On August 8 2022, América Móvil completed its towerco carve-out, to allow its commercialisation to third parties. Just over a month later, on September 29, 2022, the newly formed tower company, Sitios Latinoamérica was listed on the Mexican Stock Exchange and could begin operating as an independent towerco. The new company will operate under a trade name “Sites”, but how independent will it be, and how will its impact the LATAM industry?

A changing region

In recent years, operators have been launching spin offs of their passive telecom infrastructure to free up capital and allow them to focus on core operations. In Latin America, Millicom has also announced the formation of a new spin-off tower company, but Vodacom is following this pattern in South Africa, stc has done it in Saudi Arabia and both Orange and Vodafone have done it in Europe.

Figure 1: América Móvil’s passive telecom infrastructure in LATAM

The size and shape of Sites’ tower portfolio

Sites will initially operate a portfolio of 29,090 towers in 13 countries in Latin America: Argentina, Brazil, Chile, Costa Rica, Ecuador, El Salvador, Guatemala, Honduras, Nicaragua, Panama, Paraguay, Peru, Puerto Rico and Uruguay. The three largest markets, Chile, Argentina and Brazil each represent more than 10% of Sites’ operating income.

It was initially thought that América Móvil’s 3,687 Peruvian sites and 1,370 Dominican sites would be transferred to the new entity upon its formation, however this hasn’t been the case. Instead, Sites has formed entities in each market; in Peru it is actively building new sites for América Móvil and it is also active in the Dominican Republic, with a subsequent sale of the portfolios to Sites potentially on the cards.

This gives Sites an option for further inorganic expansion, potentially adding at least 5,000 sites, propelling it to at least 11th place in the global towerco ranking. However, América Móvil may be keeping these sites off Sites’ books in order to facilitate a sale to third party. As previously announced, América Móvil’s Colombian sites will remain separate for the time being. In the future, Sites has said it plans to expand to new territories based on business and investment opportunities in those countries.

What can Telesites tell us about Sites?

A look at an earlier América Móvil spin-off can give us an indication of how independent Sites will be from the operator. In 2014, Mexico’s telecoms regulator, the Federal Institute of Telecommunications, declared América Móvil and its subsidiaries Telcel, Telmex, Grupo Carso and Grupo Financiero Inbursa market dominant and requested a major restructuring within the group. A year later, América Móvil spun-off of its Mexican passive infrastructure assets into a separate entity, Telesites, which was subsequently listed on Mexico stock exchange.

At the time the operator cited the capex-efficiency of the towerco model as the motivation behind the move. However, without the regulatory pressure it is unlikely that América Móvil would have spun off its assets in Mexico at exactly that moment.

Although a separate company, Telesites shares the majority of its shareholders with América Móvil. In fact, over 97% of shares in the Mexican company belong to Carlos Slim and entities related to the Slim family. This is also the case for Sites. The depressed valuation for Telesites suggest it is still not seen as independent by investors, so Sites must be careful to avoid a similar assessment.

Company’s management: key executive positions

Although Sites’s major stakeholders include various Slim family related entities, as well as the asset management firm Blackrock, the company will operate autonomously from América Móvil with separate management, operational, commercial, and financial objectives. At the shareholders’ meeting in August 2022, the names of the company’s new top management team have been announced.

The new CEO will be Gerardo Kuri Kaufmann, leaving said position in Telesites, América Móvil’s Mexican spin-off. Also, previously at Telesites, Karla Ileana Arroyo Morales has been appointed as the Director of Administration and Finance (CFO). Several América Móvil employees have been transferred to the new entity, including Francisco Javier Arnau Quiroga as the General Counsel, and María Paloma Vértiz Robleda as the Investor Relationship Director. Iris Josselin Fernandez Cruz has joined the company as the Administration and Finance Director and Luis Humberto Díaz Jouanen is taking on the role of Director of Operations. As of September 2022, Sites employs a total of 223 employees, in addition to temporary staff working on specific regional projects.

