Helios Towers closed its acquisition of Omantel’s passive infrastructure assets in Oman, adding 2,519 sites to its portfolio for a gross consideration of US$495mn. 227 IBS sites remain to close following extended regulatory involvement for US$53mn. Slightly more than 100 sites appear to be remaining with Omantel, which is typical for the region, as sites which are seen as core or sensitive are required to stay with the operator.

After being first announced in May 2021 it has taken over a year to close the deal. Tom Greenwood, Chief Executive Officer, commented: “We are delighted to close the acquisition of Omantel’s tower assets. The transaction represents our first in the Middle East, and we enter one of the fastest growing markets for mobile infrastructure in the region with our valued local partner, Rakiza. Since announcing the transaction last year, we have built a talented local team and instilled our business excellence principles, and we now look forward to working with Omantel, a great long-term partner, and the other MNOs to drive the growth of mobile communications across Oman.”

Commenting on the completion, Mr. Talal Said Al Mamari, Chief Executive Officer of Omantel, said: “We are pleased to complete the sale of our passive tower infrastructure in Oman. This aligns to our strategy to develop world class asset-light, strategic and advanced communication networks in Oman. This transaction helps Omantel to achieve effective deleveraging and focus on optimised capital structure for the company. We believe Helios Towers will bring in extensive savings and efficient passive infrastructure solutions and services for Omantel, which in turn will help efficient telecom sector operations and job growth in Oman.”

Deal finances

Helios Towers deal is tied up with the Rakiza Fund, a local investor. Muneer Al-Muneeri, Chairman of Rakiza Fund, added: “Rakiza is pleased to partner with Helios Towers in closing this landmark acquisition – the first fully independent telecom towers operation in the region. We look forward to working closely with all stakeholders to achieve common targets. This is an exciting opportunity to contribute towards meeting the growing demand for state-of the-art telecoms infrastructure in Oman by combining Helios’ strong technical and operational expertise with Rakiza’s financial and regional experience.”

Revenues and Adjusted EBITDA in the first year of operations on the acquired sites are anticipated to be US$50mn and US$34mn, respectively, a 68% EBITDA margin which will immediately boost Helios Towers’ profitability. Further growth is expected through 300 build-to-suit (BTS) sites committed over the next seven years, and colocation lease-ups from Ooredoo and Vodafone Oman.

The gross consideration of US$494.6mn has been funded through US$206.2mn Group funds, of which US$24.0mn was pre-paid in 2021, US$88.4mn from Rakiza and US$200.0mn from local bank debt. Including capitalised ground leases, this represents an enterprise value of US$515mn.

The Omani market

Oman has three established MNOs; Omantel, Ooredoo and Vodafone, as well as two mobile resellers Renna Mobile and Friendi Mobile.

Oman Tower Company is leading new MNO Vodafone Oman’s network build out, delivering 970 sites to Omani MNOs so far on an investment of over US$60mn. Oman Tower Company was established in February 2018 by Oman 70 Holding Company, AktivCo and the Omani Government. As well as its deal with Vodafone Oman, Oman Tower Company manages 100s of government owned sites and has a sharing agreement with local petroleum group PDO. Helios Towers is entering a mature towerco market that’s about to get more developed.

There are just over 7,000 towers in the Omani market. Oman’s two operators were adding around 200-240 new towers per year, but Vodafone Oman will be adding points of presence at a significantly higher rate, soon to be aided by Helios Towers.

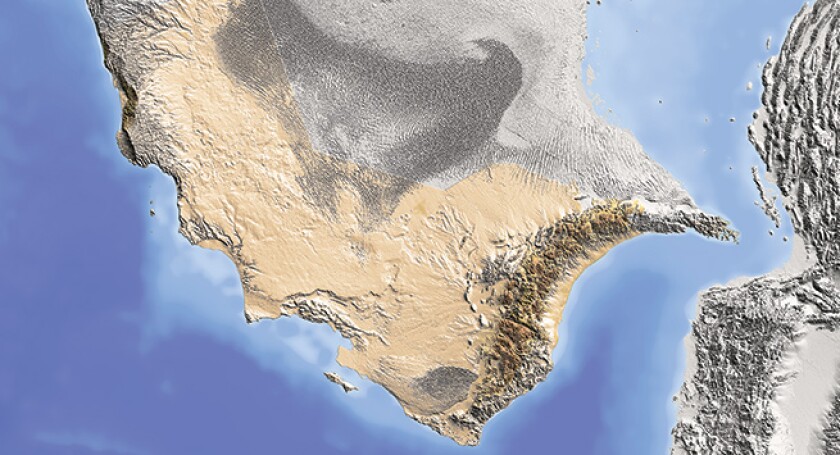

Infrastructure sharing has been limited, with estimates suggesting approximately 10% of towers are shared, but this has started to increase as the MNOs aim to execute the rollout of 4G more cost effectively. Both Omantel and Ooredoo have launched commercial 5G services in the country and with a new operator in the form of Vodafone Oman, colocation and new build growth prospects look good. Despite its mature mobile market and strong economy, Oman’s vast geography and dispersed population means the country faces energy challenges, with towercos poised to address these issues.

Omantel was not the only tower deal ongoing in Oman; Ooredoo is now looking to sell too. Ooredoo entered Oman in 2004, but rebranded to Ooredoo Oman in 2014, competing with Vodafone Oman and local Omantel. The country is starting to move towards 5G deployment as Omantel is launching 5G commercial services.

Like other Gulf states the government launched a National Program for Digital Economy in 2021 which includes digitising government processes and services as well as accelerating business digitisation through data centres and cloud technology.

What this means for the MENA tower space

Helios Towers’ closing of the Omantel transaction follows the acquisaiton of Zain’s sites by PIF and TASC. The stop-start momentum of the region has ended. Ooredoo’s planned sale and leaseback deal in Oman and elsewhere is the next significant strides in the regional tower industry; increasing the ratio of towers in the hands of towercos versus MNOs and bringing towercos into new markets.

In the GCC, towercos can hope to play a greater role in supporting digital transformation and open opportunities in new digital infrastructure verticals including more passive infrastructure management from MNOs such as fibre or data centres.

The maturity of the market in the Gulf will allow the spread of the industry into North Africa. Most exciting are the SLB deals in Tunisia and Algeria, which will likely be a turning point for a traditionally closed-off markets of North Africa. Orange has previously expressed disinterest in using towercos but with 14,000 towers across Egypt, Morocco and Tunisia, a tower review underway, and a successful European carve-out TOTEM, there are plenty of opportunities in the region. This is just the beginning.