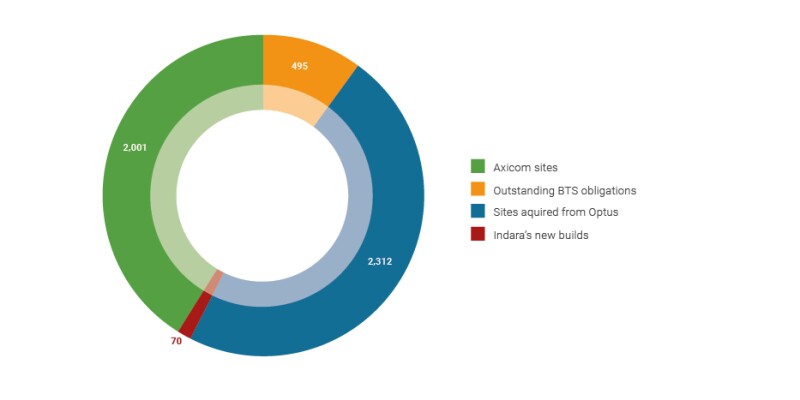

The transaction valued ATN at A$2.3bn (US$1.67m). which represents an impressive EV/EBITDA multiple of 38x. Optus entered into a long-term agreement with ATN to maintain access to the sites, while also agreeing to serve as anchor tenant on 565 new build-to-suit towers that will be constructed before the end of 2024. As of publication 70 of these new build sites have been completed.

May 2022: ATN closes acquisition of Axicom

Axicom began its life as CrownCastle Australia in 2000 when it acquired the majority of its 2,001 towers from Optus and Vodafone. A fund led by Macquarie Infrastructure and Real Assets bought the business in 2015 alongside UBS and the UniSuper pension fund. At the time the consortium paid 16x EBITDA for Axicom, which represented a sum of US$2billion. At the time Axicom managed 1700 sites.

ATN’s acquisition of Axicom was for 100% of the company and was worth an estimated US$3.5bn at an EBITDA of 27x. Speaking with TowerXchange at the time of the deal, CEO of the now Indara Towers Cameron Evans explained “Axicom is also a very complimentary business to ATN, as our networks have very few overlaps. Bringing the businesses together significantly increases our coverage across the country. We see this as a good thing for our customers, as we can offer more sites.”

There will be very little decommissioning, and only about 7% of the sites overlap. Axicom were considered one of the frontrunners when it came to acquiring the Optus towers in the first place due to the two networks history. ATN essentially represented one chunk of the Optus network, while Axicom controlled the opposite piece of the puzzle so bringing the two portfolios together made a lot of sense.

Figure 1 – estimated tower ownership in Australia (Q322)

September 2022: Indara announces the acquisition of HUB and ENE.HUB

In late September 2022, Indara announced the completion of the acquisition of public places, digital infrastructure, and services providers ENE.HUB and HUB, which will enable Indara to expand the breadth of digital solutions available to its customers.

ENE.HUB and HUB design, manufacture, distribute, and manage smart street furniture, enabling the deployment of small cells and advanced smart city services. ATN said the intent of their acquisition was to bring the towerco one step closer to achieving their vision of accelerating Australia's digital future. Indata also expressed intent to further expand beyond their existing tower and rooftop portfolio.

Indara has a strong presence in urban locations already, mainly driven by the Axicom acquisition.

Around 40% of the original ATN sites were in suburban and rural locations, whereas Axicom was far more metro focused. Many of the Axicom sites have already been upgraded for 5G because of their urban location. Earlier this year Indara set a target to work on upgrading around 900 ATN sites over a twelve-month period from May 2022.

Indara’s approach to building a digital Infraco

Since its formation, Indara has stayed true to its intention to create a business that is focused beyond towers onto other areas of digital infrastructure. Although towers are the core of the business, and play a key part of the digital infra landscape, the ethos with which ATN approaches growth is as an infrastructure specialist that can deliver a wide range of services for its customers.

There is a strong desire from Indara’s shareholders to maintain growth, and that may be further acquisitions domestically, or it might be international expansion. It could also include indara making a further jump into small cells, fibre, data centres, edge computing, DAS or IBS solutions and private networks.