With so many staff coming from Telesites and América Móvil one of the earliest challenges that Sites will face will be establishing its independence from América Móvil. Other operators are unlikely to send business to Sites if it is seen as a subsidiary of América Móvil, rather than an independent business seeking its own commercial success. ToweXchange expects to see more external hires, and independent board members appointed as otherwise the company’s independence will be in doubt.

How does Sites portfolio compare regionally and globally?

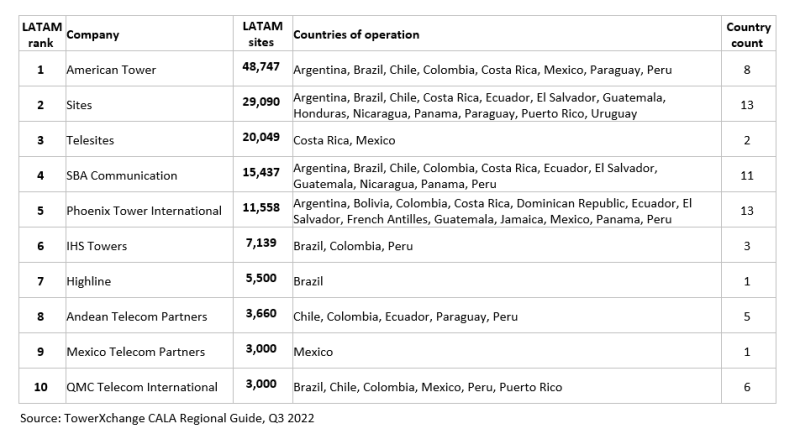

Upon incorporation, with a portfolio of 29,090 towers, Sites became the world’s 14th largest towerco (figure 3) and second largest in the Latin American region after American Tower (with its portfolio of 48,747 sites across the region). 39% of Sites’ towers (12,539) are in Latin America’s largest economy and telecoms market - Brazil, with 12% in Argentina (4,435 sites), 10% in Peru (3,687 sites) and the balance spread across the remaining 12 markets. Sites is the biggest passive infrastructure operator in at least seven of the countries in which it operates. The assets that Sites will be managing through its subsidiaries is estimated to represent approximately 19% of the total sites in those jurisdictions.

Growth opportunities and towerco competition for Sites

In almost every market it operates, Sites will have competition from other established players. Among them, the biggest competitors include American Tower (present in six of Sites’s markets), SBA Communications (present in ten), Phoenix Tower International (present in seven) DigitalBridge’s Highline and Andean Telecom Partners (collectively present in five), and IHS Towers (present in Brazil and Peru). Sites will compete with such companies and a host of smaller players as they look to drive up the tenancy ratio across their portfolio.

Sites’ strategy is to continue expanding through organic and inorganic growth based on customer needs in each market. The company is expected to build approximately 900 new sites by the end of 2022, of which just under 160 new sites will in Peru where it will be starting with zero towers.

Figure 4: Latin America’s top 10 towercos by tower count

Co-location plans and operator contracts so far

Major investments in 4G network densification and 5G network rollouts expected over the next 5+ years across Latin America offer significant organic growth opportunities through both co-locations and new build in these markets. We will witness increased competition among the region’s tower companies to capture this growth after a period of consolidation. In this context, the formation of Sites not only marks a significant shift in market dynamics in the region, but also changes the inorganic growth opportunities for Latin Americas’ towercos, which may limit their abilities to grow. On the other hand, the carve-out may make acquisitions easier, now that towers and opco management have been separated at América Móvil.

How does Sites compare to other towercos in the region?

There are no pureplay Latin American listed independent towercos with which Sites can be compared. Both American Tower and SBA Communications (who trade at multiples north of 30x) have a significant presence in Latin America, but also have a significant presence in the highly attractive US towerco market – and in the case of American Tower, across Europe, Africa and India (with SBA also having a presence in South Africa, Tanzania and The Phiippines). When compared with other global peers in the industry, Sites is currently lacking a diversified revenue base, even though its risk is concentrated in a high credit quality customer.

Sites will not reach the 25x valuation of its US peers (see Figure 5), nor is it likely to hit the high-teen multiples of Europe’s multi-country players. As a developing market towerco, Helios Towers - which trades as 8.5x EV/EBITDA multiple - could perhaps offer a closer benchmark, but as fully independent player and marked differences between dynamics in Africa and Latin America the comparisons aren’t straightforward.

Overall, Sites has a strong business profile, significant scale in Latin America, growth potential, financial flexibility and high EBITDA margins. So long as the company diversifies its customer base, increases its tenancy ratios and secures more long-term contracts across the region, we expect to see much stronger valuations of its shares on the stock exchange.

Figure 5: Listed towercos and their EV to EBITDA multiples (Source: MoffettNathanson)

What’s next for Sites and América Móvil?

The formation of a pan-regional carve-out towerco was intended to allow América Móvil to reduce costs quickly and simultaneously refocus its capital investments on the expansion of its active infrastructure. This strategy also aligns with a more general trend across Latin America and globally for MNOs to sell off or spin-off their towers to improve their balance sheets. While Sites will undoubtedly change the dynamic of the tower industry across the region, it is still not clear how independent Sites will be from América Móvil in the long run. It is now up to the company’s management to demonstrate their intention to function as an entirely separate entity and engage with the third-party tenants and the wider wireless infrastructure ecosystem on market-driven terms.

In our closing appendix, TowerXchange reviews the impact of Sites on some of the major markets of LATAM.

Key market overviews

Brazil

Latin America’s largest mobile market has attracted several towercos, with sale and leaseback transactions over the years having given them the opportunity to grow and gain scale.

American Tower has the largest portfolio in the country, having completed deals with Telefónica, TIM and Nextel (later bought by América Móvil). SBA Communications has a strong footprint in the country, having acquired towers from Oi, as well as sites from other independent players. In 2022, SBA Communications, with its current portfolio coming up to 9,985, confirmed an acquisition of additional an 2,800 sites in the country. IHS Towers has made significant inroads into the market by completing deals in the last few years and has a current portfolio of 6,859 sites. DigitalBridge-backed Highline has been steadily growing its presence in the market through a series of purchases as well, with a current portfolio numbering 5,500 sites.

Brazil’s long awaited 5G spectrum auction took place in November 2021, attracting a wave of bidders that extended beyond the country’s major national and regional mobile network operators. As expected, TIM, Vivo (Telefónica) and Claro (América Móvil) all won big in the 3.5GHz bandwidth, but it was the award of spectrum to six newcomers which made for interesting headlines. Amongst the new spectrum were a number of ISPs, as well as Winity Telecom, an infrastructure firm backed by Patria Investments that may lease its spectrum to other operators as part of a new infrastructure-sharing play. The Brazilian mobile market is undergoing consolidation with the breakdown of the mobile operator Oi, and the sale of its assets to rivals Claro, Vivo and TIM. With a portfolio of 11,233 towers, Sites is the second largest towerco in Brazil after American Tower with its 22,839 towers. Once SBA Communication finalises the recent site purchases, its portfolio in the country will come to 12,785 sites, making Sites the third largest company.

Chile

One of the most mature markets in Latin America, Chile offers significant population size as well as favourable business environment and infrastructure deployment laws with a quick and efficient permitting approval process. Chile led the region in auctioning 5G spectrum in early 2021. The winning operators will need to comply with several license obligations, including the requirement to improve connectivity in remote areas. To free up capital for additional investment, local operators have been selling off their tower portfolios over the last few years, with both Telefónica and Entel selling its Chilean assets to American Tower.

As a result, American Tower is currently the country’s largest towerco with a portfolio of over 3,871 sites. In July 2022 Phoenix Tower International announced an acquisition of 3,800 telecommunication sites from a mobile operator WOM, which would make it the second largest company in the country once the deal is finalised. With a site count of 2,509, Sites closely follows the two market leaders as the third largest towerco. The market attracts several other players, with Andean Telecom Partners owning 1,250 sites and SBA Communication owning 648 sites in the country.