Creating streamlined workflows to enable growth

When it comes to their internal processes and systems, Indara are keen to maintain a lean operating structure, leveraging automation and digitisation where possible.

Inheriting assets from Optus and skilled employees from Axicom, Indara is in a fortunate position to combine a fresh slate in terms of legacy technology with a boom in towerco tech innovation in recent years. Indara’s IT procurement decisions will be driven by the mentality of seamless integration between systems and having customers at the center of all they do. IT they invest in must be designed to allow their customers quicker and more effective access to their asset base.

Indara are investing in a digital twin model as part of this strategy.Indara view Digital Twins as a way to utilise the information they are gathering from towers to improve access to the sites for customers, automate parts of their engineering and optimise their asset management strategies.

What’s next for Indara?

Indara’s Chair, Sue O’Connor, believes Indara's new identity reflects the company's refreshed strategic focus on customer outcomes, operating excellence, and innovation.

“Our transition to a new identity is a significant step for our organisation as we focus on strengthening our portfolio to meet current and emerging customer needs. Indara is a distinctive brand that aligns with our unique capabilities - our strong in-house technical engineering and design, and our delivery of critical infrastructure, providing communities across Australia with a range of ways to stay connected,” Ms O’Connor said.

The build to suit contract acquired during the original Optus carve out maps a road to just under 4,900 tower sites for Indara in the next two years.

Indara will no doubt have a number of opportunities in the Australian digital infrastructure marketplace to grow further beyond their tower base, and it is not unlikely that the services they are offering grow in conjunction with the variety of assets.

Figure 2 – breakdown of Indara’s tower assets and BTS pipeline

Increased responsibility for power provision?

Currently, Indara’s portfolio doesn't always include responsibility for the power supply to the site, or at least the assets that provide that power, but there is potential for this to change.

Indara have been exploring opportunities to supplement power drawn from the grid with renewable energy. As well as reducing its draw from the grid, Indara is also exploring whether it can use its assets to supplement the grid as well in a sell back scheme that is starting to be rolled out en-mass in Europe.

Unfortunately, Australia has been struck by a number of natural disasters, from fires to floods and climate volatility is likely to persist. As a result, there is far more demand from MNOs for backup power solutions, which could present an opportunity for Indara.

Will we see further assets carved out from Singtel?

Singtel’s sale of its Optus towers is not an isolated incident. The multi-market MNO has committed to an “asset right” business model that plays into an infrastructure strategy designed to unlock value through freeing up capital to reallocate and reinvest in key growth areas for the business.

In addition to its stake in Optus, Singtel owns stakes in Filipino operator Globe, Indonesian operator Telkomsel and Indian operator Bharti Airtel – all of which have sold towers to towercos in their respective markets. Telkomsel and Globes deals account for 28% of the sales and leaseback transactions that have occurred in Asia this year.

A further Singtel asset-carve out could provide an opportunity for Indara to grow its portfolio of digital infrastructure again. Optus carve are reportedly looking to divest their fiber portfolio in Australia, which is rumored to be worth over US$2bn. Singtel are touted to be eyeing up either a stake sale, partnership with an investor, or a sale and lease back arrangement.

The case for towercos to own active equipment

Australia’s towercos are all carefully observing the active sharing agreements that are being brokered between the countries three MNOs with a watchful eye and looking to explore the potential to move up the value chain and own the active equipment as a neutral host, just like how they own towers.

If this model takes off at scale, it will offer Indara a new way to support MNO network with less capital investment. A big part of that will be timing because a lot of the decisions have already been made on the 5G round of upgrades. 6G might be the right time to do this next step, which gives Indara time to focus on growing its digital infrastructure portfolio in the short to medium term.

Likewise, think for Australia particularly, there's a lot of work going on at the state government level to make rollout in rural areas more efficient and to ensure that rural populations don’t suffer from blackspots.

Meet Indara at TowerXchange meetup Asia!

Cameron Evans and Jason Horley, Executive Director, Property and Customer Engagement will both be speaking at TowerXchange meetup Asia. Catch Cameron’s keynote on the morning of November 30th at and hear Jason speak on our all-star panel - “Future growth opportunities in Asia” at 12pm on November 29th. Make sure to book your tickets today. <linktoregistration>