Peru

According to telecom regulator OSIPTEL, Peru needs as many as 36,695 new cellular base stations (antennas) by 2025 in order to meet the increase in traffic demand. Peru enjoys a relatively smooth permitting process for new builds, facilitating the work of towercos and MNOs to meet the ambitious densification plans outlined by the regulator. Currently the Ministry of Transport and Communications (MTC) is working on the 5G spectrum auction, although original 2021 timelines have slipped. Entel and Claro will continue competing and investing in their 4G networks and the former has sealed a RAN sharing agreement with Telefónica’s Movistar to optimise resource allocation and enhance network capabilities in Peru.

Operators have been steadily monetising their tower portfolios in the Peruvian market over the last few years. Entel agreed the sale of their towers to American Tower in 2019. And Telefónica carved out its passive infrastructure assets into an infraco, Telxius, subsequently selling it to American Tower in 2021.

Towercos has been growing steadily and reporting considerable levels of organic growth and co-locations in Peru. American Tower represents the country’s largest towerco, with a portfolio of over 4,300 sites. In February 2022, Andean Telecom Partners purchased BTS Towers and increased its tower count to over 1100. Both Phoenix Tower International and SBA Communications have portfolios numbering around 400 sites. IHS Towers is also present with a small portfolio and looking to expand.

Argentina

Collectively, Argentina’s operators are understood to own just under 13,000 towers in the country. Telefónica had carved just under 400 of its circa 4,500 Argentinian towers into its own infraco, Telxius prior to agreeing the sale of Telxius’ tower business to American Tower. Telefónica retains around 4,000 sites in the market, with the operator reportedly having projects underway to carve out and manage its remaining assets to maximise value creation.

The country still needs around 50,000 towers, but regulatory barriers and a continuously challenging economic situation are set to continue slowing down rates of investment and, subsequently, the deployment of telecom infrastructure. At the start of 2021, regulator ENACOM imposed strict limits on telecom operators to their freedom to increase prices. As a result, emphasis from operators is currently placed on driving efficiencies and reducing spending – not the best news for towercos.

Whilst towerco penetration is still very low, Argentina is now home to many strong players, with American Tower, SBA Communications and Phoenix Tower International all have presence in the market, along with a number of independent players. Against American Tower’s, modest portfolio of 503 towers, Sites has become an absolute leader in the market with 4,097 towers on its books. The market would be more than ready for a busier time, if and when conditions allow. In spite of the promising beginning, the market has not managed to take off yet, mostly due to the unfavourable tax regime and the overall macroeconomic environment in the country.

Central America

Business environment in Central American markets have been complicated by ongoing civil unrests and a long history of political and economic uncertainty. Still, over the last decade, a number of multinational tower companies have been steadily growing their presence in the region. In 2019, Spanish telecoms giant Telefónica has sold its businesses in Guatemala to América Móvil. Since then, the markets have seen consolidation and fierce competition in the telecom sector with Millicom’s Tigo and América Móvil’s Claro battling head-to-head in most of the region’s markets. Now, Sites became number one tower company by site count in Guatemala, Nicaragua and El Salvador. Its main rival in Central America is SBA Communications. Over a number of years, SBA Communications has been growing its footprint in the region through a series of acquisitions and is currently the biggest towerco in Costa Rica (at 996 sites as of Q3 2022) and Panama (590 sites).

American Tower, Phoenix Tower International, Torrecom and Continental Towers also have presence in each of the Central American markets where Sites operates, however, the main competition to the company is expected to come from another carrier spin-off. In early 2022, Millicom (operating under the brand Tigo), announced plans for a passive infrastructure carve-out with a portfolio of over 10,000 towers across eight markets in Central and South America. In Guatemala, Millicom owns 4,200 sites to Sites’s 3020, and in Honduras, Millicom’s total site count comes to 1,900, to Sites’s 1,370. Once Millicom’s carve-out is finalised (expected in late 2022 or early 2023), the new company will replace Sites as the leading towerco in these markets.

Figure 6: Millicom’s tower portfolio in Central and South America